Loan Payoff Demand Request Form

What is the Loan Payoff Demand Request

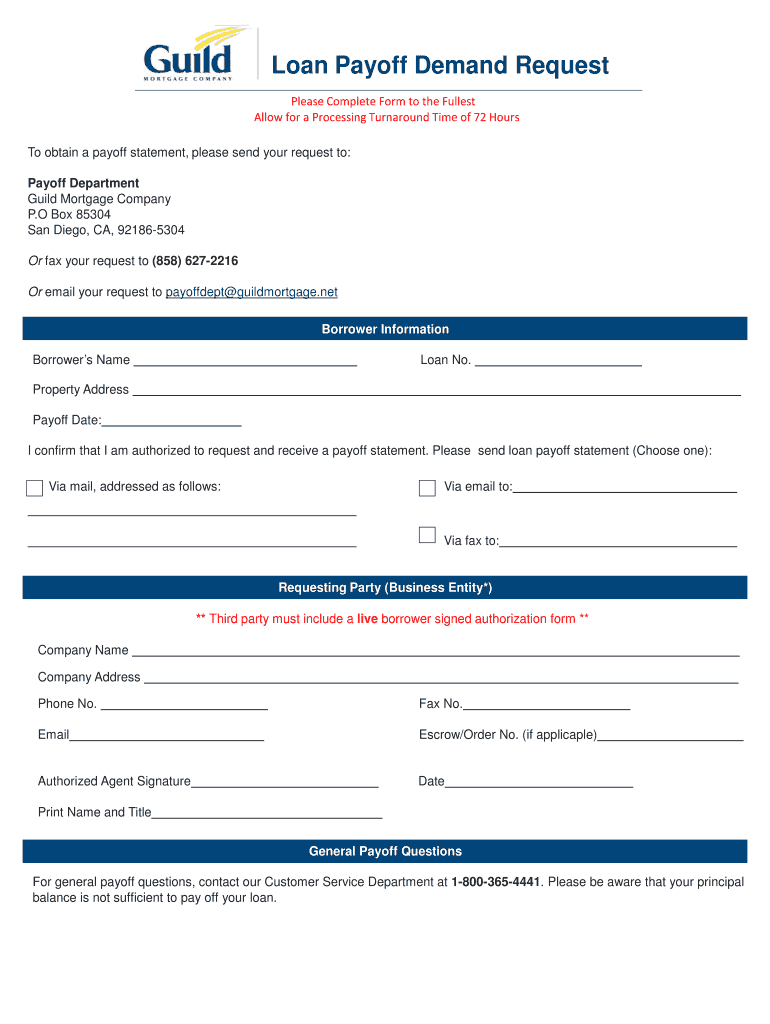

The Loan Payoff Demand Request is a formal document used by borrowers to request the total amount needed to pay off a mortgage loan. This request is typically directed to the lender or mortgage servicer and includes essential details such as the loan account number, property address, and the borrower's contact information. The payoff amount usually includes the remaining principal, any accrued interest, and potential fees or penalties associated with early repayment.

How to use the Loan Payoff Demand Request

Using the Loan Payoff Demand Request involves a few straightforward steps. First, gather all necessary information, including your loan account number and property details. Next, fill out the request form, ensuring all information is accurate and complete. Once the form is filled out, submit it to your lender either electronically or via mail. It is advisable to keep a copy of the request for your records. After submission, the lender will process the request and provide the payoff amount, which is valid for a specific period.

Steps to complete the Loan Payoff Demand Request

Completing the Loan Payoff Demand Request requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including your mortgage statement and loan details.

- Fill out the request form, including your full name, contact information, and loan account number.

- Specify the date by which you need the payoff amount.

- Review the form for accuracy to avoid delays in processing.

- Submit the completed form to your lender through the preferred method—online, by mail, or in person.

Key elements of the Loan Payoff Demand Request

Several key elements must be included in the Loan Payoff Demand Request to ensure it is processed correctly. These elements include:

- Borrower Information: Full name, address, and contact details.

- Loan Information: Loan account number and property address.

- Request Date: The date you are submitting the request.

- Payoff Date: The date by which you wish to receive the payoff amount.

- Signature: Your signature or electronic signature to validate the request.

Legal use of the Loan Payoff Demand Request

The Loan Payoff Demand Request is a legally recognized document that obligates the lender to provide the requested payoff information. It is important to ensure that the request complies with any applicable state and federal regulations. By using a legally binding electronic signature solution, such as airSlate SignNow, you can ensure that your request is secure and compliant with laws like ESIGN and UETA, which govern electronic signatures.

Form Submission Methods

There are various methods for submitting the Loan Payoff Demand Request. Borrowers can choose to send their requests:

- Online: Many lenders offer online portals where you can submit your request electronically.

- By Mail: You can print the completed form and send it to your lender's designated address.

- In Person: Some borrowers may prefer to deliver the request directly to their lender's office.

Quick guide on how to complete loan payoff demand request

Prepare Loan Payoff Demand Request effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and electronically sign your documents quickly and efficiently. Manage Loan Payoff Demand Request on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to alter and electronically sign Loan Payoff Demand Request with ease

- Obtain Loan Payoff Demand Request and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Loan Payoff Demand Request to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan payoff demand request

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is a Guild mortgage payoff request?

A Guild mortgage payoff request is a formal procedure to obtain the total amount needed to pay off your Guild Mortgage loan. This document includes details of your remaining balance and any applicable fees. Understanding this request is crucial for closing your loan accurately and efficiently.

-

How do I submit a Guild mortgage payoff request using airSlate SignNow?

To submit a Guild mortgage payoff request via airSlate SignNow, simply log into your account, select the appropriate document template, and fill out the necessary fields. Then, eSign the document and send it directly to your lender. This streamlined process ensures your request is processed swiftly and securely.

-

What are the fees associated with a Guild mortgage payoff request?

The fees for a Guild mortgage payoff request may vary depending on your specific loan agreement and any outstanding amounts. Generally, there may be a small processing fee associated with the request, which is disclosed in your mortgage documents. Always check with Guild and refer to your loan terms for precise fee information.

-

What features does airSlate SignNow offer for managing Guild mortgage payoff requests?

airSlate SignNow provides a secure platform to create, send, and manage your Guild mortgage payoff requests efficiently. Features include customizable templates, real-time tracking, and eSignature capabilities, making it easier than ever to handle your mortgage paperwork. These tools help save time and reduce the hassle of document management.

-

Can I track the status of my Guild mortgage payoff request?

Yes, with airSlate SignNow, you can easily track the status of your Guild mortgage payoff request. Our platform allows you to view whether your request has been sent, signed, or completed, providing full transparency throughout the process. This feature keeps you informed and reduces anxiety while waiting for your payoff request to be processed.

-

What benefits does airSlate SignNow offer for processing Guild mortgage payoff requests?

Using airSlate SignNow for processing your Guild mortgage payoff requests streamlines the process and increases efficiency. You benefit from an intuitive user interface, reduced paperwork, and robust security for sensitive documents. Moreover, our cost-effective solution is designed to save you time and money when handling important transactions.

-

Is it safe to send my Guild mortgage payoff request through airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security and confidentiality of your documents. Our platform uses advanced encryption technology to protect your Guild mortgage payoff request and personal information. You can have peace of mind knowing your sensitive data is stored and transmitted securely.

Get more for Loan Payoff Demand Request

Find out other Loan Payoff Demand Request

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease