Attach to Your Tax Return Go to Www Irs GovForm8990 for 2020

What is the 2019 Form 8990?

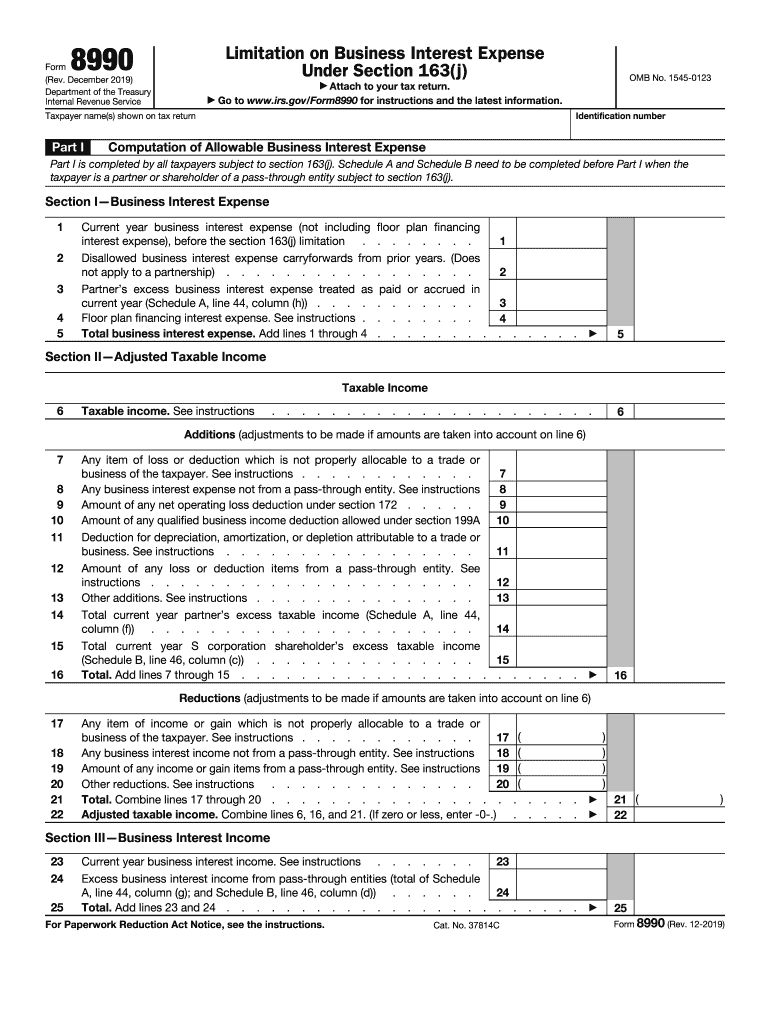

The 2019 Form 8990 is a tax form used by businesses to report limitations on business interest expense deductions under Internal Revenue Code Section 163(j). This form is crucial for entities that have incurred interest expenses, as it helps determine the allowable amount that can be deducted for tax purposes. The form is required to be attached to the business's tax return, ensuring compliance with IRS regulations.

Key elements of the 2019 Form 8990

The 2019 Form 8990 includes several important sections that need to be completed accurately. Key elements consist of:

- Business Information: The name, address, and Employer Identification Number (EIN) of the business.

- Interest Expense Calculation: A detailed breakdown of the total interest expense incurred during the tax year.

- Adjusted Taxable Income: This section requires the calculation of adjusted taxable income, which is essential for determining the allowable interest deduction.

- Limitation Calculation: The form includes a calculation to establish the maximum deductible interest expense based on the business's income and other factors.

Steps to complete the 2019 Form 8990

Completing the 2019 Form 8990 involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary financial documents, including income statements and interest expense records.

- Fill in the business information section with accurate details.

- Calculate the total interest expense and enter it in the appropriate section.

- Determine the adjusted taxable income based on your financial records.

- Complete the limitation calculation to find the allowable interest deduction.

- Review the form for accuracy before submission.

IRS Guidelines for Form 8990

The IRS provides specific guidelines regarding the completion and submission of Form 8990. Key points to consider include:

- Ensure that the form is filled out completely and accurately to avoid delays or penalties.

- Submit the form along with the business's tax return by the designated filing deadline.

- Retain a copy of the completed form for your records, as it may be required for future reference or audits.

Penalties for Non-Compliance with Form 8990

Failure to comply with the requirements of Form 8990 can result in significant penalties. These may include:

- Disallowance of interest expense deductions, leading to increased tax liabilities.

- Potential fines imposed by the IRS for late or incorrect submissions.

- Increased scrutiny during audits, which could result in further penalties or legal issues.

Form Submission Methods

The 2019 Form 8990 can be submitted through various methods, including:

- Online Submission: Many tax software programs allow for electronic filing of Form 8990.

- Mail: The completed form can be printed and mailed to the appropriate IRS address.

- In-Person: Businesses may also choose to submit the form in person at local IRS offices, although this is less common.

Quick guide on how to complete attach to your tax return go to wwwirsgovform8990 for

Prepare Attach To Your Tax Return Go To Www irs govForm8990 For effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and without interruptions. Handle Attach To Your Tax Return Go To Www irs govForm8990 For on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Attach To Your Tax Return Go To Www irs govForm8990 For with ease

- Locate Attach To Your Tax Return Go To Www irs govForm8990 For and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal authority as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to submit your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Attach To Your Tax Return Go To Www irs govForm8990 For and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct attach to your tax return go to wwwirsgovform8990 for

Create this form in 5 minutes!

How to create an eSignature for the attach to your tax return go to wwwirsgovform8990 for

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is form 8990 and why is it important?

Form 8990 is used to calculate the limitation on the business interest expense deduction under the Tax Cuts and Jobs Act. Understanding how to fill out form 8990 correctly is crucial for businesses to ensure compliance with tax regulations and maximize deductions.

-

How can airSlate SignNow assist with form 8990 management?

airSlate SignNow simplifies the process of preparing and signing form 8990 by providing an intuitive platform to create, send, and eSign documents. This allows businesses to efficiently manage paperwork and ensure timely submissions to the IRS.

-

Is there a cost associated with using airSlate SignNow for form 8990?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different business needs, making it a cost-effective solution for managing form 8990. Detailed pricing can be found on our website, ensuring transparency and value for users.

-

What features does airSlate SignNow offer for form 8990 document handling?

AirSlate SignNow provides features such as customizable templates, secure eSignatures, and cloud storage, which are beneficial for managing form 8990. These features streamline the entire document workflow, enhancing efficiency and accuracy.

-

Can I integrate airSlate SignNow with other tools for form 8990 preparation?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and accounting software, improving the workflow for form 8990 preparation. This integration allows for easy access to necessary documents and data, reducing manual entry and errors.

-

What benefits does using airSlate SignNow provide for form 8990 submissions?

Using airSlate SignNow for form 8990 submissions enhances security, accelerates the signing process, and ensures compliance with legal standards. Businesses can benefit from faster turnaround times and reduced paperwork, leading to better productivity.

-

Is it user-friendly to prepare form 8990 on airSlate SignNow?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to prepare form 8990, even without extensive technical knowledge. Its straightforward interface guides users step-by-step, ensuring a hassle-free experience.

Get more for Attach To Your Tax Return Go To Www irs govForm8990 For

- Beer tax return mt 50 form

- Tda loan application for loans from your tax deferred annuity tda program account code lo15 form

- Expires 09302022 form

- Form 8932 rev december 2019 internal revenue service

- Form 1040 x rev january 2020 amended us individual income tax return

- Irs form 13844 application for reduced user fee for

- Form it 210411219new york state city of new york and city of yonkers certificate of nonresidence and allocation of withholding

- Request for indiana corporate estimated quarterly income form

Find out other Attach To Your Tax Return Go To Www irs govForm8990 For

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation