Acknowledgment by Charitable or Educational Form

What is the acknowledgment by charitable or educational?

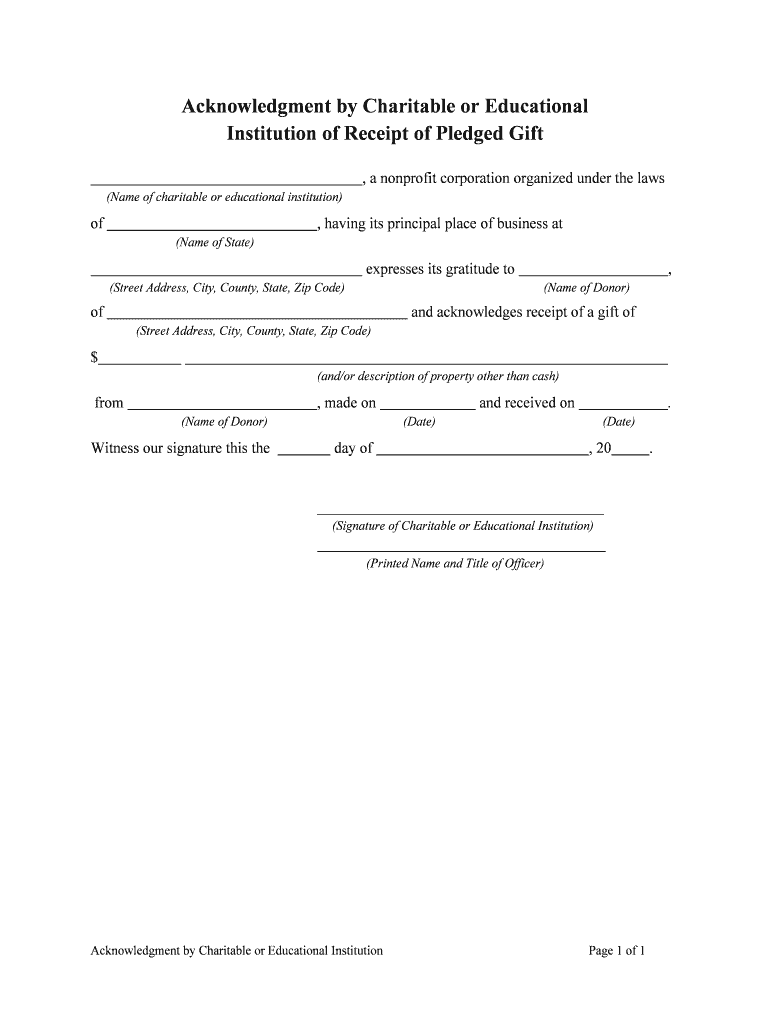

The acknowledgment by charitable or educational form serves as a formal document that verifies a donor's contribution to a nonprofit organization or educational institution. This form is crucial for donors who wish to claim tax deductions for their charitable contributions. It typically includes details such as the donor's name, the amount donated, and a statement confirming that no goods or services were provided in exchange for the donation. This ensures compliance with IRS regulations and helps maintain transparency in charitable giving.

How to use the acknowledgment by charitable or educational

Using the acknowledgment by charitable or educational form involves a straightforward process. First, ensure that the organization providing the acknowledgment meets IRS criteria for tax-exempt status. After making a donation, request the acknowledgment form from the organization. Once received, review the details for accuracy, including your name, donation amount, and date of the contribution. Keep a copy for your records, as you will need it when filing your taxes to substantiate your charitable deduction.

Steps to complete the acknowledgment by charitable or educational

Completing the acknowledgment by charitable or educational form requires a few essential steps:

- Make a donation to a qualified charitable organization or educational institution.

- Request the acknowledgment form from the organization.

- Fill out your personal information, including your name and address.

- Provide details of the donation, such as the amount and date.

- Ensure the form states that no goods or services were received in return for the donation.

- Sign and date the form, if required, and keep a copy for your tax records.

Legal use of the acknowledgment by charitable or educational

The legal use of the acknowledgment by charitable or educational form is vital for ensuring that donors can claim their tax deductions. According to IRS guidelines, a written acknowledgment is required for any donation of $250 or more. This document serves as proof of the donation and must include specific information to be valid. Failure to provide a proper acknowledgment can result in the disallowance of the claimed deduction during tax filing.

Key elements of the acknowledgment by charitable or educational

Several key elements must be included in the acknowledgment by charitable or educational form to ensure its validity:

- The name and address of the charitable organization or educational institution.

- The donor's name and address.

- The date of the contribution.

- The amount of the contribution.

- A statement confirming that no goods or services were provided in exchange for the donation.

Examples of using the acknowledgment by charitable or educational

Examples of using the acknowledgment by charitable or educational form can vary widely. For instance, an individual donating $500 to a local animal shelter would request an acknowledgment form from the shelter. This form would confirm the donation and allow the donor to claim the deduction on their taxes. Similarly, a parent donating to a school fundraiser would receive an acknowledgment to substantiate their contribution when filing their tax return.

Quick guide on how to complete acknowledgment by charitable or educational

Complete Acknowledgment By Charitable Or Educational with ease on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents swiftly without hold-ups. Handle Acknowledgment By Charitable Or Educational on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Acknowledgment By Charitable Or Educational effortlessly

- Locate Acknowledgment By Charitable Or Educational and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Acknowledgment By Charitable Or Educational and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 'Acknowledgment By Charitable Or Educational' in the context of airSlate SignNow?

'Acknowledgment By Charitable Or Educational' refers to the official recognition that a donation or contribution has been received by a charitable or educational organization. airSlate SignNow allows organizations to easily create and manage documents related to such acknowledgments, ensuring compliance and transparency.

-

How can airSlate SignNow help streamline the process of 'Acknowledgment By Charitable Or Educational'?

airSlate SignNow simplifies the entire acknowledgment process by providing customizable templates for acknowledgment letters and forms. With its electronic signature capabilities, organizations can quickly send and receive these documents, saving time and improving efficiency.

-

Are there any additional costs associated with 'Acknowledgment By Charitable Or Educational' features in airSlate SignNow?

airSlate SignNow offers transparent pricing plans that include features for 'Acknowledgment By Charitable Or Educational' documentation. Users can choose a plan that fits their budget while utilizing all necessary functionalities without unexpected fees.

-

What integrations does airSlate SignNow offer that enhance 'Acknowledgment By Charitable Or Educational' processes?

airSlate SignNow integrates seamlessly with popular platforms such as Google Drive, Dropbox, and CRM systems, making it easier to manage 'Acknowledgment By Charitable Or Educational' documents. These integrations ensure that all relevant data is synchronized and readily accessible, improving overall workflow.

-

How does airSlate SignNow ensure compliance for 'Acknowledgment By Charitable Or Educational' documents?

airSlate SignNow adheres to industry standards and regulations, ensuring that all 'Acknowledgment By Charitable Or Educational' documents are legally binding and compliant. The platform's security features protect sensitive information, giving users peace of mind.

-

Can I customize templates for 'Acknowledgment By Charitable Or Educational' documents in airSlate SignNow?

Yes, airSlate SignNow allows users to customize templates for 'Acknowledgment By Charitable Or Educational' documents according to their specific needs. This level of customization makes it easy to include branding, specific legal language, and personalized messages.

-

What benefits can organizations expect from using airSlate SignNow for 'Acknowledgment By Charitable Or Educational'?

Organizations can expect enhanced efficiency, improved documentation accuracy, and streamlined communication when using airSlate SignNow for 'Acknowledgment By Charitable Or Educational' processes. The platform minimizes paperwork and delays, allowing organizations to focus on their missions.

Get more for Acknowledgment By Charitable Or Educational

- Consent to change of name ohio supreme court form

- Application for change of name of adult form

- Oklahoma board of bar examiners form

- In the district court of county form

- I the undersigned individual of legal age being first sworn do state that i am familiar with the form

- Pre lien notice oklahoma form

- Osb registration form optional demographics osb registration form optional demographics

- Oregon exam bar form

Find out other Acknowledgment By Charitable Or Educational

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online