it 2104 2 Form 1999

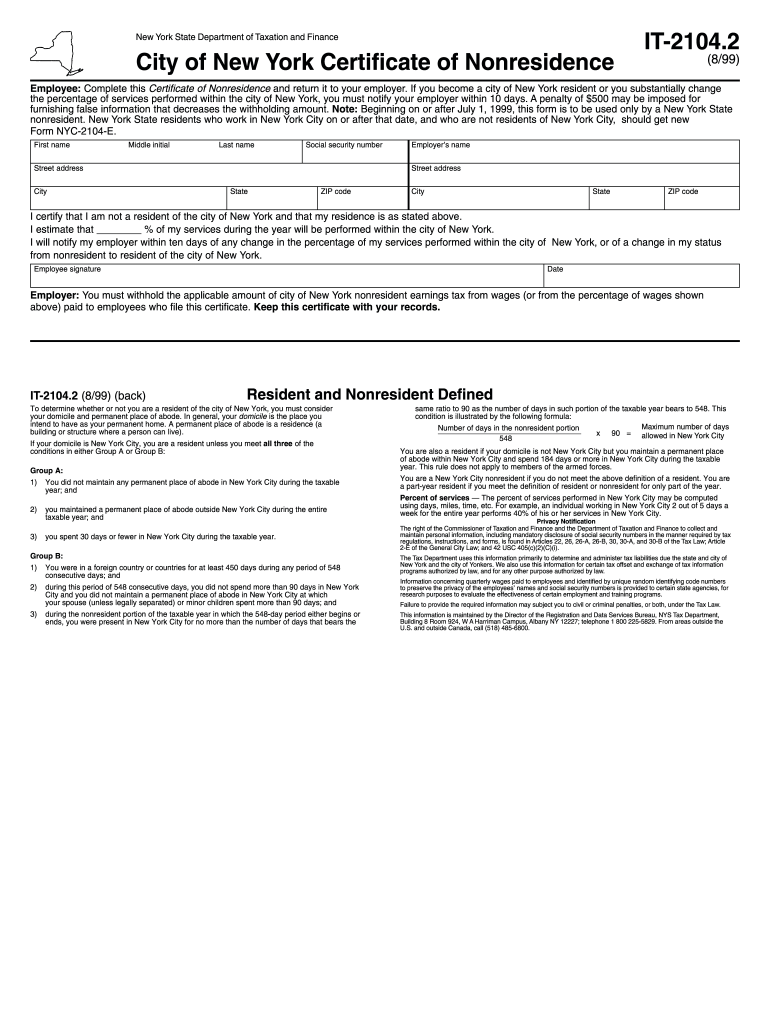

What is the It 2104 2 Form

The It 2104 2 Form is a tax document used in the United States for specific reporting purposes. This form is designed to gather essential information from taxpayers, ensuring compliance with federal regulations. It is crucial for individuals and businesses to understand the purpose of this form to accurately report their financial activities and obligations.

How to use the It 2104 2 Form

Using the It 2104 2 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents and information required for the form. Next, fill out the form online or on paper, ensuring all fields are completed correctly. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Utilizing eSignature solutions can streamline this process, allowing for a secure and efficient submission.

Steps to complete the It 2104 2 Form

Completing the It 2104 2 Form can be done in a few straightforward steps:

- Gather all relevant financial documents, including income statements and deductions.

- Access the form online or obtain a physical copy.

- Fill in the required fields, ensuring accuracy and completeness.

- Review the form for any errors or omissions.

- Sign the form electronically or manually as required.

- Submit the completed form to the designated tax authority.

Legal use of the It 2104 2 Form

The It 2104 2 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to guidelines regarding the information provided and the method of submission. Utilizing electronic signatures is permissible under the ESIGN Act, which adds a layer of security and convenience for taxpayers. It is essential to keep a copy of the submitted form for personal records and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the It 2104 2 Form vary based on individual circumstances, such as whether the taxpayer is self-employed or part of a corporation. Generally, the form should be submitted by the established tax filing deadline, which is typically April 15 for individual taxpayers. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The It 2104 2 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via authorized e-filing services.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Each method has its own advantages, such as immediate confirmation of receipt for online submissions or the ability to ask questions in person.

Quick guide on how to complete it 2104 2 1999 form

Your assistance manual on how to prepare your It 2104 2 Form

If you desire to understand how to finalize and submit your It 2104 2 Form, here are some brief instructions to simplify the tax processing.

To get started, simply register your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to modify, create, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to edit information as needed. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your It 2104 2 Form within a few moments:

- Establish your account and begin working on PDFs in no time.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your It 2104 2 Form in our editor.

- Fill in the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and amend any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please remember that submitting in paper format may increase return errors and delay refunds. Naturally, prior to e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 2104 2 1999 form

FAQs

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

I live in NJ and will work in NY, do I still have to fill out the NJ W4 or will the IT-2104 suffice?

The prior two commenters did not answer the question. If you work in New York but live in New Jersey, the IT-2104 should be all you need, because you have no earned income in New Jersey, so there should be no reason to complete an NJ-W4. There is one caveat however - if you are going to spend a signNow of WORKING days in New Jersey and your employer actually tracks this and withholds New Jersey income tax, then you should complete an NJ-W4 so not too much New Jersey tax is withheld. Otherwise there is no reason to complete an NJ-W4.

-

What should I put in line 1 and 2 for the IT-2104 form?

The answer to line 2 is it does not matter, you should have checked the box just above Line 1 that says you are not a NY City resident and thus not subject to NY City Income tax. NYC only taxes its residents. Your employer should not be withholding NYC income tax from your pay.As for line 1, that is actually a pretty complicated question and probably beyond what could be answered here, but I will tell you the critical issue to consider and hopefully you can get close. First you will owe NY state income tax on your wages earned in New York. You can start by completing the worksheet on page 3, lines 6-17 to see what number you come up with for line 1. The problem is most of the credits will not apply to you because you will are not a NY resident and as such file a non-resident tax return for NY. You do have to file a tax return with NY and pay tax on the wages you earn, but your deductions and exemptions are going to be allocated between NY and NJ earnings. Since you have a dependent you should at least have a 1 on line 1. The larger the number on line 1, the less New York state tax that will be withheld. If you don't have enough withheld, the downside is you have to come up with a payment to NY when you file your return next year. The downside to putting a larger number on line 1 is your take home pay will go down and you could actually pay in more tax dollars than you need to. The good news is you will get the money back when you file your tax return.If you can afford to have more withheld the safe thing to do is put 1 and in most cases you should have more than enough paid in to cover your tax liability. If in fact that does give you a big refund from NY next year, you can increase the number on line 1 for the next year. Each exemption you claim on line 1 is going to be equal to about $1,000 of tax withheld for the entire year.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

Create this form in 5 minutes!

How to create an eSignature for the it 2104 2 1999 form

How to create an eSignature for your It 2104 2 1999 Form in the online mode

How to generate an eSignature for your It 2104 2 1999 Form in Google Chrome

How to make an electronic signature for putting it on the It 2104 2 1999 Form in Gmail

How to make an eSignature for the It 2104 2 1999 Form right from your mobile device

How to generate an electronic signature for the It 2104 2 1999 Form on iOS

How to make an electronic signature for the It 2104 2 1999 Form on Android OS

People also ask

-

What is the IT 2104 2 Form and why is it important?

The IT 2104 2 Form is a New York State tax form that allows employees to adjust their withholding allowances. Completing this form accurately ensures that the right amount of taxes is withheld from your paycheck, preventing overpayment or underpayment. Using airSlate SignNow can simplify the signing and submission process of the IT 2104 2 Form.

-

How can airSlate SignNow help with the IT 2104 2 Form?

airSlate SignNow offers a seamless platform to fill out, sign, and send the IT 2104 2 Form quickly and securely. With its user-friendly interface, you can easily manage all your tax documentation, ensuring that you meet deadlines without hassle. This efficiency helps you focus on other important aspects of your business.

-

Is there a cost associated with using airSlate SignNow for the IT 2104 2 Form?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. However, the cost is often offset by the time saved and the efficiency gained in managing documents like the IT 2104 2 Form. You can choose a plan that best suits your requirements and budget.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides features like electronic signatures, document templates, and real-time tracking, which are perfect for managing the IT 2104 2 Form. You can create templates for recurring forms, ensuring consistency and saving time for future submissions. Additionally, the platform allows for secure storage and easy access to your documents.

-

Can I integrate airSlate SignNow with other software for the IT 2104 2 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the IT 2104 2 Form alongside other business processes. Whether you use CRM systems, cloud storage, or productivity tools, these integrations streamline your workflows and improve overall efficiency.

-

How secure is the signing process for the IT 2104 2 Form on airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs robust encryption and compliance with industry standards to ensure that your IT 2104 2 Form and other documents are protected. You can confidently send and receive signed documents, knowing that your data is secure.

-

What benefits does airSlate SignNow provide for businesses handling the IT 2104 2 Form?

Using airSlate SignNow for the IT 2104 2 Form offers numerous benefits, including faster processing times and reduced paper waste. It enhances collaboration among team members, allowing for quick reviews and approvals. This efficiency can lead to signNow cost savings and improved productivity within your organization.

Get more for It 2104 2 Form

- Landlords attention that tenant is keeping form

- The condition of the roof is interfering with my quiet enjoyment of the premises and is causing form

- The window glass is broken form

- The leased dwelling has been severely compromised by the failure of the form

- Problems list form

- Specifically the following problems exist form

- This letter is to provide you with notice the lack of garbage bins in which to store garbage form

- We agreed that your monthly rent would be reduced by the amount form

Find out other It 2104 2 Form

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure

- Sign Connecticut Affidavit of Service Free

- Sign Michigan Affidavit of Service Online

- How To Sign New Hampshire Affidavit of Service

- How Can I Sign Wyoming Affidavit of Service