Continuing and Unconditional Guaranty of Business Indebtedness Form

What is the Continuing And Unconditional Guaranty Of Business Indebtedness

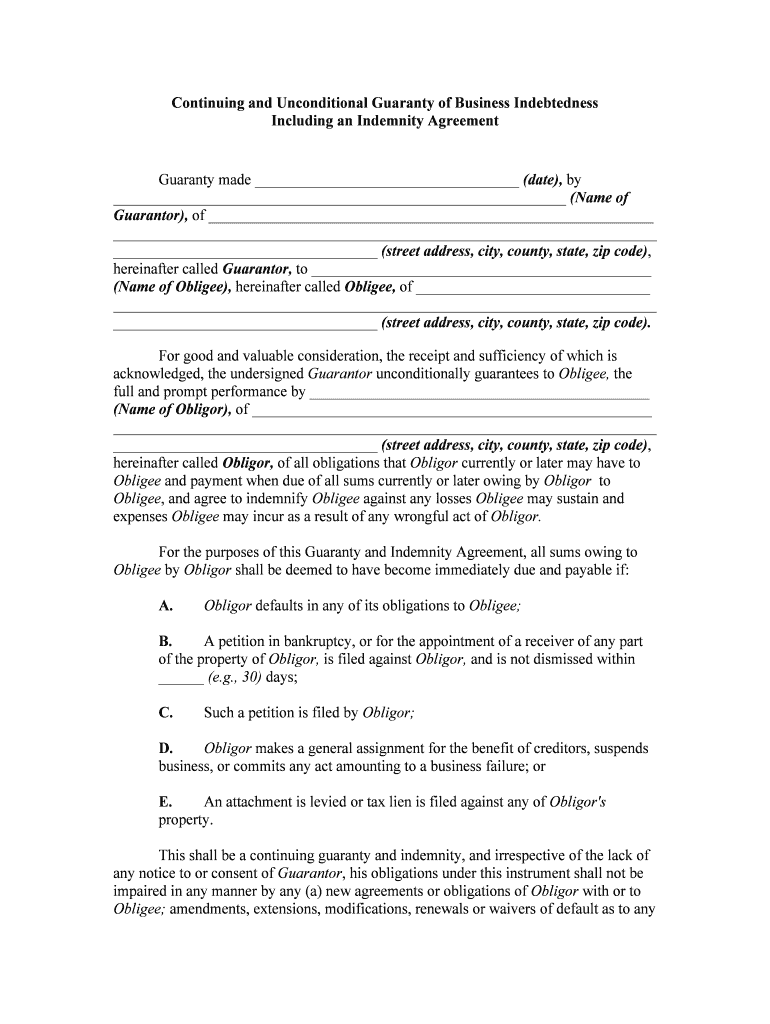

The Continuing and Unconditional Guaranty of Business Indebtedness is a legal document that ensures a guarantor agrees to be responsible for a borrower's debts. This form is often utilized in business transactions where a lender seeks additional security beyond the borrower’s creditworthiness. The guarantor pledges to cover the debts, regardless of the circumstances, making it a vital tool for lenders to mitigate risk.

Key Elements of the Continuing And Unconditional Guaranty Of Business Indebtedness

Understanding the key elements of this guaranty is crucial for both lenders and borrowers. The main components typically include:

- Identification of Parties: Clearly states the names and addresses of the borrower and guarantor.

- Scope of Guarantee: Defines the extent of the guarantor's liability, including the types of debts covered.

- Duration: Specifies how long the guaranty remains in effect, often until the debt is fully repaid.

- Conditions: Outlines any conditions under which the guarantor may be released from liability.

Steps to Complete the Continuing And Unconditional Guaranty Of Business Indebtedness

Completing the Continuing and Unconditional Guaranty of Business Indebtedness involves several important steps:

- Gather Information: Collect necessary details about the borrower, guarantor, and the debt.

- Fill Out the Form: Accurately complete all sections of the form, ensuring clarity and correctness.

- Review Terms: Both parties should review the terms and conditions outlined in the document.

- Sign and Date: Ensure that the guarantor signs and dates the form, as this is crucial for its validity.

Legal Use of the Continuing And Unconditional Guaranty Of Business Indebtedness

The legal use of this guaranty is governed by state laws and regulations. It is essential for the guarantor to understand their obligations and rights under the law. The guaranty must comply with the Uniform Commercial Code (UCC) and other relevant statutes to be enforceable. This ensures that the lender can enforce the guaranty in a court of law if necessary.

How to Use the Continuing And Unconditional Guaranty Of Business Indebtedness

Using the Continuing and Unconditional Guaranty of Business Indebtedness effectively requires careful consideration. Lenders typically present this form during the loan application process. The guarantor should assess their financial situation and ability to cover the debt before signing. It is advisable to consult with a legal professional to understand the implications of the guaranty fully.

Examples of Using the Continuing And Unconditional Guaranty Of Business Indebtedness

Practical examples can illustrate how this guaranty functions in real-world scenarios. For instance, a small business applying for a loan may require a personal guaranty from the owner or a major stakeholder. In another case, a franchise might ask for a guaranty from the parent company to secure financing for expansion. These examples highlight the flexibility and necessity of the guaranty in various business contexts.

Quick guide on how to complete continuing and unconditional guaranty of business indebtedness

Complete Continuing And Unconditional Guaranty Of Business Indebtedness effortlessly on any gadget

Digital document management has become widely embraced by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Continuing And Unconditional Guaranty Of Business Indebtedness on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to alter and electronically sign Continuing And Unconditional Guaranty Of Business Indebtedness with ease

- Obtain Continuing And Unconditional Guaranty Of Business Indebtedness and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Continuing And Unconditional Guaranty Of Business Indebtedness to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Continuing And Unconditional Guaranty Of Business Indebtedness?

A Continuing And Unconditional Guaranty Of Business Indebtedness is a legal agreement that ensures a guarantor agrees to fulfill the obligations of a business in the event of default. This type of guaranty provides lenders the security they need to extend credit, knowing they can claim payment from the guarantor if necessary.

-

How can airSlate SignNow help with the Continuing And Unconditional Guaranty Of Business Indebtedness?

airSlate SignNow simplifies the process of sending and eSigning documents, including those related to a Continuing And Unconditional Guaranty Of Business Indebtedness. With our user-friendly platform, businesses can quickly generate and transmit these essential documents securely.

-

What are the benefits of using airSlate SignNow for my guaranty documents?

Using airSlate SignNow for your Continuing And Unconditional Guaranty Of Business Indebtedness offers numerous benefits, including improved efficiency, reduced paperwork, and secure storage. Our solution ensures that all parties can easily review, sign, and store critical documents in one place.

-

Is airSlate SignNow cost-effective for handling business indebtedness guarantees?

Yes, airSlate SignNow is a cost-effective solution for managing your Continuing And Unconditional Guaranty Of Business Indebtedness documents. With our competitive pricing plans, businesses of all sizes can utilize our features without breaking the budget.

-

What features does airSlate SignNow offer for business agreements?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking, making it ideal for managing Continuing And Unconditional Guaranty Of Business Indebtedness agreements. These tools enhance collaboration and ensure all parties stay informed throughout the process.

-

Can airSlate SignNow integrate with other business tools for better document management?

Absolutely! airSlate SignNow offers seamless integrations with various business tools such as CRMs, project management software, and more. This allows for enhanced efficiency when creating and managing documents related to Continuing And Unconditional Guaranty Of Business Indebtedness.

-

How secure is airSlate SignNow for storing my guaranty documents?

Security is a top priority for airSlate SignNow. All documents, including those related to Continuing And Unconditional Guaranty Of Business Indebtedness, are encrypted and stored in compliance with industry standards, ensuring your sensitive information remains protected.

Get more for Continuing And Unconditional Guaranty Of Business Indebtedness

- Dhx bol form

- Declaration batteries form

- Iusb housing application form

- Lake tahoe community college transcripts form

- Poly tank inspection form

- Sample lease formdoc purpose built taxi sample lease agreement caes uga

- Training allowance entitlement form f103

- 4 rs classroom observation walk through tool form

Find out other Continuing And Unconditional Guaranty Of Business Indebtedness

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template