Engagement LetterBetween Accounting Firm and ClientFor Audit and Tax Return PreparationChapter of Not for Profit Organization Form

What is the Engagement Letter Between Accounting Firm And Client For Audit And Tax Return Preparation Chapter Of Not for Profit Organization

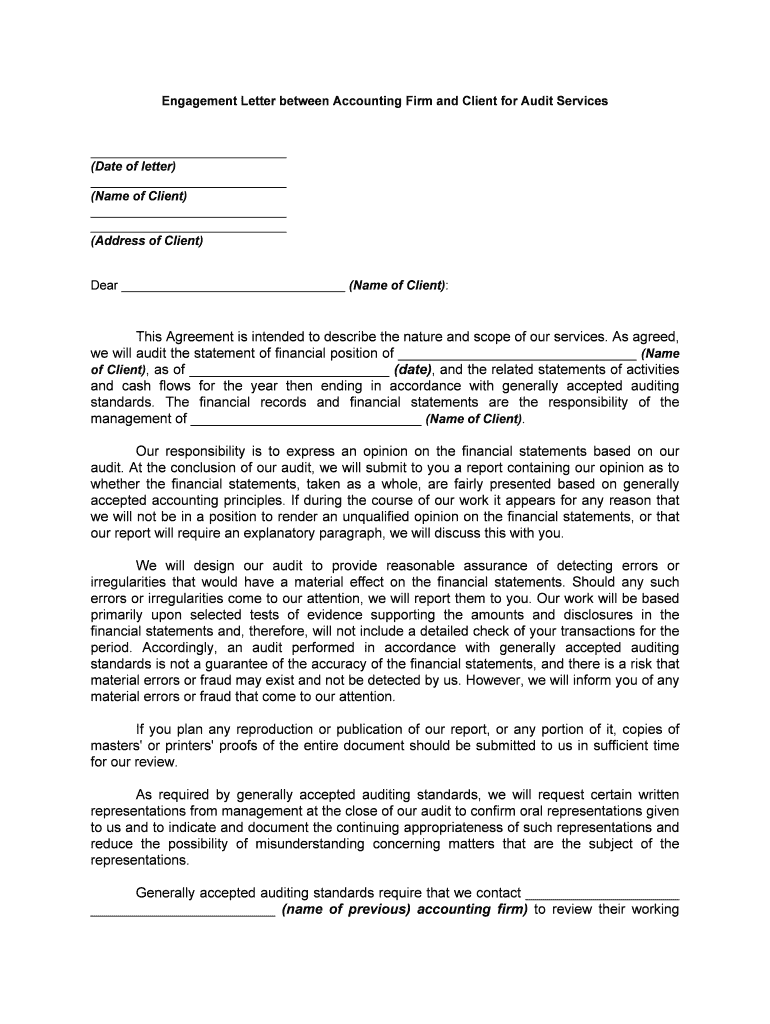

The engagement letter between an accounting firm and a client for audit and tax return preparation is a formal document that outlines the scope of services to be provided by the accounting firm to a not-for-profit organization. This letter serves as a contract, detailing the responsibilities of both parties, including the specific tasks to be performed, timelines, and fees. It ensures clarity and sets expectations, which is crucial for maintaining a professional relationship and avoiding misunderstandings.

Key Elements of the Engagement Letter Between Accounting Firm And Client For Audit And Tax Return Preparation Chapter Of Not for Profit Organization

Essential components of the engagement letter include:

- Scope of Services: A detailed description of the audit and tax return preparation services to be provided.

- Responsibilities: Clear delineation of the responsibilities of both the accounting firm and the client.

- Fees and Payment Terms: Information regarding the fees for services rendered and payment terms.

- Timeline: A schedule for the completion of services, including key deadlines.

- Confidentiality Clause: Provisions to protect sensitive information shared between the parties.

Steps to Complete the Engagement Letter Between Accounting Firm And Client For Audit And Tax Return Preparation Chapter Of Not for Profit Organization

Completing the engagement letter involves several steps:

- Drafting: The accounting firm prepares a draft of the engagement letter based on the specific needs of the not-for-profit organization.

- Review: Both parties review the draft to ensure all terms are accurate and acceptable.

- Negotiation: Any necessary adjustments are made through discussion and negotiation between the firm and the client.

- Finalization: Once both parties agree on the terms, the final version of the letter is prepared.

- Signing: Both parties sign the engagement letter, making it legally binding.

Legal Use of the Engagement Letter Between Accounting Firm And Client For Audit And Tax Return Preparation Chapter Of Not for Profit Organization

The engagement letter is legally binding once signed by both parties, provided it meets specific legal requirements. It must clearly outline the terms of the engagement and be signed by authorized representatives of both the accounting firm and the not-for-profit organization. Compliance with relevant laws, such as the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act (ESIGN), is essential when executing the document electronically.

How to Use the Engagement Letter Between Accounting Firm And Client For Audit And Tax Return Preparation Chapter Of Not for Profit Organization

To effectively use the engagement letter, both the accounting firm and the client should:

- Refer to the letter throughout the engagement to ensure compliance with agreed-upon terms.

- Use it as a guide for the scope of work and responsibilities during the audit and tax preparation process.

- Review it periodically to address any changes in circumstances or scope of services.

- Keep a copy for their records to ensure clarity and reference in future communications.

How to Obtain the Engagement Letter Between Accounting Firm And Client For Audit And Tax Return Preparation Chapter Of Not for Profit Organization

Obtaining the engagement letter typically involves the following steps:

- Contacting the Accounting Firm: The not-for-profit organization should reach out to the accounting firm to express interest in their services.

- Discussion of Needs: A discussion should take place to outline the specific needs and expectations of the organization.

- Draft Preparation: The accounting firm will prepare a draft engagement letter based on the discussion.

- Review and Finalization: After reviewing the draft, both parties will finalize the letter before signing.

Quick guide on how to complete engagement letterbetween accounting firm and clientfor audit and tax return preparationchapter of not for profit organization

Effortlessly Prepare Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly option compared to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization with ease

- Find Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, be it via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new printouts. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization?

An Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization is a formal agreement that outlines the scope of services provided by the accounting firm to the nonprofit organization. This document serves to clarify responsibilities, timelines, and pricing, ensuring both parties are aligned on expectations.

-

How can airSlate SignNow simplify the process of creating an Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization?

airSlate SignNow provides customizable templates that allow accounting firms to quickly draft an Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization. The user-friendly interface enables seamless editing and sharing, reducing the time required to finalize agreements.

-

What are the pricing options for using airSlate SignNow for Engagement Letters?

airSlate SignNow offers flexible pricing plans that cater to different organizational needs, making it affordable for accounting firms and nonprofits alike. The plans include monthly or annual subscriptions, and each provides access to features tailored specifically for drafting Engagement LettersBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization.

-

Are there any benefits to using airSlate SignNow for Engagement Letters in the not-for-profit sector?

Yes, airSlate SignNow streamlines the process of handling Engagement LettersBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization by reducing paperwork and minimizing errors. This efficiency not only saves time but also enhances transparency and accountability between the firm and the client.

-

Can I integrate airSlate SignNow with other accounting software for Engagement Letters?

Absolutely, airSlate SignNow offers seamless integrations with various accounting software systems. This enables users to easily transfer data and collaborate on Engagement LettersBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization, ensuring a smooth process from drafting to signing.

-

Is electronic signature legally binding for Engagement Letters?

Yes, electronic signatures created through airSlate SignNow are legally binding in many jurisdictions. This validity applies to Engagement LettersBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization, giving both parties confidence in the enforceability of their agreements.

-

What features does airSlate SignNow provide to enhance the Engagement Letter process?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage, all designed for ease of use. These capabilities signNowly enhance the process of managing Engagement LettersBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization, making document management efficient and user-friendly.

Get more for Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization

Find out other Engagement LetterBetween Accounting Firm And ClientFor Audit And Tax Return PreparationChapter Of Not for profit Organization

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation