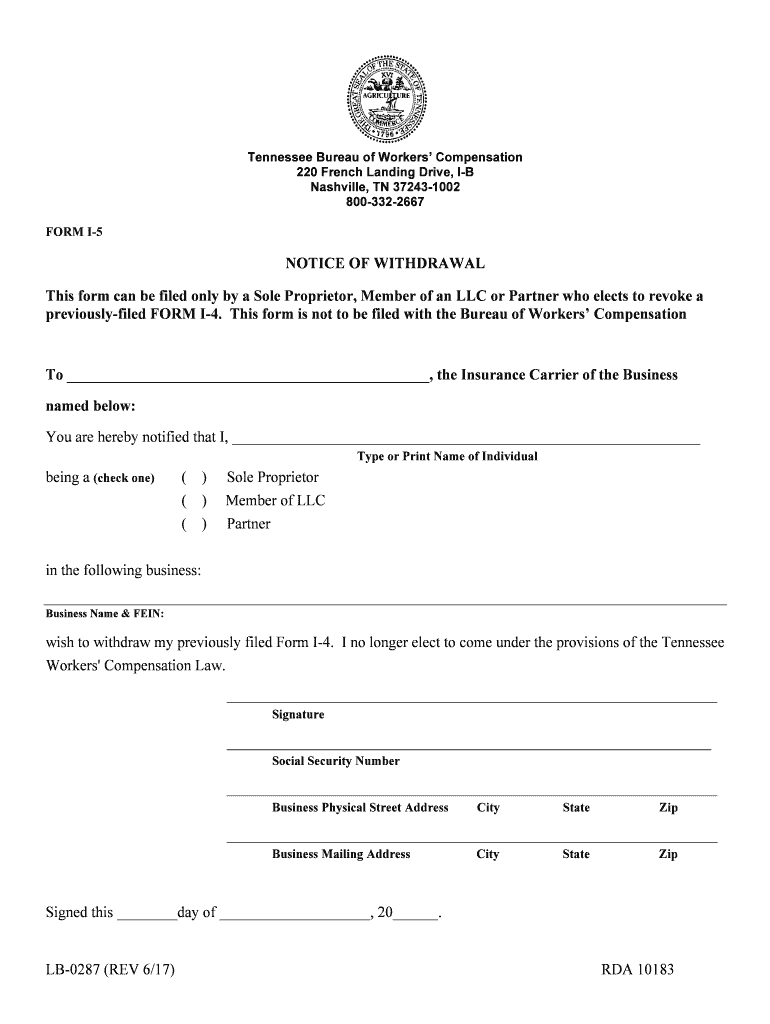

This Form Can Be Filed Only by a Sole Proprietor, Member of an LLC or Partner Who Elects to Revoke a

What is the form for sole proprietors, LLC members, or partners who elect to revoke?

This form is specifically designed for sole proprietors, members of limited liability companies (LLCs), or partners who wish to revoke a previous election or status. It serves as a formal declaration to notify relevant authorities of the change in business structure or tax status. Understanding the purpose of this form is crucial for ensuring compliance with federal and state regulations.

How to use the form for sole proprietors, LLC members, or partners who elect to revoke

Using this form involves several steps to ensure that it is completed accurately. First, gather all necessary information related to your business, including your tax identification number and details about your business structure. Next, fill out the form carefully, ensuring that all sections are completed according to the instructions provided. Finally, submit the form through the appropriate channel, whether online, by mail, or in person, depending on the requirements of the governing body.

Steps to complete the form for sole proprietors, LLC members, or partners who elect to revoke

Completing this form requires attention to detail. Follow these steps:

- Review the form instructions thoroughly to understand each section.

- Provide accurate information about your business, including your name, address, and tax identification number.

- Indicate your current business structure and the reason for revocation.

- Sign and date the form, ensuring that your signature matches the name provided.

- Submit the form as directed, keeping a copy for your records.

Legal use of the form for sole proprietors, LLC members, or partners who elect to revoke

This form is legally binding when filled out correctly and submitted according to the relevant laws. It is essential to comply with all federal and state regulations to ensure that your revocation is recognized. Failure to use the form appropriately may result in legal complications or penalties. Always consult with a legal professional if you have questions about the implications of revoking your business status.

Required documents for the form for sole proprietors, LLC members, or partners who elect to revoke

When preparing to submit this form, you may need to gather several documents, including:

- Your business registration documents.

- Tax identification number documentation.

- Any previous election forms that are being revoked.

- Identification proof, such as a driver's license or passport.

Filing deadlines for the form for sole proprietors, LLC members, or partners who elect to revoke

It is important to be aware of any filing deadlines associated with this form. Typically, deadlines may vary based on the specific circumstances of your business and the governing agency involved. Check with the appropriate state or federal agency to confirm the required submission dates to avoid any potential penalties.

Quick guide on how to complete this form can be filed only by a sole proprietor member of an llc or partner who elects to revoke a

Prepare This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly replacement for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your files quickly without any hold-ups. Manage This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to modify and eSign This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A with ease

- Locate This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether it be via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

Who can file this form?

This form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a prior election. Understanding the eligibility helps businesses navigate their filing requirements effectively.

-

How does airSlate SignNow facilitate the filing process?

airSlate SignNow streamlines the document signing and filing process, making it user-friendly. Businesses can easily prepare and send forms so that this form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a.

-

What features make airSlate SignNow a cost-effective solution?

With airSlate SignNow, users benefit from features like unlimited document signing and robust integrations that streamline operations. This ensures that this form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a efficiently and affordably.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow complies with all relevant legal standards for electronic signatures. This means that businesses can trust that this form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a while maintaining legal integrity.

-

Can airSlate SignNow integrate with other business tools?

Certainly! airSlate SignNow offers a variety of integrations with popular business tools, enhancing workflow efficiency. This allows users to ensure that this form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a in conjunction with their existing systems.

-

What kind of support does airSlate SignNow provide?

airSlate SignNow offers comprehensive customer support to assist users at any stage. Whether it’s guidance on how this form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a or troubleshooting, assistance is readily available.

-

Are there any hidden costs with airSlate SignNow?

No, airSlate SignNow is transparent about its pricing. Users can confidently proceed knowing that there are no hidden costs involved when utilizing features to ensure this form can be filed only by a sole proprietor, member of an LLC, or partner who elects to revoke a.

Get more for This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A

- Indian bank nomination form

- Consent form forelectronic privacy notice delivery

- Peoples national bank harrisburg il personal financial statement form

- Assumption of ownership voya for professionals form

- Myriad financial assistance program mfap application form

- Credit authorization form

- Ubi questionnaire form

- Non financial service request legacy financial group form

Find out other This Form Can Be Filed Only By A Sole Proprietor, Member Of An LLC Or Partner Who Elects To Revoke A

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors