General Engagement Letter for Fiduciary Form 1041 Tax

What is the General Engagement Letter For Fiduciary Form 1041 Tax

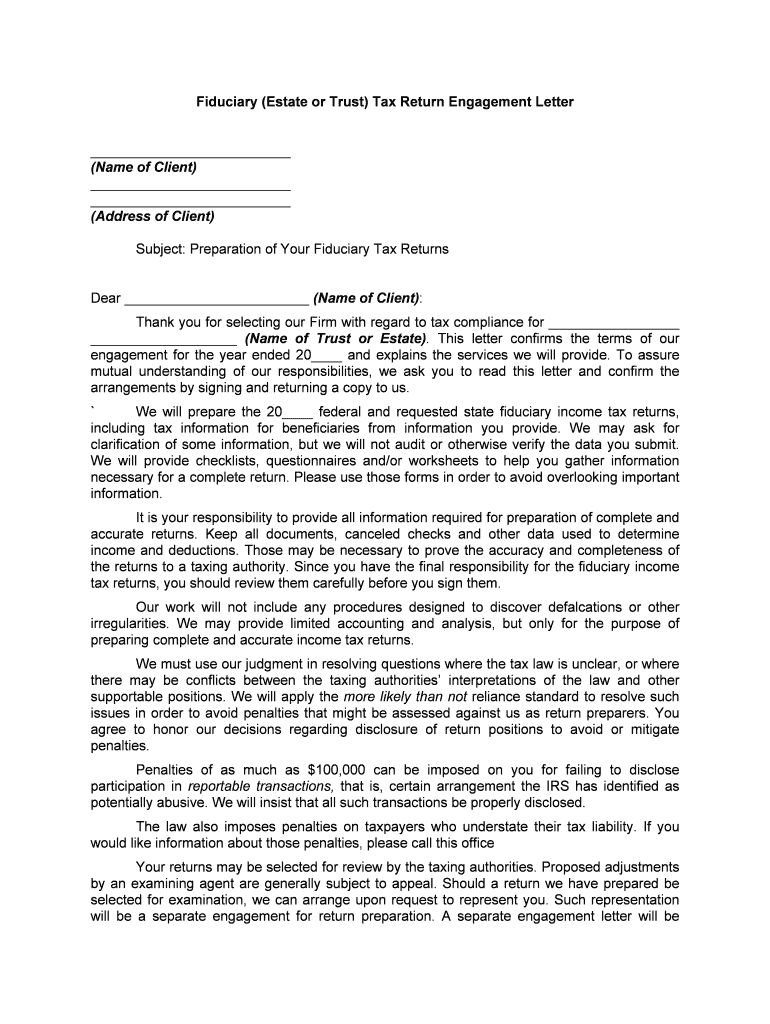

The General Engagement Letter for Fiduciary Form 1041 Tax is a crucial document used by fiduciaries to outline the terms of their engagement when preparing and filing Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This letter serves as a formal agreement between the fiduciary and the client, detailing the responsibilities, scope of work, and expectations of both parties. It is essential for ensuring clarity and compliance with tax regulations, helping to prevent misunderstandings and potential legal issues.

Key Elements of the General Engagement Letter For Fiduciary Form 1041 Tax

Several key elements should be included in the General Engagement Letter for Fiduciary Form 1041 Tax to ensure its effectiveness. These elements typically include:

- Identification of Parties: Clearly state the names and roles of the fiduciary and the client.

- Scope of Services: Define the specific services the fiduciary will provide, including tax preparation and filing.

- Fees and Payment Terms: Outline the fee structure, payment schedule, and any additional costs that may arise.

- Responsibilities: Specify the responsibilities of both the fiduciary and the client, including the provision of necessary documents.

- Confidentiality Clause: Include a statement regarding the confidentiality of the information shared during the engagement.

- Termination Clause: Describe the conditions under which either party may terminate the agreement.

Steps to Complete the General Engagement Letter For Fiduciary Form 1041 Tax

Completing the General Engagement Letter for Fiduciary Form 1041 Tax involves several important steps to ensure accuracy and compliance. Follow these steps:

- Gather Information: Collect all necessary information about the fiduciary and the client, including contact details and relevant tax identification numbers.

- Draft the Letter: Use a template or create a draft that incorporates all key elements discussed earlier.

- Review the Document: Carefully review the letter for clarity and accuracy, ensuring that all terms are clearly defined.

- Obtain Signatures: Both parties should sign the letter to formalize the agreement. Digital signatures can be used for convenience and efficiency.

- Store the Document: Keep a copy of the signed letter for your records, as it may be needed for future reference or compliance checks.

Legal Use of the General Engagement Letter For Fiduciary Form 1041 Tax

The General Engagement Letter for Fiduciary Form 1041 Tax is legally binding when properly executed. It establishes a formal relationship between the fiduciary and the client, outlining the expectations and obligations of both parties. To ensure its legal validity, it is important that the letter complies with applicable laws and regulations, including those related to fiduciary duties and tax obligations. Additionally, using a reliable eSignature solution can help ensure that the document meets legal requirements for electronic signatures.

How to Use the General Engagement Letter For Fiduciary Form 1041 Tax

Using the General Engagement Letter for Fiduciary Form 1041 Tax effectively involves understanding its purpose and applying it correctly within the context of fiduciary duties. The letter should be presented to the client at the beginning of the engagement process. It serves as a foundational document that clarifies the fiduciary's role and the services to be provided. After the letter is signed, the fiduciary can proceed with the necessary tax preparation and filing tasks, ensuring that all actions align with the terms outlined in the agreement.

IRS Guidelines

When preparing the General Engagement Letter for Fiduciary Form 1041 Tax, it is important to adhere to IRS guidelines. The IRS provides specific instructions regarding the filing of Form 1041, including deadlines, required information, and compliance with tax laws. Familiarizing yourself with these guidelines can help ensure that the engagement letter aligns with IRS expectations, ultimately supporting the fiduciary in fulfilling their tax obligations accurately and on time.

Quick guide on how to complete general engagement letter for fiduciary form 1041 tax

Prepare General Engagement Letter For Fiduciary Form 1041 Tax effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage General Engagement Letter For Fiduciary Form 1041 Tax on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign General Engagement Letter For Fiduciary Form 1041 Tax with ease

- Locate General Engagement Letter For Fiduciary Form 1041 Tax and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow specially offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, and errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign General Engagement Letter For Fiduciary Form 1041 Tax and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a General Engagement Letter For Fiduciary Form 1041 Tax?

A General Engagement Letter For Fiduciary Form 1041 Tax is a formal document that outlines the responsibilities and expectations between a fiduciary and their clients for tax preparation. It ensures clarity and helps avoid potential misunderstandings during the tax filing process.

-

How does airSlate SignNow simplify the process of creating a General Engagement Letter For Fiduciary Form 1041 Tax?

airSlate SignNow provides customizable templates that make creating a General Engagement Letter For Fiduciary Form 1041 Tax straightforward. Users can easily fill in their specific details, ensuring compliance and efficiency in document preparation.

-

Is there a cost associated with using airSlate SignNow for a General Engagement Letter For Fiduciary Form 1041 Tax?

Yes, airSlate SignNow offers various pricing plans, allowing users to choose an option that fits their needs. The cost-effective solutions streamline the process of preparing a General Engagement Letter For Fiduciary Form 1041 Tax while providing essential features.

-

What features does airSlate SignNow offer for signing a General Engagement Letter For Fiduciary Form 1041 Tax?

airSlate SignNow offers robust features such as electronic signatures, audit trails, and document storage. These features enhance the security and efficiency of executing a General Engagement Letter For Fiduciary Form 1041 Tax easily.

-

Can I integrate airSlate SignNow with other tools for managing a General Engagement Letter For Fiduciary Form 1041 Tax?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems. This flexibility allows users to manage their General Engagement Letter For Fiduciary Form 1041 Tax alongside other business processes.

-

What are the benefits of using airSlate SignNow for a General Engagement Letter For Fiduciary Form 1041 Tax?

The benefits of using airSlate SignNow include increased efficiency, reduced turnaround time, and enhanced document security. By using our platform for a General Engagement Letter For Fiduciary Form 1041 Tax, you can focus on your fiduciary duties without worrying about the complexities of document management.

-

Is it secure to eSign a General Engagement Letter For Fiduciary Form 1041 Tax with airSlate SignNow?

Absolutely, airSlate SignNow utilizes advanced encryption and industry-standard security protocols to safeguard your documents. eSigning a General Engagement Letter For Fiduciary Form 1041 Tax on our platform ensures confidentiality and compliance.

Get more for General Engagement Letter For Fiduciary Form 1041 Tax

- Bmi form

- American legion baseball state winner form

- Nomination form borang penamaan allianzcommy

- Participant approval formssierra club outings

- Remote training agreement form

- European organisation for astronomical research in the southern hemisphere eso form

- Request for involuntary distribution form

- Kofc rsvp form

Find out other General Engagement Letter For Fiduciary Form 1041 Tax

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free