IRS Tax Lien Help Request Right to Redeem Property Pub 4235 Form

What is the IRS Tax Lien Help Request Right To Redeem Property Pub 4235

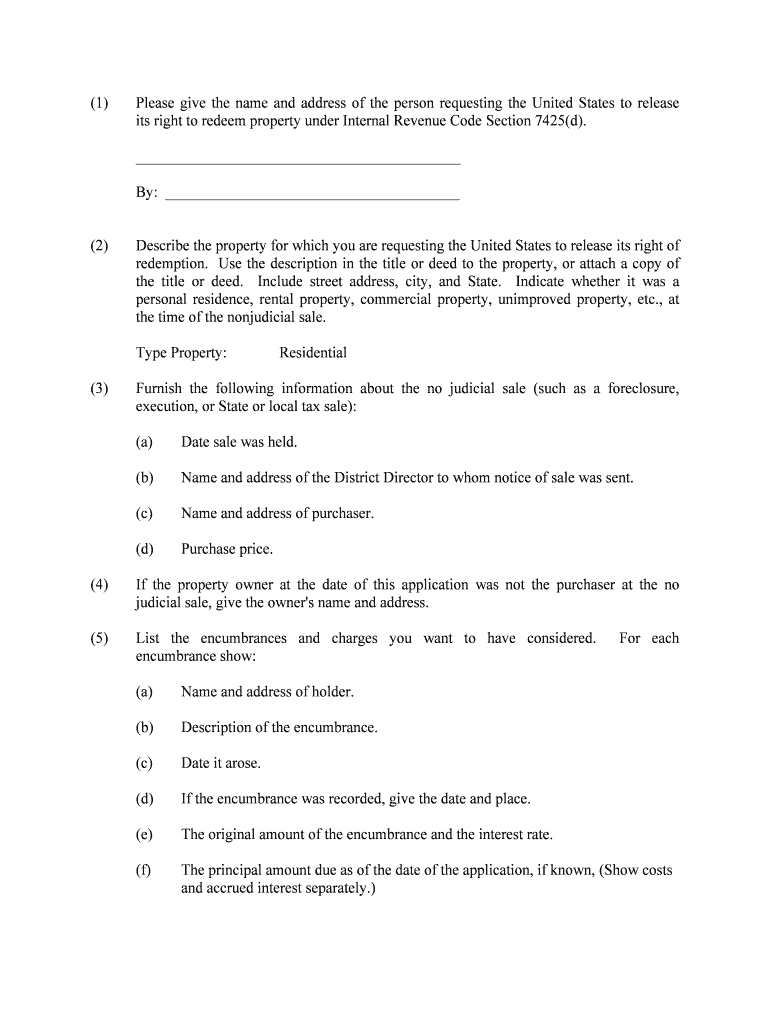

The IRS Tax Lien Help Request Right To Redeem Property Pub 4235 is a form that allows taxpayers to request assistance regarding a tax lien on their property. This document is essential for individuals seeking to reclaim their rights to property that may have been affected by an IRS tax lien. Understanding this form is crucial for navigating the complexities of tax law and ensuring compliance with IRS regulations.

How to use the IRS Tax Lien Help Request Right To Redeem Property Pub 4235

Using the IRS Tax Lien Help Request Right To Redeem Property Pub 4235 involves several steps. First, ensure that you have all necessary information about your tax lien, including the lien amount and property details. Next, complete the form accurately, providing all requested information. Once filled out, you can submit the form electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the IRS Tax Lien Help Request Right To Redeem Property Pub 4235

Completing the IRS Tax Lien Help Request Right To Redeem Property Pub 4235 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your tax identification number and details about the property.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Legal use of the IRS Tax Lien Help Request Right To Redeem Property Pub 4235

The legal use of the IRS Tax Lien Help Request Right To Redeem Property Pub 4235 is governed by IRS regulations. This form must be completed in compliance with federal tax laws to be considered valid. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal complications or delays in processing your request.

Eligibility Criteria

Eligibility for using the IRS Tax Lien Help Request Right To Redeem Property Pub 4235 typically includes individuals who have a tax lien placed on their property by the IRS. Taxpayers must demonstrate that they have a legitimate interest in the property and that they are seeking to resolve the lien. It is advisable to review the specific eligibility requirements outlined by the IRS to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The IRS Tax Lien Help Request Right To Redeem Property Pub 4235 can be submitted through various methods. Taxpayers may choose to submit the form online via the IRS website, which often provides a quicker processing time. Alternatively, the form can be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete irs tax lien help request right to redeem property pub 4235

Effortlessly Prepare IRS Tax Lien Help Request Right To Redeem Property Pub 4235 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage IRS Tax Lien Help Request Right To Redeem Property Pub 4235 on any device using the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to Edit and eSign IRS Tax Lien Help Request Right To Redeem Property Pub 4235 with Ease

- Find IRS Tax Lien Help Request Right To Redeem Property Pub 4235 and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign IRS Tax Lien Help Request Right To Redeem Property Pub 4235 to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is pub 4235 and how does it relate to airSlate SignNow?

Pub 4235 refers to a specific regulatory framework that governs electronic signatures. airSlate SignNow complies with this framework, ensuring that your eSigning processes are not only secure but also legally binding. By using airSlate SignNow, you can confidently adhere to pub 4235 standards in your document workflows.

-

What features does airSlate SignNow offer to meet pub 4235 requirements?

airSlate SignNow offers several features that align with pub 4235 requirements, including robust security protocols, user authentication, and an audit trail. These features ensure that every document signed meets all necessary legal standards. Additionally, our platform provides customizable templates to streamline your workflow under pub 4235.

-

How does airSlate SignNow ensure compliance with pub 4235?

AirSlate SignNow is designed with compliance in mind. We implement industry-standard security measures, enforce user authentication, and maintain detailed logs to meet pub 4235 requirements. Our commitment to compliance helps our users safely navigate eSigning in regulated industries.

-

What are the pricing options for using airSlate SignNow under pub 4235?

AirSlate SignNow offers flexible pricing plans tailored to suit different business needs, all while ensuring compliance with pub 4235. You can choose from a variety of subscription levels based on your requirements, ensuring you get the best value for your investment. Our competitive pricing allows businesses of all sizes to benefit from compliant eSigning.

-

Can airSlate SignNow integrate with other tools while adhering to pub 4235 standards?

Yes, airSlate SignNow provides seamless integrations with a variety of third-party applications while staying compliant with pub 4235 standards. This flexibility allows your business to enhance its workflow while ensuring that all document signing remains secure and legally valid. Integrating with tools like CRM and project management software can streamline operations.

-

What benefits does airSlate SignNow provide for businesses under pub 4235?

Using airSlate SignNow, businesses can quickly and efficiently obtain legally binding eSignatures while complying with pub 4235. This not only speeds up the document signing process but also reduces costs associated with traditional paper methods. Embracing airSlate SignNow enhances productivity and ensures legal compliance.

-

Is training available for understanding pub 4235 and using airSlate SignNow?

Absolutely! AirSlate SignNow provides comprehensive resources and training sessions to help users understand pub 4235 and effectively utilize our platform. From webinars to documentation, we ensure that you have all the tools needed to stay compliant while maximizing the benefits of airSlate SignNow.

Get more for IRS Tax Lien Help Request Right To Redeem Property Pub 4235

- Rev 072016 ksjc 1 372 in the district court of county kansasjudicialcouncil form

- In the district courts of the thirty first judicial district 31st judicial kansasjudicialcouncil form

- Rev 072016 ksjc 1 361 in the district court of kansasjudicialcouncil form

- 5113 1 127 in the district court of kansas judicial council kansasjudicialcouncil form

- 08302016 1 1702 in the district court of kansasjudicialcouncil form

- Real estate kansas probate notice publication form

- Rev 072016 ksjc 1 334 in the district court of county kansasjudicialcouncil form

- Juvenile cover sheet 120914 kansas judicial council kansasjudicialcouncil form

Find out other IRS Tax Lien Help Request Right To Redeem Property Pub 4235

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now