Writing an Unable to Pay Debt Letter Sample Letters Form

Understanding the Sample Letter to Creditor Unable to Pay

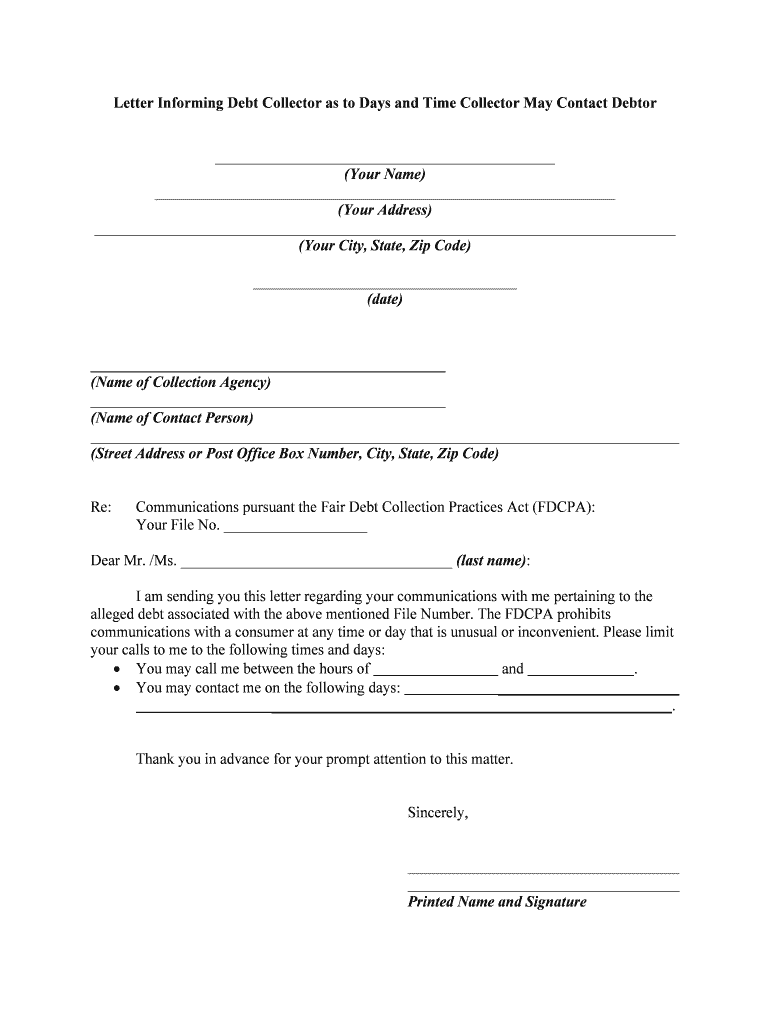

A sample letter to creditor unable to pay is a formal document used to communicate with creditors regarding an inability to meet payment obligations. This letter serves to explain your financial situation, express your intention to resolve the debt, and propose a possible repayment plan or request for leniency. It is important to articulate your circumstances clearly and respectfully, as this can influence the creditor's response.

Key Elements of the Sample Letter to Creditor Unable to Pay

When drafting a letter to a creditor, certain key elements should be included to ensure clarity and professionalism:

- Your Contact Information: Include your name, address, phone number, and email at the top of the letter.

- Date: Add the date you are writing the letter.

- Creditor's Information: Include the name and address of the creditor or collection agency.

- Subject Line: Clearly state the purpose of the letter, such as "Unable to Pay Debt."

- Body of the Letter: Explain your situation, including any relevant details about your financial hardship.

- Proposed Solution: Suggest a repayment plan or request for a temporary hold on payments.

- Closing: Thank the creditor for their understanding and provide your signature.

Steps to Complete the Sample Letter to Creditor Unable to Pay

Completing a letter to a creditor involves several important steps to ensure it is effective:

- Gather Documentation: Collect any relevant financial documents that support your claim, such as income statements or bills.

- Draft the Letter: Use the key elements outlined above to create a clear and concise letter.

- Review and Edit: Check for grammatical errors and ensure the tone is professional and respectful.

- Sign the Letter: Add your signature to personalize the document.

- Send the Letter: Choose a method of delivery, such as certified mail, to ensure it is received.

Legal Use of the Sample Letter to Creditor Unable to Pay

Using a sample letter to creditor unable to pay can have legal implications. It is important to understand that this letter does not absolve you of your debt but rather communicates your current financial difficulties. Ensure that your letter is truthful and does not contain misleading information, as this could lead to legal issues. Additionally, keeping a copy of the letter and any correspondence with the creditor is advisable for your records.

Examples of Using the Sample Letter to Creditor Unable to Pay

Here are a few scenarios where a sample letter to creditor unable to pay may be applicable:

- Job Loss: If you have recently lost your job and are unable to make payments, explain your situation and request a temporary payment plan.

- Medical Expenses: If unexpected medical bills have impacted your finances, detail these circumstances in your letter.

- Divorce or Separation: Financial strain due to divorce can be a valid reason to communicate with creditors about payment difficulties.

How to Use the Sample Letter to Creditor Unable to Pay

To effectively use a sample letter to creditor unable to pay, follow these guidelines:

- Personalize the Template: Adjust the sample letter to reflect your unique circumstances and financial situation.

- Maintain Professionalism: Keep the tone respectful and avoid emotional language.

- Follow Up: After sending the letter, follow up with the creditor to confirm receipt and discuss any potential arrangements.

Quick guide on how to complete writing an unable to pay debt letter sample letters

Prepare Writing An Unable To Pay Debt Letter Sample Letters effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Writing An Unable To Pay Debt Letter Sample Letters across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based task today.

How to change and eSign Writing An Unable To Pay Debt Letter Sample Letters without hassle

- Locate Writing An Unable To Pay Debt Letter Sample Letters and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as an ordinary wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign Writing An Unable To Pay Debt Letter Sample Letters to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter to creditor unable to pay?

A sample letter to creditor unable to pay is a template that helps individuals communicate with their creditors when they're facing financial difficulties. It outlines the reasons for inability to make payments and often includes a request for forbearance or a revised payment plan. Utilizing such a template can help ensure that the message is clear and professional.

-

How can I use airSlate SignNow to send a sample letter to creditor unable to pay?

AirSlate SignNow provides a user-friendly platform to create and send documents, including a sample letter to creditor unable to pay. You can customize the template according to your situation and eSign it securely. This streamlines the process and allows for quick delivery to your creditor.

-

Are there templates available for a sample letter to creditor unable to pay?

Yes, airSlate SignNow offers various templates, including a sample letter to creditor unable to pay. These templates can be easily customized to meet your specific needs, ensuring your communication is both effective and professional. You can access these templates directly within the SignNow platform.

-

What features does airSlate SignNow offer for managing financial documents?

AirSlate SignNow includes features such as customizable templates, electronic signatures, and document tracking, which are essential for managing financial documents like a sample letter to creditor unable to pay. These features enable you to easily create, send, and monitor your documents, ensuring efficient communication with your creditors.

-

Is airSlate SignNow cost-effective for sending legal documents?

Absolutely! AirSlate SignNow is designed to be a cost-effective solution for sending legal documents, including a sample letter to creditor unable to pay. With a variety of pricing plans available, businesses of all sizes can find an option that fits their needs and budget while enjoying powerful document management features.

-

How secure is airSlate SignNow when sending sensitive documents?

AirSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect your sensitive documents, including a sample letter to creditor unable to pay. You can feel confident that your information is handled securely, reducing the risk of data bsignNowes.

-

Can I integrate airSlate SignNow with other tools for better document management?

Yes, airSlate SignNow offers seamless integrations with various business tools, enhancing your document management process. By integrating with platforms like CRM systems or cloud storage solutions, you can improve the efficiency of sending documents like a sample letter to creditor unable to pay and maintain better organization.

Get more for Writing An Unable To Pay Debt Letter Sample Letters

- Conventional application terra properties form

- Appraisal transfer letter to another lender form

- Walk through addendum form

- Bounce house release form

- Becomes a part of lease contract form

- Deville apartments amp builders rental application apartments for form

- Vinebrook homes rental application form

- Appraisal request form

Find out other Writing An Unable To Pay Debt Letter Sample Letters

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement