Apology for Accounting Errors and Past Due Notices Form

What is the Apology For Accounting Errors And Past Due Notices

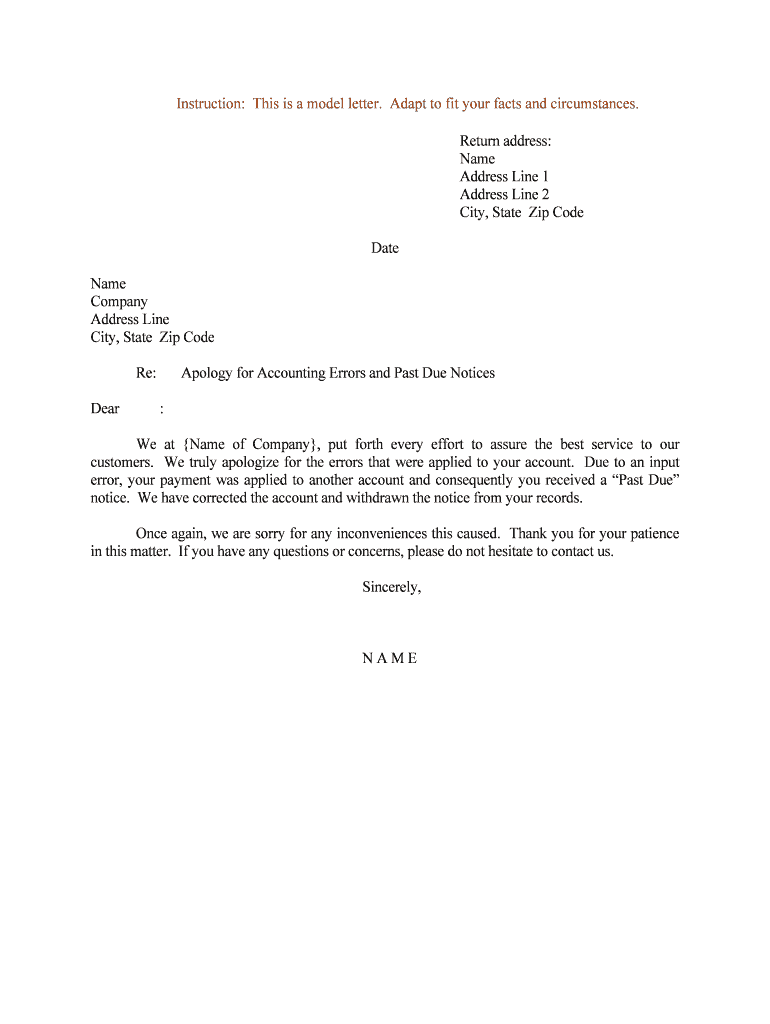

The Apology for Accounting Errors and Past Due Notices is a formal document used by businesses to acknowledge and address mistakes in accounting records or overdue payments. This form serves as a means to communicate with clients or stakeholders, ensuring transparency and maintaining trust. By issuing this apology, organizations can clarify the nature of the error, outline steps taken to rectify it, and provide reassurance regarding future accuracy in financial dealings.

How to use the Apology For Accounting Errors And Past Due Notices

Using the Apology for Accounting Errors and Past Due Notices involves several key steps. First, gather all relevant information regarding the error, including the specific details of the accounting mistake and any associated past due notices. Next, draft the apology, ensuring it includes an acknowledgment of the error, an explanation of its impact, and a commitment to rectify the situation. Finally, deliver the completed document to the affected parties, either digitally or in print, to ensure proper communication and record-keeping.

Steps to complete the Apology For Accounting Errors And Past Due Notices

Completing the Apology for Accounting Errors and Past Due Notices requires careful attention to detail. Follow these steps:

- Identify the error: Clearly define what the accounting mistake was and how it occurred.

- Gather documentation: Collect any relevant financial records or correspondence that support your explanation.

- Draft the apology: Write a clear and concise statement that includes an acknowledgment of the error and an explanation of corrective actions.

- Review for accuracy: Ensure that all information is correct and that the tone is professional and supportive.

- Distribute the document: Send the apology to all relevant parties, ensuring that it is received and acknowledged.

Legal use of the Apology For Accounting Errors And Past Due Notices

The Apology for Accounting Errors and Past Due Notices holds legal significance, particularly in maintaining compliance with financial regulations. When properly executed, this document can serve as evidence of good faith efforts to rectify mistakes. It is important to ensure that the apology is signed and dated, as this adds to its legal validity. Additionally, organizations should retain copies of the apology for their records, as it may be needed for future reference or audits.

Key elements of the Apology For Accounting Errors And Past Due Notices

Several key elements should be included in the Apology for Accounting Errors and Past Due Notices to ensure clarity and effectiveness:

- Date: Include the date of the apology to establish a timeline.

- Recipient information: Clearly state the name and contact details of the individual or organization receiving the apology.

- Description of the error: Provide a detailed account of the mistake, including how it occurred and its impact.

- Corrective actions: Outline the steps taken to correct the error and prevent future occurrences.

- Contact information: Offer a point of contact for any questions or further discussion regarding the issue.

Examples of using the Apology For Accounting Errors And Past Due Notices

Examples of the Apology for Accounting Errors and Past Due Notices can vary depending on the context. For instance, a small business might use this form to address an error in invoicing that led to a client receiving a past due notice in error. Another example could involve a nonprofit organization apologizing for misreporting donation amounts, thereby affecting donor trust. Each example illustrates the importance of transparency and accountability in maintaining professional relationships.

Quick guide on how to complete apology for accounting errors and past due notices

Complete Apology For Accounting Errors And Past Due Notices easily on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow offers all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Apology For Accounting Errors And Past Due Notices on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Apology For Accounting Errors And Past Due Notices effortlessly

- Find Apology For Accounting Errors And Past Due Notices and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Apology For Accounting Errors And Past Due Notices to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of an Apology For Accounting Errors And Past Due Notices?

An Apology For Accounting Errors And Past Due Notices is crucial for maintaining trust with clients and partners. It not only acknowledges mistakes but also reflects your commitment to transparency and accountability. By addressing these errors promptly, businesses can mitigate negative impacts and foster stronger relationships.

-

How can airSlate SignNow help manage Apology For Accounting Errors And Past Due Notices?

airSlate SignNow simplifies the process of creating and sending Apology For Accounting Errors And Past Due Notices through its user-friendly interface. Our solution allows you to draft customized messages that address specific errors while maintaining a professional tone. Additionally, you can easily track the status of these communications.

-

Is airSlate SignNow cost-effective for small businesses seeking to send Apology For Accounting Errors And Past Due Notices?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses looking to send Apology For Accounting Errors And Past Due Notices without breaking the bank. Our affordable subscriptions provide access to essential features that streamline the document signing process, ensuring that even small teams can communicate effectively.

-

What features does airSlate SignNow offer for handling Apology For Accounting Errors And Past Due Notices?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking for Apology For Accounting Errors And Past Due Notices. These functionalities ensure that your communications are efficient and professional. You can also save time by reusing templates for frequently sent notices.

-

Can I integrate airSlate SignNow with other accounting software for better management of Apology For Accounting Errors And Past Due Notices?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, enhancing your ability to manage Apology For Accounting Errors And Past Due Notices. This integration ensures that your financial documents and communications are synchronized, reducing the chances of future errors and ensuring a smooth workflow.

-

How does airSlate SignNow ensure security for sensitive Apology For Accounting Errors And Past Due Notices?

airSlate SignNow prioritizes security with advanced encryption methods, ensuring that your Apology For Accounting Errors And Past Due Notices remain confidential. Our platform complies with industry standards and regulations to protect sensitive information. You can send and sign documents with peace of mind knowing your data is secure.

-

What support options are available for users of airSlate SignNow dealing with Apology For Accounting Errors And Past Due Notices?

Users of airSlate SignNow have access to dedicated support resources, including FAQs, tutorials, and live chat. Our support team is readily available to assist you with any questions related to handling Apology For Accounting Errors And Past Due Notices. Whether it’s technical assistance or best practices, we’re here to help.

Get more for Apology For Accounting Errors And Past Due Notices

Find out other Apology For Accounting Errors And Past Due Notices

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure