Irs Goc Stimulus 2018

What is the IRS GOC Stimulus?

The IRS GOC stimulus refers to financial assistance provided by the Internal Revenue Service to eligible individuals and families. This program is designed to offer economic relief during challenging times, such as economic downturns or crises. The funds are typically aimed at supporting taxpayers in meeting their financial obligations and stimulating economic activity.

How to Use the IRS GOC Stimulus

Utilizing the IRS GOC stimulus involves understanding your eligibility and how the funds can be applied. Eligible recipients can use the funds for various purposes, including paying bills, covering essential expenses, or investing in personal or business needs. It is important to keep records of how the funds are used, as this may be required for tax reporting purposes.

Steps to Complete the IRS GOC Stimulus

Completing the IRS GOC stimulus process involves several key steps:

- Determine your eligibility based on IRS guidelines.

- Gather necessary documentation, such as income statements and identification.

- Complete the required IRS forms accurately.

- Submit your application via the appropriate method, whether online or by mail.

- Monitor the status of your application to ensure timely processing.

Legal Use of the IRS GOC Stimulus

The IRS GOC stimulus must be used in accordance with federal guidelines. Recipients are encouraged to use the funds for legitimate expenses that align with the program's intent. Misuse of funds may lead to penalties or the requirement to repay the assistance. It is essential to retain documentation to demonstrate compliance with legal requirements.

Eligibility Criteria

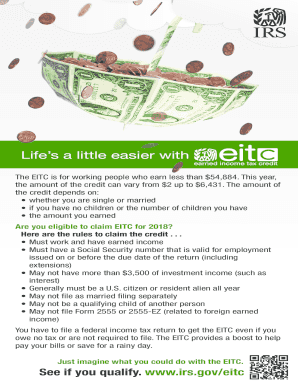

Eligibility for the IRS GOC stimulus typically includes factors such as income level, filing status, and residency requirements. Individuals must meet specific income thresholds to qualify for assistance. Additionally, certain groups, such as low-income families or those affected by specific economic conditions, may receive priority consideration.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines related to the IRS GOC stimulus. These dates can vary based on the specific program and year. Generally, applications must be submitted by a designated deadline to ensure consideration for assistance. Keeping track of these dates helps avoid missing out on potential support.

Required Documents

To apply for the IRS GOC stimulus, applicants must provide various documents, including:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver's license or Social Security card.

- Any additional forms specified by the IRS for the stimulus program.

Quick guide on how to complete irs goc stimulus

Effortlessly prepare Irs Goc Stimulus on any device

The management of online documents has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary forms and securely save them online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Irs Goc Stimulus on any device using the airSlate SignNow applications for Android or iOS and enhance your document-centric processes today.

The easiest approach to modify and electronically sign Irs Goc Stimulus effortlessly

- Obtain Irs Goc Stimulus and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and press the Done button to save your modifications.

- Choose how you'd like to share your form, whether via email, SMS, invitation link, or by downloading it to your computer.

Wave goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Irs Goc Stimulus to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs goc stimulus

Create this form in 5 minutes!

How to create an eSignature for the irs goc stimulus

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the IRS GOC Stimulus, and how does it relate to airSlate SignNow?

The IRS GOC Stimulus refers to government-issued financial assistance programs designed to support individuals and businesses. airSlate SignNow can help streamline the documentation process required for applying for these funds, making it easier to eSign and submit necessary forms securely and efficiently.

-

How can airSlate SignNow assist with IRS GOC Stimulus applications?

airSlate SignNow simplifies the process of preparing and eSigning documents needed for IRS GOC Stimulus applications. With our user-friendly interface, you can quickly create, send, and sign documents, ensuring that your application is submitted without delays.

-

Are there any costs associated with using airSlate SignNow for IRS GOC Stimulus applications?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our cost-effective solution allows you to manage your document signing process efficiently, which can be especially beneficial when dealing with important applications like those for the IRS GOC Stimulus.

-

What features does airSlate SignNow offer for IRS GOC Stimulus documentation?

airSlate SignNow provides a range of features including customizable templates, bulk sending, and advanced tracking capabilities. These tools make it easier to manage IRS GOC Stimulus documents and ensure all parties can eSign them quickly and securely.

-

Can I integrate airSlate SignNow with other software for IRS GOC Stimulus processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications including CRMs, cloud storage, and project management tools. This makes it easier to manage your IRS GOC Stimulus documentation alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for IRS GOC Stimulus applications?

Using airSlate SignNow for IRS GOC Stimulus applications offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that all documents are stored securely and can be accessed easily, streamlining the entire process.

-

Is airSlate SignNow user-friendly for those applying for IRS GOC Stimulus funds?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for individuals and businesses alike. Whether you're familiar with eSigning or new to it, our intuitive interface allows you to navigate the IRS GOC Stimulus application process with ease.

Get more for Irs Goc Stimulus

- Youre financially unable to pay the liability in full when form

- 2017 3 form 2018 2019

- 2018 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

- About attorneys connecticut judicial branch ctgov form

- Attorney revocable retirementwritten notice connecticut judicial form

- Gv 115 request to continue court hearing for firearms restraining order judicial council forms

- Plea form and waiver of rights florida 2015 2019

- Service agents license study guide california department of food form

Find out other Irs Goc Stimulus

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now