Form 40, Oregon Individual Income Tax State of Oregon

Understanding the Oregon Form 40, Individual Income Tax

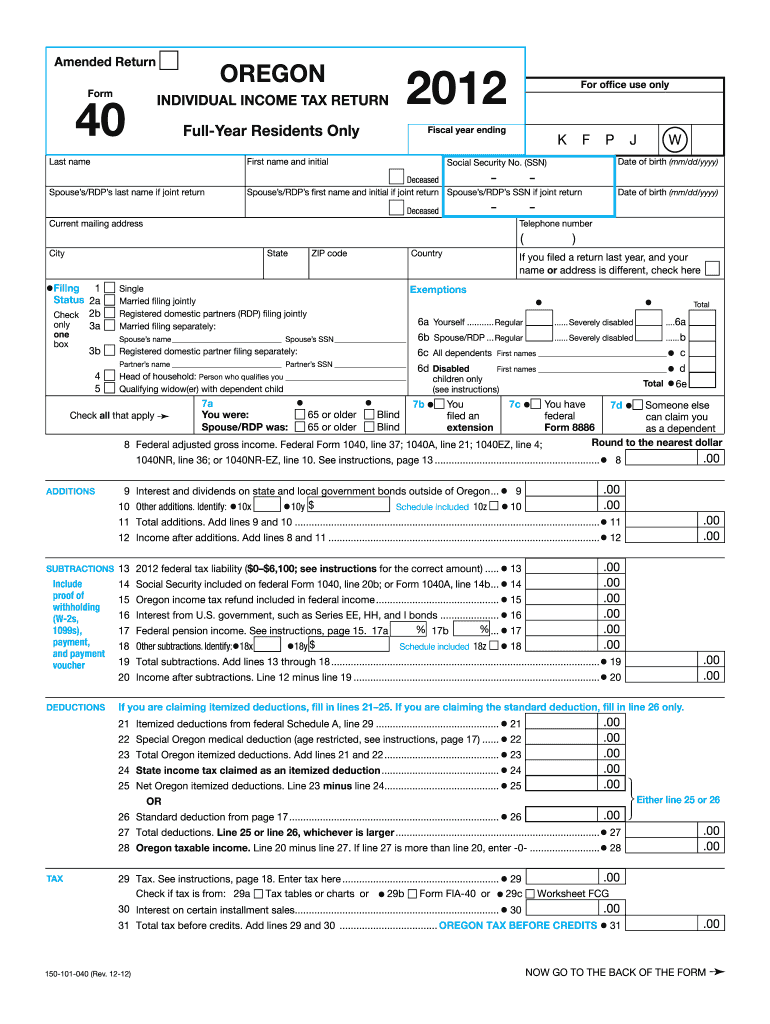

The Oregon Form 40 is the primary document used by residents to report their individual income tax. This form is essential for calculating the amount of tax owed to the state based on income earned during the tax year. It encompasses various income sources, including wages, self-employment income, and investment earnings. The form also allows taxpayers to claim deductions and credits that may reduce their overall tax liability.

Steps to Complete the Oregon Form 40

Completing the Oregon Form 40 involves several key steps to ensure accurate reporting of income and tax obligations. Begin by gathering all necessary documentation, including W-2s, 1099s, and records of any other income. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim any applicable deductions, such as those for mortgage interest or student loan interest.

- Calculate your total tax liability using the provided tax tables.

- Sign and date the form to validate your submission.

Obtaining the Oregon Form 40

The Oregon Form 40 can be obtained through several convenient methods. Taxpayers can access the form online via the Oregon Department of Revenue website, where it is available for download in PDF format. Additionally, physical copies of the form can be requested by contacting the department directly. Local libraries and post offices may also carry printed versions of the form.

Filing Deadlines for the Oregon Form 40

Timely filing of the Oregon Form 40 is crucial to avoid penalties. The standard deadline for filing is typically April 15, unless it falls on a weekend or holiday, in which case the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may be available, allowing for additional time to submit the form without incurring late fees.

Legal Use of the Oregon Form 40

The Oregon Form 40 is legally binding once it is signed and submitted. It must be completed accurately to ensure compliance with state tax laws. Any discrepancies or errors can lead to audits or penalties. It is important to retain copies of the submitted form and any supporting documents for future reference, as they may be required for verification by the Oregon Department of Revenue.

Key Elements of the Oregon Form 40

Understanding the key elements of the Oregon Form 40 is essential for effective completion. These elements include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: All income sources must be reported accurately.

- Deductions and Credits: Taxpayers can claim various deductions to lower their taxable income.

- Tax Calculation: The form includes guidelines for calculating the total tax owed.

Quick guide on how to complete 2012 form 40

Prepare Form 40, Oregon Individual Income Tax State Of Oregon seamlessly on any device

Managing documents online has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 40, Oregon Individual Income Tax State Of Oregon on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form 40, Oregon Individual Income Tax State Of Oregon with ease

- Locate Form 40, Oregon Individual Income Tax State Of Oregon and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a typical wet ink signature.

- Review all details and click the Done button to save your adjustments.

- Select your preferred method to share your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 40, Oregon Individual Income Tax State Of Oregon and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How did Snapchat get traction?

Just a little over four years ago, Snapchat was supposedly just an idea that founder Evan Spiegel and friends had while in a class at Stanford.Now, over 100 million active users and 7 billion daily video views later,the White House has joined, presidential candidate Bernie Sanders is running a campaign on it and senior ad buyers are starting to take notice and planning to advertise on the platform over other social media sites.How did Snapchat, an app that first made headlines as the“sexting app”, get here?THE HISTORY OF SNAPCHAT: HOW DISAPPEARING PHOTOS CHANGED THE GAMEI was surprised early on that people didn’t realize that the way Snapchat works is much closer to how we communicate face to face than any other social network. What I mean by this is that: when we talk to each other, passing in the halls or just living out our lives, those moments disappear. Snapchat emulates that behavior and psychology.Snapchat was started at a time when everybody and their mom thought they were an entrepreneur who could launch a successful social app. Facebook was where you went for updates on family and friends, Instagram was beautiful photo content, and Twitter was the conversation at a cocktail party. These three social giants dominated most of the conversation, but they all played off of each other in terms of functionality, and, most importantly, audience. However, Snapchat was able to counterbalance the strengths of all three players and create a new social pipeline.The norm of the internet age is to create platforms in which everything is saved—everything is stored and documented digitally. Snapchat went the opposite direction and is predicated on our reality: moments are temporary and that’s exactly the feeling and behavior that Snapchat mapped to. Snaps could even be compared to television the first fifty years it was introduced: the broadcast aired, and that was it. Snapchat managed to tap into a lot of historical truths, instead of creating something entirely new.FACEBOOK OFFERS TO BUY SNAPCHATAll these things quickly led Snapchat to come to the attention of Facebook’s CEO Mark Zuckerberg. Just one year after launch, Zuckerberg reportedly tried to buy the app for $3 billion.Let me just say this: Zuckerberg is the greatest trader in consumer attention of all time.He understands the value of attention. He recognized that Snapchat was well on its way to winning the attention of a generation, much like he did with Instagram (which Facebook bought in 2012 for $1 billion). He saw it as a vulnerability and saw that a Snapchat generation could emerge, much like there was a Facebook generation before it. Facebook acquired a monopoly on 18 to 24 year olds with Instagram, they had a monopoly on an older demo with Facebook; they just needed Snapchat to fill the gaps.But Spiegel turned the offer down. He saw what Zuckerberg saw: the potential to fill-in the social pipelines that other platforms had ignored. He knew he had one of the hottest apps of the time; now it was just up to him and the team to blow out their user base and execute against their core function.THE MATURATION OF SNAPCHAT’S ATTENTIONBut, let’s be honest: what really makes a new social network become popular fast?Teenagers.There are two things that are very true when it comes to teens. One, it’s not cool to hang out at the same club as your mom. And two, you want to lock your room.Snapchat solved both those things. Parents were starting to join Facebook in droves, so teens were looking to leave and looking for somewhere to go. And, the disappearing photos function was essentially the same thing as a “do not disturb” sign on your door, except much more effective. Both these things led to Snapchat’s extreme and sudden user growth. Just a year after launching, Snapchat hit 10 million active users.In October 2013, Snapchat made a signNow update to the platform:Stories. Users could now also add Snaps to a feature called their “Story”, which acted like a longer narrative of snaps strung together. The stories last twenty-four hours after being posted and are public to all their followers.I’m going to be very clear here: I went on the record saying I thought the update was a bad idea. I thought it was absurd to imagine that users would actually go out of their way to watch something on a platform where things were historically delivered to them (Stories live on their own page and you have to click into a Story to watch it).But boy was I wrong. This update marked Snapchat’s first big move into becoming a major platform by creating it’s own social language and context. It already had functionality very different from any other social network at the time; you could draw on top of photos, content disappeared, and the gestures of swiping up, down and to the side were relatively new. But after Stories the platform began to take off and mature as a content destination. By August 2014, 40% of 18 year olds in the US were using Snapchat on a daily basis.The biggest update in recent Snapchat history, and the one that really changed the game for me to push it towards the mainstream, has to be Discover.SNAPCHAT BECOMES A MEDIA DESTINATIONIn early 2015, Snapchat launched Discover. It’s a feature that allows users to receive content provided by top media companies. Launch participants included National Geographic, Vice, ESPN, and more. Eleven participants in all started it off. It was, and still is, a serious play to be part of Snapchat Discover because it puts a company in a very aggressive place within the overall user interface of the app and delivers an unmatched form of attention from their youthful user base. It also completely changed the swipe navigation and how the app is used.It was very exciting step forward for Snapchat. It was obvious they were paying attention to current trends and were ready to act: the explosion of content and companies becoming media companies, putting out their own content, the importance of mobile being first.Using Discover as their platform, Snapchat went out and made deals that allowed them to curate some of the top content providers in the world in this one spot. This gives them more power in the micromanagement of what shows up on the Discover page.The brands that launched as partners, and the 18 brands now currently in the space, have an enormous relationship with Snapchat, and they are getting great equity for it. Why? 45% of Snapchat’s users are under 25.There are over 100 million users, nearing 200 million. Snapchat is basically handing these brands the 25-and-under demo. So it’s no surprise that these media companies have hired entire teams around the initiative. Their only job is to make content for Snapchat.Now, Snapchat is partnering with the NFL, the White House has recently joined, and it’s safe to assume they’ll continue to broker relationships with more content creators as they’re proving that they are a real media property to be reckoned with.THE BASICS OF SNAPCHATSo now that you know everything there is to know about the history of the platform, let’s get down to the most important part: how the fuck do you use this thing? On every article I have written about Snapchat in the past, most of the comments come back to me saying something like “Yeah, but how the hell do I use this this?” or “It’s so confusing!”No problem. Below are some handy guides I have put together to teach you guys the basic functionalities of Snapchat, as well as some cool hacks.THE DIFFERENCE BETWEEN SNAP, STORY, AND CHATSo…how exactly do you define a Snap?Great question. A Snap is the main functionality of the app and is what the disappearing photos and videos are called. You send these directly to friends in the app. They last anywhere from one second up to ten seconds after being opened, then the “snap” disappears.And the difference between that and a Story is…?A Story is a collection of Snaps put together to create a, well, Story. Unlike direct Snaps, these can be viewed by anyone who follows you. When you send a Snap to your Story, it becomes public to your followers. Stories last up to 24 hours before disappearing, but still can only be up to 10 seconds long.There’s also chat right?Yep. When you swipe right on a person’s name in your direct Snap inbox, the chat function will appear. You know you’ve received a chat when a blue speech bubble appears next to someone’s name. Chats also disappear after being opened.QUICK GIF GUIDES TO USING SNAPCHATSNAPCHATTING A VIDEO V/S PHOTOHOW TO ADD FILTERS AND DOUBLE FILTERS ON SNAPCHATHOW TO USE SNAPCHAT VIDEO FILTERSHOW TO SAVE A PHOTO OR VIDEOSNAPCHAT ACCOUNTS TO FOLLOWThis is just a short list of people who are killing it on the platform. There aren’t that many yet because people still aren’t taking it seriously. So get on it now.DJ Khaled: @djkhaled305Shonduras: @shondurasCasey Neistat: @caseyneistatLACMA: @lacmaDiplo: @diploOh by the way, I’m on there too: @GaryVee.THE HISTORY OF SNAPCHAT IN ONE TIMELINE

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 40

How to create an electronic signature for your 2012 Form 40 online

How to generate an electronic signature for your 2012 Form 40 in Google Chrome

How to generate an eSignature for putting it on the 2012 Form 40 in Gmail

How to create an eSignature for the 2012 Form 40 from your smartphone

How to create an eSignature for the 2012 Form 40 on iOS

How to generate an electronic signature for the 2012 Form 40 on Android OS

People also ask

-

What is Form 40, Oregon Individual Income Tax, and who needs to file it?

Form 40, Oregon Individual Income Tax, is the state's tax return for residents who earn income within Oregon. It's required for individuals who meet specific income thresholds, and filing it accurately ensures compliance with Oregon tax laws. Understanding the requirements for Form 40, Oregon Individual Income Tax, is essential for efficient tax filing.

-

How can airSlate SignNow help with filling out Form 40, Oregon Individual Income Tax?

airSlate SignNow simplifies the process of completing Form 40, Oregon Individual Income Tax, by providing an easy-to-use platform for electronic signatures and document management. Users can fill out the form digitally, ensuring accuracy and reducing the chances of errors. Using airSlate SignNow makes tax season less stressful and more efficient.

-

What features does airSlate SignNow offer for handling tax documents like Form 40, Oregon Individual Income Tax?

airSlate SignNow offers a range of features including customizable templates, secure e-signature capabilities, and streamlined document sharing. These tools are particularly useful for managing Form 40, Oregon Individual Income Tax, allowing users to collaborate with tax professionals effortlessly. With airSlate SignNow, managing your tax documents becomes a seamless experience.

-

Is airSlate SignNow a cost-effective solution for managing Form 40, Oregon Individual Income Tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses needing to manage documents like Form 40, Oregon Individual Income Tax. With various pricing plans, users can choose one that best fits their needs without breaking the bank. This affordability makes it an attractive option during tax season.

-

Can airSlate SignNow integrate with other software for handling Form 40, Oregon Individual Income Tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software that can help with Form 40, Oregon Individual Income Tax. These integrations enhance workflow efficiency, allowing users to manage their tax documents within their preferred tools easily. This ensures a streamlined process from document creation to submission.

-

What are the benefits of using airSlate SignNow for Form 40, Oregon Individual Income Tax?

Using airSlate SignNow for Form 40, Oregon Individual Income Tax, provides several benefits, including increased efficiency, secure document handling, and reduced paperwork. The platform's e-signature feature speeds up the signing process, making it easier to meet tax deadlines. Additionally, it ensures that all documents are stored securely and can be accessed whenever needed.

-

How secure is airSlate SignNow when handling Form 40, Oregon Individual Income Tax?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like Form 40, Oregon Individual Income Tax. The platform utilizes advanced encryption protocols to protect user data and ensure that all transactions are secure. This commitment to security gives users peace of mind while managing their tax documents.

Get more for Form 40, Oregon Individual Income Tax State Of Oregon

- Notice of motion to compel further answers to requests form

- Expert witness declaration of attorney form

- California assessment of student performance and lausd

- Technical specifications and configuration guide for caaspp form

- Order granting application form

- Internet httpcand form

- Subpoena duces tecum form dir

- You are hereby commanded to appear before form

Find out other Form 40, Oregon Individual Income Tax State Of Oregon

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy