00 Each Filing Form

What is the 00 Each Filing

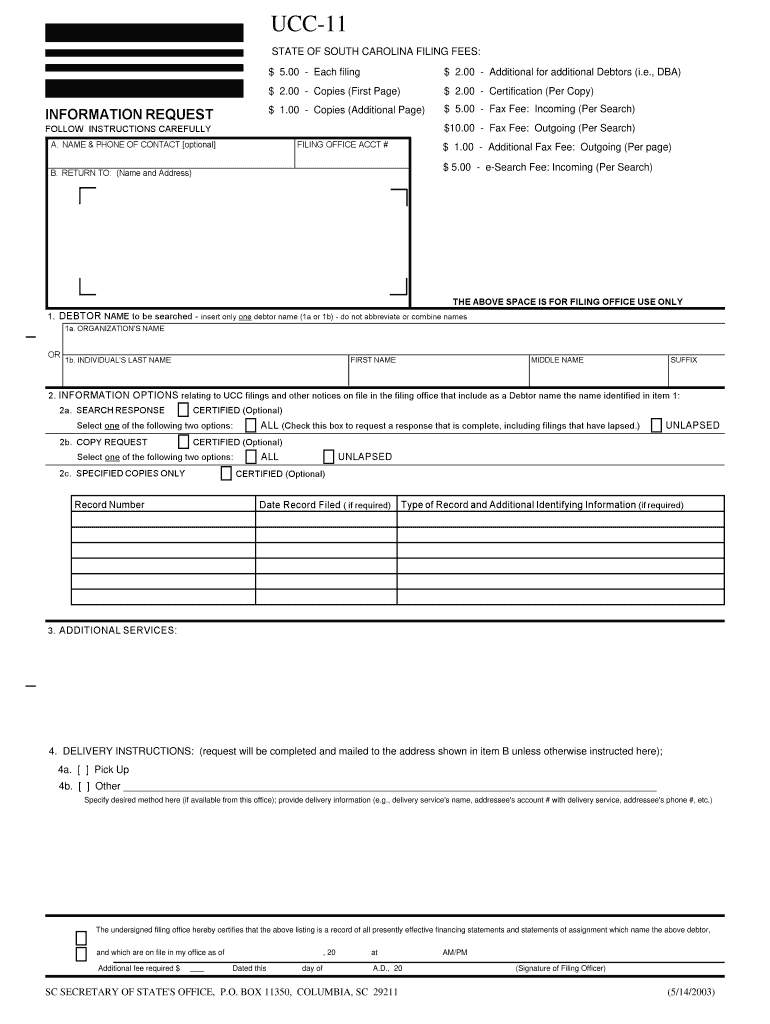

The 00 Each Filing is a specific form utilized primarily for tax purposes in the United States. This form is essential for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). It ensures compliance with federal tax regulations and helps in the accurate assessment of tax liabilities. Understanding the purpose and requirements of this form is crucial for maintaining proper tax records and avoiding potential penalties.

Steps to complete the 00 Each Filing

Completing the 00 Each Filing involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay special attention to any calculations, as errors can lead to complications. After completing the form, review it thoroughly before submission. Finally, submit the form according to the guidelines provided by the IRS, either electronically or by mail.

Legal use of the 00 Each Filing

The legal use of the 00 Each Filing is defined by IRS regulations. This form must be filled out accurately to ensure that it is considered valid for tax purposes. It is important to understand the legal implications of the information provided, as inaccuracies can lead to audits or penalties. The form serves as a legal document that can be used to verify income and expenses, making it crucial for both individuals and businesses to adhere to the guidelines set forth by the IRS.

Filing Deadlines / Important Dates

Timely submission of the 00 Each Filing is essential to avoid penalties. The IRS typically sets specific deadlines for filing this form, which may vary based on the type of filer (individual or business). Generally, the deadline for individuals is April fifteenth, while businesses may have different deadlines depending on their structure. It is advisable to check the IRS website or consult a tax professional for the most current deadlines and any potential extensions that may be available.

Required Documents

To accurately complete the 00 Each Filing, several documents are typically required. These may include W-2 forms, 1099 forms, receipts for deductible expenses, and any relevant financial statements. Having these documents readily available can streamline the filing process and reduce the likelihood of errors. It is important to ensure that all documents are current and reflect the correct financial information for the tax year in question.

Form Submission Methods (Online / Mail / In-Person)

The 00 Each Filing can be submitted through various methods, providing flexibility for filers. Many individuals and businesses opt for online submission via the IRS e-file system, which is secure and efficient. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is sent well before the deadline. In some cases, in-person submission may be possible at designated IRS offices, although this method is less common. Each submission method has its own set of guidelines, so it is important to follow the instructions carefully.

Examples of using the 00 Each Filing

Examples of using the 00 Each Filing can vary widely based on individual circumstances. For instance, a self-employed individual may use this form to report income from freelance work, while a small business owner might use it to report earnings and expenses from their operations. Each scenario requires careful documentation and accurate reporting to ensure compliance with tax laws. Understanding these examples can help filers better prepare for their own filing needs.

Quick guide on how to complete 00 each filing

Effortlessly Prepare 00 Each Filing on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditionally printed and signed papers, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and electronically sign your documents without delays. Handle 00 Each Filing on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to Modify and Electronically Sign 00 Each Filing with Ease

- Find 00 Each Filing and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, tedious document searching, or errors that demand the printing of new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign 00 Each Filing and ensure superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost associated with 00 Each Filing on airSlate SignNow?

The pricing for 00 Each Filing on airSlate SignNow is designed to be budget-friendly, ensuring that businesses of all sizes can access our services without breaking the bank. We offer flexible plans that scale based on the number of documents and users. For specific pricing details, visit our pricing page.

-

How does airSlate SignNow streamline the 00 Each Filing process?

airSlate SignNow simplifies the 00 Each Filing process by providing a user-friendly interface that allows users to create, send, and sign documents quickly. Our platform reduces the time spent on paperwork, enabling businesses to focus on their core activities. Features like templates and automated workflows further enhance efficiency.

-

What are the key features of the 00 Each Filing service?

Our 00 Each Filing service includes essential features such as document templates, customizable workflows, real-time tracking, and integrations with popular applications. Additionally, eSignature capabilities ensure that all documents are signed securely and legally. This comprehensive suite of tools makes managing filings easier than ever.

-

Are there any integrations available for the 00 Each Filing system?

Yes, airSlate SignNow supports various integrations that enhance the 00 Each Filing experience. Our platform connects smoothly with popular software like Google Drive, Salesforce, and Microsoft Office. These integrations allow for seamless document management and collaboration, making your filing process even more efficient.

-

What benefits does airSlate SignNow provide for 00 Each Filing?

The primary benefits of using airSlate SignNow for 00 Each Filing include enhanced efficiency, reduced paperwork, and improved document security. Our service eliminates the hassle of traditional filing methods, enabling users to complete filings faster. Additionally, our secure environment ensures that sensitive information remains protected throughout the process.

-

Is it easy to switch to airSlate SignNow for 00 Each Filing?

Absolutely! Transitioning to airSlate SignNow for 00 Each Filing is straightforward. We provide comprehensive support and resources to help users migrate their existing documents and data. Our intuitive platform allows you to start sending and signing documents in no time.

-

How secure is the 00 Each Filing process with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for 00 Each Filing. Our platform employs advanced encryption and compliance with relevant regulations to ensure that all documents are protected from unauthorized access. Trust us to handle your sensitive filings safely and confidentially.

Get more for 00 Each Filing

- Llc operating agreement oklahoma form

- Land contract ohio form

- Commercial lease application form 361876

- Well agreement form arizona

- Requester instructions mva maryland form

- Azahp application form

- W 1 ltc application ct form

- Goergia passr level 1 applicatino resident identificaation screening instrument form

Find out other 00 Each Filing

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online