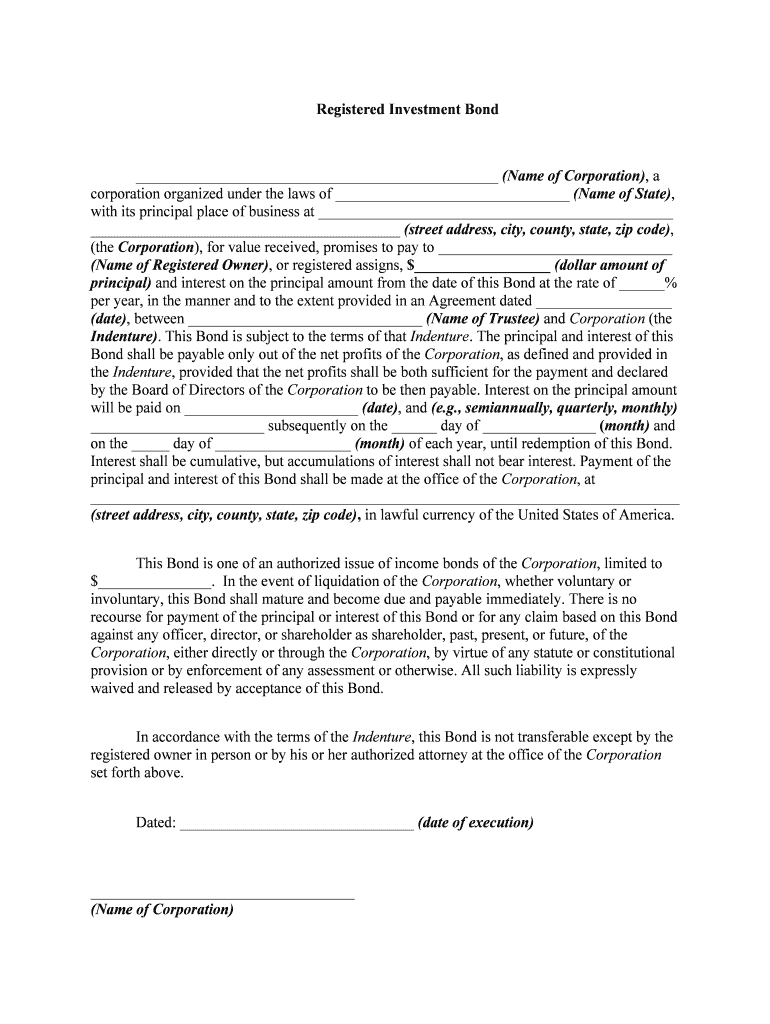

Registered Investment Bond Form

What is the Registered Investment Bond

A registered investment bond is a financial instrument that allows individuals to invest in a bond issued by a corporation or government entity. This type of bond is typically registered in the name of the investor, which provides a level of security and ensures that the bondholder receives interest payments directly. Registered investment bonds are often used for long-term investment strategies, offering a reliable source of income through periodic interest payments.

How to use the Registered Investment Bond

Using a registered investment bond involves several steps. First, an investor must identify the type of bond that aligns with their financial goals. Once selected, the investor can purchase the bond through a broker or directly from the issuing entity. After acquiring the bond, the investor should monitor its performance and be aware of the maturity date, which indicates when the principal amount will be returned. Investors may also choose to sell their bonds in the secondary market if they need liquidity before maturity.

Steps to complete the Registered Investment Bond

Completing the registered investment bond process involves the following steps:

- Research and select the appropriate bond based on investment objectives.

- Fill out the necessary application forms, providing personal and financial information.

- Submit the application along with any required documentation to the issuing entity or broker.

- Review and sign the bond agreement, ensuring all terms are understood.

- Receive confirmation of the bond purchase and keep all documentation for future reference.

Legal use of the Registered Investment Bond

The legal use of a registered investment bond is governed by federal and state securities laws. These laws ensure that the bond is issued and traded in compliance with regulations designed to protect investors. It is essential for bondholders to understand their rights and obligations under the bond agreement. This includes recognizing the implications of default and the process for claiming any owed interest or principal. Consulting with a financial advisor or legal expert can provide clarity on these matters.

Key elements of the Registered Investment Bond

Key elements of a registered investment bond include:

- Interest Rate: The rate at which interest is paid to the bondholder, typically fixed for the life of the bond.

- Maturity Date: The date on which the bond will mature, and the principal amount will be repaid.

- Face Value: The amount paid to the bondholder at maturity, usually set at one thousand dollars.

- Issuer: The entity that issues the bond, which can be a corporation or government agency.

- Registration Information: Details about the bondholder, ensuring that interest payments are made directly to them.

IRS Guidelines

IRS guidelines for registered investment bonds outline the tax implications associated with bond investments. Generally, interest income from these bonds is subject to federal income tax, and investors should report this income on their tax returns. Additionally, if a bond is sold before maturity, any capital gains or losses must also be reported. It is advisable for investors to keep detailed records of all transactions related to their bonds to ensure compliance with IRS regulations.

Eligibility Criteria

Eligibility criteria for purchasing a registered investment bond typically include:

- Age requirement: Investors must be at least eighteen years old.

- Residency: Many bonds are available only to U.S. residents.

- Financial capacity: Investors should demonstrate the ability to meet the minimum investment amount, often set at one thousand dollars.

- Compliance with regulations: Investors must comply with any applicable securities laws and regulations.

Quick guide on how to complete registered investment bond

Complete Registered Investment Bond effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Registered Investment Bond on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Registered Investment Bond with ease

- Find Registered Investment Bond and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your updates.

- Choose how you wish to send your form, either by email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Registered Investment Bond and ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Registered Investment Bond?

A Registered Investment Bond is a financial product designed to provide investors with a fixed income over a specified period. These bonds are registered with a government authority, ensuring that the investment is secure and regulated. They are ideal for those seeking stable returns while contributing to their long-term financial goals.

-

How does a Registered Investment Bond work?

A Registered Investment Bond works by offering a loan to the issuer, typically a government or corporation, in exchange for periodic interest payments and the return of the principal amount upon maturity. Investors can easily track their investments through their registration details. This transparency makes Registered Investment Bonds a trusted option for risk-averse investors.

-

What are the benefits of investing in a Registered Investment Bond?

Investing in a Registered Investment Bond offers several benefits, including predictable returns and lower risk compared to other investment options. They often come with tax advantages and are a safe way to diversify your investment portfolio. Additionally, their fixed tenure can help investors plan their financial future more effectively.

-

Are there any fees associated with a Registered Investment Bond?

Typically, there are minimal fees associated with purchasing a Registered Investment Bond, which can vary depending on the issuer. It’s important to review the terms before investing, as some bonds may have associated maintenance or management fees. Overall, these costs are generally lower compared to many alternative investment products.

-

Can I integrate a Registered Investment Bond into my existing investment portfolio?

Yes, integrating a Registered Investment Bond into your existing investment portfolio can provide enhanced balance and stability. It helps in achieving a diversified investment strategy, as these bonds offer steady income and lower risks. Always consult your financial advisor to ensure it complements your current investments.

-

What features should I look for in a Registered Investment Bond?

When considering a Registered Investment Bond, look for features such as yield rate, maturity period, and tax implications. Assessing the bond’s credit rating is also crucial to ensure you’re investing in a reliable issuer. Additional features like early redemption options can enhance flexibility for investors.

-

How do I acquire a Registered Investment Bond?

Acquiring a Registered Investment Bond is straightforward; you can typically purchase them through banks, financial institutions, or brokerages. Ensure that you conduct thorough research to find the best rates and conditions. Many institutions offer online platforms to streamline the investment process for your convenience.

Get more for Registered Investment Bond

- Final wwlev2no7indd form

- Chair massage consent form bodymend bodymend

- Pauls hospital chemistry form

- Chiropractic intake form affinity health clinic affinityhealthclinic

- Residential tenancy lease agreement form

- Online scattergories form

- Ipsc ontario members renewal form

- Vancouvr 1635357 v4 sa 108 funeral services billing form vol 2

Find out other Registered Investment Bond

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document