Tax Rules for Hiring Resident Property ManagersNolo Form

What is the Tax Rules For Hiring Resident Property ManagersNolo

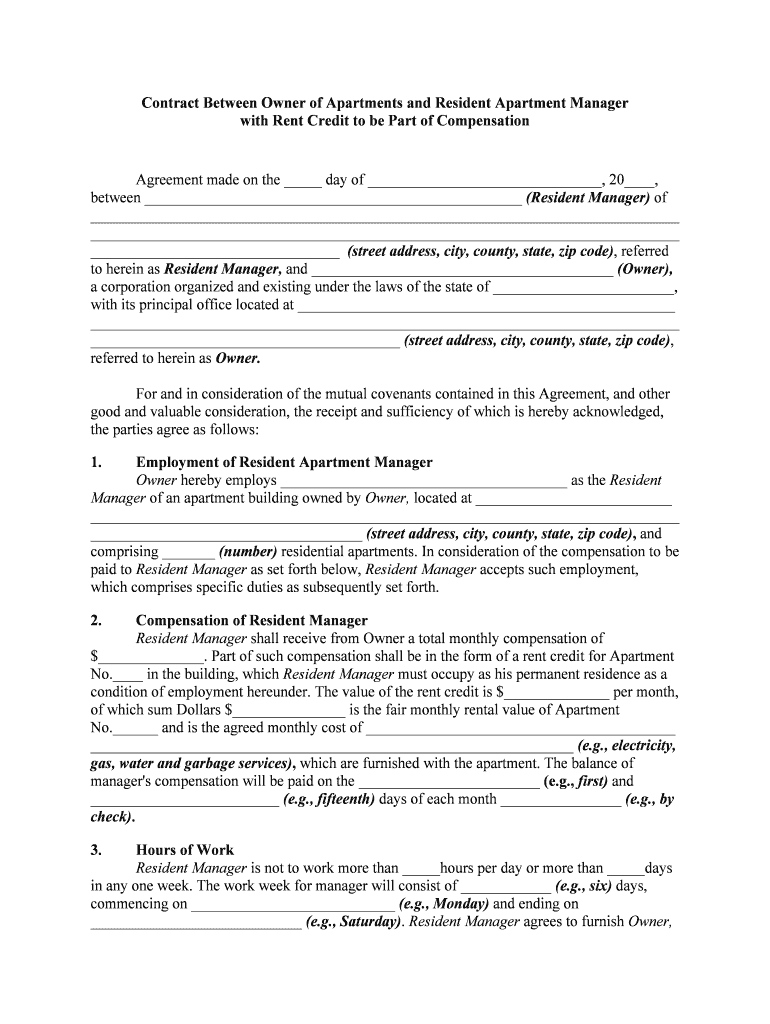

The Tax Rules For Hiring Resident Property ManagersNolo outlines the specific tax obligations and regulations that property owners must adhere to when employing resident property managers. This form serves as a guide to understanding various tax implications, including income reporting and deductions related to property management services. It is essential for property owners to familiarize themselves with these rules to ensure compliance with federal and state tax laws.

Steps to complete the Tax Rules For Hiring Resident Property ManagersNolo

Completing the Tax Rules For Hiring Resident Property ManagersNolo involves several key steps. First, gather all necessary information regarding the resident property manager's employment status, including their compensation structure and any applicable benefits. Next, accurately fill out the form, ensuring that all sections are completed thoroughly to avoid delays or issues with the IRS. Finally, review the completed form for accuracy before submission, as errors can lead to complications in tax reporting.

Key elements of the Tax Rules For Hiring Resident Property ManagersNolo

Several key elements are crucial to the Tax Rules For Hiring Resident Property ManagersNolo. These include the classification of the property manager as an employee or independent contractor, the reporting requirements for compensation, and the eligibility for tax deductions related to property management expenses. Understanding these elements helps property owners navigate their tax responsibilities effectively and avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the taxation of resident property managers. These guidelines clarify the tax treatment of compensation paid to property managers, including how to report this income on tax returns. Property owners should consult the IRS publications relevant to their situation to ensure compliance and to take advantage of any available deductions or credits.

Penalties for Non-Compliance

Failure to adhere to the Tax Rules For Hiring Resident Property ManagersNolo can result in significant penalties. Non-compliance may lead to fines, interest on unpaid taxes, and potential audits by the IRS. It is vital for property owners to understand the risks associated with improper reporting and to take proactive measures to ensure compliance with all applicable tax laws.

Eligibility Criteria

Eligibility criteria for utilizing the Tax Rules For Hiring Resident Property ManagersNolo include the requirement that the property manager must provide services directly related to the management of residential properties. Additionally, property owners must ensure that they meet all federal and state tax obligations associated with hiring a resident property manager. Understanding these criteria helps in determining the correct application of tax rules.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Tax Rules For Hiring Resident Property ManagersNolo. Property owners can choose to file the form online through the IRS e-file system, which offers a fast and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate IRS address, or submitted in person at designated IRS offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits the owner's needs.

Quick guide on how to complete tax rules for hiring resident property managersnolo

Complete Tax Rules For Hiring Resident Property ManagersNolo effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Tax Rules For Hiring Resident Property ManagersNolo on any platform using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The most efficient way to modify and eSign Tax Rules For Hiring Resident Property ManagersNolo with ease

- Locate Tax Rules For Hiring Resident Property ManagersNolo and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive data using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Tax Rules For Hiring Resident Property ManagersNolo and guarantee outstanding communication throughout the preparation process of the form with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the Tax Rules For Hiring Resident Property ManagersNolo?

The Tax Rules For Hiring Resident Property ManagersNolo inform property owners about the regulations and deductions applicable when hiring a property manager. Understanding these rules helps you manage your expenses effectively. With the right documentation, you can take advantage of potential tax benefits.

-

How can I ensure compliance with Tax Rules For Hiring Resident Property ManagersNolo?

To ensure compliance with the Tax Rules For Hiring Resident Property ManagersNolo, it’s advisable to keep accurate records of all transactions. Consulting a tax professional familiar with these regulations can also provide clarity and help avoid costly mistakes. Additionally, using tools that streamline contract management can enhance your compliance efforts.

-

What features does airSlate SignNow offer for managing documents related to Tax Rules For Hiring Resident Property ManagersNolo?

airSlate SignNow offers features like eSignature, document templates, and real-time collaboration, making it easier to manage contracts and agreements relevant to the Tax Rules For Hiring Resident Property ManagersNolo. These tools simplify compliance documentation and ensure that all agreements are signed promptly. This efficiency can be a signNow asset for property managers.

-

Is airSlate SignNow cost-effective for managing contracts under Tax Rules For Hiring Resident Property ManagersNolo?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing contracts, especially when considering the Tax Rules For Hiring Resident Property ManagersNolo. The pricing structure is competitive, and businesses can save time and money by streamlining their document workflow. This leads to increased efficiency and improved operational costs.

-

Can I integrate airSlate SignNow with other platforms to assist with Tax Rules For Hiring Resident Property ManagersNolo?

Absolutely, airSlate SignNow can integrate with various platforms to enhance document management related to Tax Rules For Hiring Resident Property ManagersNolo. Integrations allow for seamless data transfer between systems, enabling better tracking of contracts and compliance documentation. This connectivity supports a more efficient workflow for property management.

-

What benefits does airSlate SignNow provide for managing tax documentation under Tax Rules For Hiring Resident Property ManagersNolo?

The benefits of using airSlate SignNow include reducing paperwork, improving document turnaround times, and ensuring that all necessary tax documentation for the Tax Rules For Hiring Resident Property ManagersNolo is properly organized. This digital transformation can lead to increased accuracy and reduced risk of non-compliance. Overall, it simplifies the management process for property owners.

-

How does airSlate SignNow handle the security of documents related to Tax Rules For Hiring Resident Property ManagersNolo?

airSlate SignNow prioritizes the security of your documents, including those related to the Tax Rules For Hiring Resident Property ManagersNolo. The platform employs advanced encryption and security protocols to protect sensitive data. Users can rest assured that their information is safe and compliant with industry standards.

Get more for Tax Rules For Hiring Resident Property ManagersNolo

Find out other Tax Rules For Hiring Resident Property ManagersNolo

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement