South Dakota Exemption Certificate Form 2004

What is the South Dakota Exemption Certificate Form

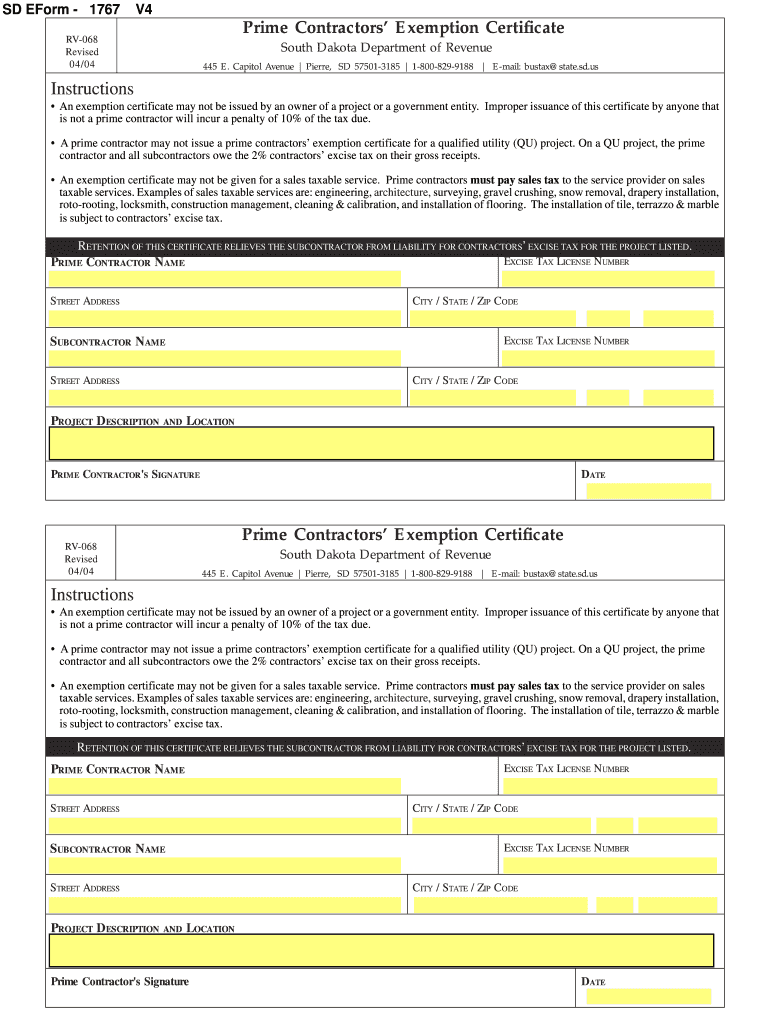

The South Dakota Exemption Certificate Form is a crucial document used primarily for tax purposes. It allows qualifying individuals or businesses to claim exemption from sales tax on certain purchases. This form is essential for entities that meet specific criteria, such as non-profit organizations or government agencies, enabling them to avoid paying sales tax on eligible transactions. Understanding the purpose of this form is vital for ensuring compliance with state tax regulations.

How to use the South Dakota Exemption Certificate Form

Using the South Dakota Exemption Certificate Form involves several straightforward steps. First, ensure that you meet the eligibility requirements for exemption. Next, download the form from a reliable source or obtain it from the appropriate state department. Fill out the form accurately, providing all necessary information, including the name of the purchaser, the seller, and a description of the items being purchased. Once completed, present the form to the seller at the time of purchase to claim the exemption.

Steps to complete the South Dakota Exemption Certificate Form

Completing the South Dakota Exemption Certificate Form requires careful attention to detail. Follow these steps:

- Download the form from an official source.

- Enter your name and address in the designated fields.

- Provide the seller's information, including their name and address.

- Describe the items or services for which you are claiming exemption.

- Sign and date the form to validate it.

After completing the form, ensure that all information is accurate before submitting it to the seller.

Legal use of the South Dakota Exemption Certificate Form

The legal use of the South Dakota Exemption Certificate Form is governed by state tax laws. It is essential to use this form only for eligible purchases to avoid potential penalties. Misuse of the form, such as claiming exemptions for ineligible items, can result in fines or legal action. Therefore, it is important to familiarize yourself with the specific conditions under which the exemption applies and to maintain accurate records of all transactions involving this form.

Key elements of the South Dakota Exemption Certificate Form

Several key elements are essential for the South Dakota Exemption Certificate Form to be valid:

- Purchaser Information: The name and address of the individual or entity claiming the exemption.

- Seller Information: The name and address of the seller providing the goods or services.

- Description of Goods/Services: A detailed description of the items or services for which the exemption is claimed.

- Signature: The signature of the purchaser or an authorized representative, along with the date of signing.

Ensuring all these elements are correctly filled out is crucial for the form's acceptance by the seller.

State-specific rules for the South Dakota Exemption Certificate Form

Each state has its own rules regarding the use of exemption certificates, and South Dakota is no exception. It is important to understand the specific criteria that qualify for exemption in South Dakota. This includes knowing which types of purchases are exempt, such as those made by non-profit organizations or government entities. Additionally, the state may have particular documentation requirements or limitations on the types of goods and services eligible for exemption. Staying informed about these rules helps ensure compliance and avoids potential issues during audits.

Quick guide on how to complete south dakota exemption certificate 2004 form

Your assistance manual on how to prepare your South Dakota Exemption Certificate Form

If you’re interested in learning how to complete and submit your South Dakota Exemption Certificate Form, here are a few brief guidelines on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow profile to transform the way you handle documents online. airSlate SignNow is a user-friendly and robust document solution that allows you to edit, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revert to modify information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your South Dakota Exemption Certificate Form in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your South Dakota Exemption Certificate Form in our editor.

- Fill in the necessary fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to include your legally-binding eSignature (if required).

- Examine your document and rectify any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to return errors and delay reimbursements. Certainly, before e-filing your taxes, check the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct south dakota exemption certificate 2004 form

FAQs

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Create this form in 5 minutes!

How to create an eSignature for the south dakota exemption certificate 2004 form

How to generate an electronic signature for your South Dakota Exemption Certificate 2004 Form online

How to make an eSignature for the South Dakota Exemption Certificate 2004 Form in Google Chrome

How to generate an eSignature for signing the South Dakota Exemption Certificate 2004 Form in Gmail

How to create an eSignature for the South Dakota Exemption Certificate 2004 Form from your mobile device

How to generate an electronic signature for the South Dakota Exemption Certificate 2004 Form on iOS devices

How to make an eSignature for the South Dakota Exemption Certificate 2004 Form on Android

People also ask

-

What is a South Dakota Exemption Certificate Form?

The South Dakota Exemption Certificate Form is a document used by businesses and individuals to claim tax-exempt status for certain purchases. This form helps streamline the process of buying goods without incurring sales tax. Utilizing airSlate SignNow to manage and eSign your South Dakota Exemption Certificate Form simplifies this process signNowly.

-

How can I complete a South Dakota Exemption Certificate Form using airSlate SignNow?

To complete a South Dakota Exemption Certificate Form using airSlate SignNow, simply upload the document, fill in the required fields, and apply your electronic signature. Our platform ensures that your form is filled out accurately and securely. With airSlate SignNow, you can finish this hassle-free in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for the South Dakota Exemption Certificate Form?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it cost-effective for users. You can access all the essential features, including eSigning the South Dakota Exemption Certificate Form, without breaking the bank. Check our pricing page for more details on affordable options.

-

What are the benefits of using airSlate SignNow for the South Dakota Exemption Certificate Form?

Using airSlate SignNow for the South Dakota Exemption Certificate Form enhances efficiency by allowing you to complete and sign documents digitally. It eliminates the need for printing, scanning, and mailing, saving both time and resources. Furthermore, your documents are securely stored and easily accessible for future reference.

-

Can I integrate airSlate SignNow with other applications for handling the South Dakota Exemption Certificate Form?

Yes, airSlate SignNow seamlessly integrates with various applications, ensuring a smooth workflow for completing the South Dakota Exemption Certificate Form. You can connect it to popular tools like Google Drive, Dropbox, and more, enhancing your document management capabilities. These integrations facilitate collaboration and improve overall efficiency.

-

How secure is my information when using airSlate SignNow to manage the South Dakota Exemption Certificate Form?

Security is a top priority for airSlate SignNow. When managing your South Dakota Exemption Certificate Form, all data is encrypted with advanced security protocols to protect your sensitive information. Additionally, our platform complies with industry standards, ensuring your documents remain confidential and secure.

-

Can multiple users access and sign the South Dakota Exemption Certificate Form?

Absolutely! With airSlate SignNow, multiple users can easily access, review, and eSign the South Dakota Exemption Certificate Form. This feature is perfect for business teams that require collective input or authorizations on documents. Collaboration has never been easier with our user-friendly platform.

Get more for South Dakota Exemption Certificate Form

- Subp 010 search edit fill sign fax ampamp save pdf online form

- To plaintiff name form

- Form at 160 download fillable pdf form cd 140

- To the person notified name form

- Attorney registration change of nameaddressnorthern form

- App002 search edit fill sign fax ampamp save pdf online form

- Order to set aside attachment civil attachment at 175 rev july 1 1983 form

- Work comp faqsprocessing overdue no response form

Find out other South Dakota Exemption Certificate Form

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template