Individual Guarantor Form

What is the Individual Guarantor

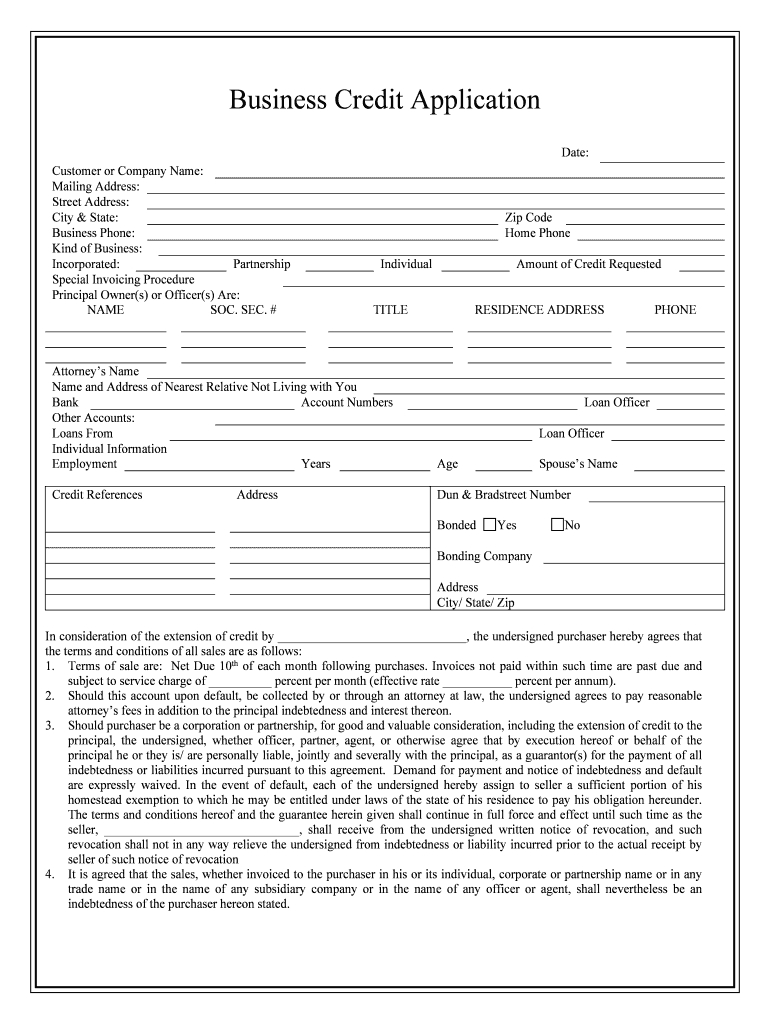

An individual guarantor is a person who agrees to be responsible for the obligations of another party, typically in financial agreements. This role is crucial in various situations, such as rental agreements, loans, or business contracts, where the primary party may not have sufficient credit or financial history. By signing as a guarantor, the individual provides a safety net for the lender or landlord, ensuring that they will receive payment or fulfillment of the contract even if the primary party defaults.

How to use the Individual Guarantor

Using the individual guarantor form involves several steps. First, the primary party seeking the guarantee must identify a suitable individual who is willing to take on this responsibility. Once the guarantor is chosen, both parties need to fill out the individual guarantor form accurately. This form typically requires personal information about the guarantor, such as their name, address, and financial details. After completing the form, both parties should sign it to make it legally binding. It is advisable to keep a copy of the signed document for future reference.

Steps to complete the Individual Guarantor

Completing the individual guarantor form involves a systematic approach:

- Gather necessary information, including the guarantor's personal details and financial information.

- Fill out the individual guarantor form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Both the primary party and the guarantor should sign the form to validate it.

- Submit the completed form to the relevant institution, whether online, by mail, or in person.

Legal use of the Individual Guarantor

The legal use of the individual guarantor form is governed by specific regulations that vary by state. Generally, for the form to be legally binding, it must meet certain criteria, such as clear identification of the parties involved and a defined obligation. It is essential for both the guarantor and the primary party to understand their rights and responsibilities under the agreement. Additionally, the form must comply with relevant laws, such as the ESIGN Act, which recognizes electronic signatures as valid.

Key elements of the Individual Guarantor

Several key elements define the individual guarantor form:

- Identification: Clear identification of the guarantor and the primary party.

- Obligation: A detailed description of the obligations the guarantor is assuming.

- Signatures: Signatures from both parties to validate the agreement.

- Date: The date when the agreement is signed, which is crucial for legal purposes.

Examples of using the Individual Guarantor

Individual guarantors are commonly used in various scenarios, including:

- Rental Agreements: A landlord may require a tenant to have a guarantor if they lack sufficient credit history.

- Loan Applications: Borrowers may need a guarantor to secure a loan, especially if they have poor credit.

- Business Contracts: Small business owners may use personal guarantors to back business loans or leases.

Quick guide on how to complete individual guarantor

Effortlessly Complete Individual Guarantor on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Individual Guarantor on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Individual Guarantor with Ease

- Find Individual Guarantor and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Individual Guarantor, ensuring effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Guarantor in the context of airSlate SignNow?

An Individual Guarantor is someone who agrees to be held responsible for a document or agreement within the airSlate SignNow platform. This feature allows for enhanced accountability and trust in agreements, ensuring that all parties are secured and protected throughout the signing process.

-

How does airSlate SignNow support Individual Guarantor agreements?

airSlate SignNow simplifies the process of creating agreements that require an Individual Guarantor by providing customizable templates and eSignature capabilities. Users can easily assign roles and permissions, allowing the guarantor to review and sign documents quickly and efficiently.

-

What are the benefits of using an Individual Guarantor with airSlate SignNow?

Using an Individual Guarantor in airSlate SignNow adds a layer of security and trust to your agreements. It helps minimize risks, ensures compliance, and can expedite the contract signing process, which ultimately enhances your business operations.

-

Is there an additional cost for utilizing the Individual Guarantor feature in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the Individual Guarantor feature. Users can choose a plan that fits their budget while enjoying robust features, including document management and eSigning services tailored to meet business needs.

-

Can I integrate airSlate SignNow with other applications for Individual Guarantor management?

Yes, airSlate SignNow supports integrations with various applications, making it easier to manage your Individual Guarantor agreements. Whether you're using CRM systems or project management tools, you can seamlessly incorporate airSlate SignNow into your existing workflows.

-

How secure is the Individual Guarantor process in airSlate SignNow?

The Individual Guarantor process in airSlate SignNow is highly secure, utilizing advanced encryption and authentication methods. This ensures that all documents and signatures are protected, giving you peace of mind while managing critical agreements.

-

What types of documents can I use with an Individual Guarantor in airSlate SignNow?

You can use various document types with an Individual Guarantor in airSlate SignNow, such as contracts, leases, and agreements. This flexibility allows you to customize the eSigning experience according to your specific business requirements.

Get more for Individual Guarantor

Find out other Individual Guarantor

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now