Foreclosure Defenses the Lender's Failure to Comply with Form

What is the Foreclosure Defenses The Lender's Failure To Comply With

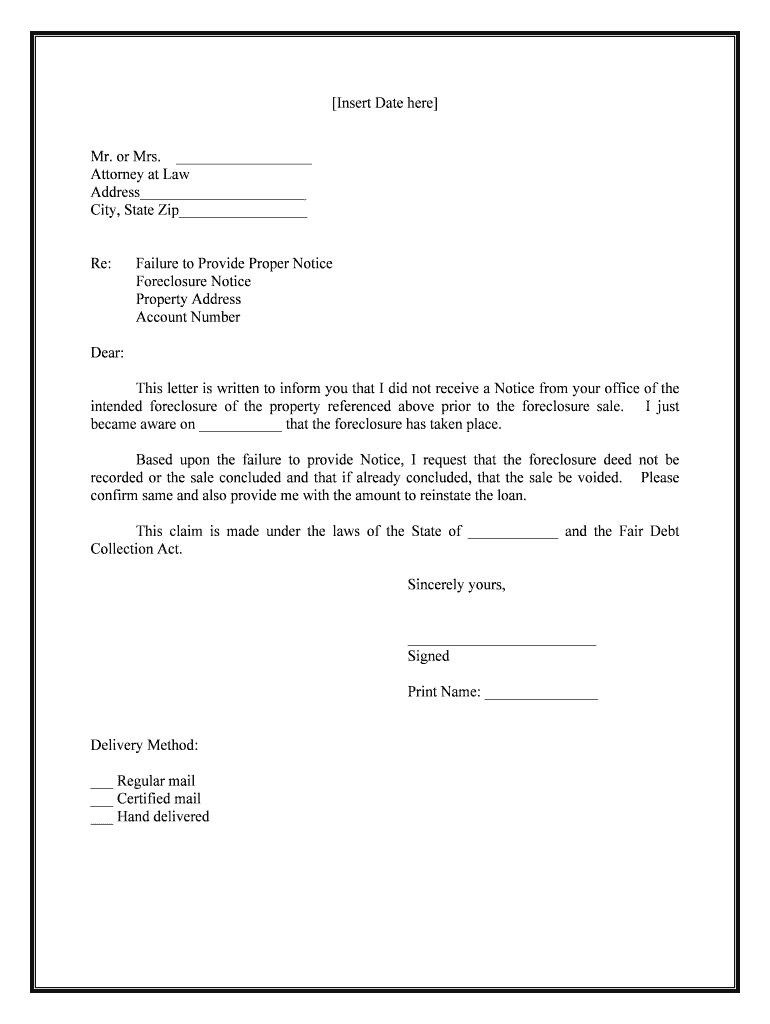

The Foreclosure Defenses The Lender's Failure To Comply With form is a legal document that allows homeowners to assert defenses against foreclosure based on the lender's failure to adhere to specific legal requirements. This form is crucial in situations where lenders may not have followed proper procedures, potentially invalidating their claims to foreclose on a property. Understanding the legal implications of this form can empower homeowners to protect their rights and navigate the foreclosure process more effectively.

Key elements of the Foreclosure Defenses The Lender's Failure To Comply With

Several key elements define the effectiveness of the Foreclosure Defenses The Lender's Failure To Comply With form. These include:

- Identification of the Lender: Clearly stating the lender's name and contact information is essential.

- Details of Non-Compliance: Specific instances where the lender failed to comply with legal requirements must be outlined.

- Homeowner's Information: The homeowner's name, address, and any relevant account numbers should be included.

- Supporting Evidence: Attach any documentation that supports the claim of non-compliance, such as correspondence or notices.

Steps to complete the Foreclosure Defenses The Lender's Failure To Comply With

Completing the Foreclosure Defenses The Lender's Failure To Comply With form involves several important steps:

- Gather all necessary information, including lender details and personal information.

- Identify and document specific instances of the lender's non-compliance.

- Fill out the form accurately, ensuring all sections are completed.

- Attach any supporting documents that validate your claims.

- Review the completed form for accuracy before submission.

How to use the Foreclosure Defenses The Lender's Failure To Comply With

Using the Foreclosure Defenses The Lender's Failure To Comply With form effectively requires understanding its purpose and the context in which it is applied. Once completed, the form should be submitted to the appropriate court or agency handling the foreclosure proceedings. It is important to keep copies of the submitted form and any attached documents for personal records. Additionally, homeowners may want to consult with a legal professional to ensure the form is utilized correctly and to explore further options for defending against foreclosure.

Legal use of the Foreclosure Defenses The Lender's Failure To Comply With

The legal use of the Foreclosure Defenses The Lender's Failure To Comply With form hinges on compliance with state and federal laws governing foreclosure processes. Homeowners must ensure that their claims are based on legitimate instances of non-compliance by the lender. This form can serve as a formal assertion of defenses in court, potentially delaying foreclosure proceedings or leading to a favorable resolution. It is advisable to seek legal counsel to navigate the complexities involved in foreclosure defense.

State-specific rules for the Foreclosure Defenses The Lender's Failure To Comply With

State-specific rules play a significant role in the application of the Foreclosure Defenses The Lender's Failure To Comply With form. Each state has its own foreclosure laws and regulations, which can affect the validity and acceptance of this form. Homeowners should familiarize themselves with their state's requirements regarding notice periods, documentation, and court procedures. Understanding these nuances can enhance the effectiveness of the form and ensure compliance with local laws.

Quick guide on how to complete foreclosure defenses the lenders failure to comply with

Effortlessly Prepare Foreclosure Defenses The Lender's Failure To Comply With on any Device

The management of documents online has gained traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed forms, as you can easily locate the appropriate document and securely keep it online. airSlate SignNow offers all the tools necessary to swiftly generate, modify, and electronically sign your documents without delays. Handle Foreclosure Defenses The Lender's Failure To Comply With on any device with airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

Effortlessly Edit and Electronically Sign Foreclosure Defenses The Lender's Failure To Comply With

- Find Foreclosure Defenses The Lender's Failure To Comply With and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Select important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether through email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Foreclosure Defenses The Lender's Failure To Comply With to ensure exceptional communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Foreclosure Defenses The Lender's Failure To Comply With?

Foreclosure Defenses The Lender's Failure To Comply With refers to legal arguments used by borrowers to contest foreclosure actions based on the lender's failure to follow proper protocols. Such defenses may highlight failures in documentation, notice requirements, or other legal obligations that lenders must meet. Understanding these defenses can be crucial for homeowners facing foreclosure.

-

How can airSlate SignNow help with Foreclosure Defenses?

airSlate SignNow provides a reliable platform to prepare and manage legal documents related to Foreclosure Defenses The Lender's Failure To Comply With. Users can create, send, and eSign important documents efficiently, ensuring all paperwork adheres to legal standards. This simplifies the process for borrowers tackling foreclosure issues.

-

What features does airSlate SignNow offer for handling foreclosure documents?

airSlate SignNow offers a range of features tailored for managing foreclosure documents, including templates specifically for legal notices and eSigning capabilities. Users can easily collaborate with legal advisors and ensure compliance with Foreclosure Defenses The Lender's Failure To Comply With. This helps streamline the documentation process signNowly.

-

Is airSlate SignNow a cost-effective solution for foreclosure document management?

Yes, airSlate SignNow is known for its cost-effective pricing plans that provide excellent value for managing foreclosure documents. The platform ensures that users can efficiently handle Foreclosure Defenses The Lender's Failure To Comply With without incurring high expenses. With various subscription options, businesses can choose a plan that suits their needs.

-

How secure is airSlate SignNow for sensitive foreclosure documents?

airSlate SignNow takes security seriously, implementing robust encryption and compliance measures to protect sensitive information related to Foreclosure Defenses The Lender's Failure To Comply With. Users can trust that their documents are securely stored and transmitted, maintaining confidentiality and integrity throughout the process.

-

Can airSlate SignNow integrate with other tools for legal management?

Absolutely! airSlate SignNow seamlessly integrates with various tools, enhancing the management of Foreclosure Defenses The Lender's Failure To Comply With. Whether you're using CRM systems, cloud storage solutions, or project management tools, the integrations help streamline workflows and improve efficiency in document handling.

-

What are the benefits of choosing airSlate SignNow for foreclosure defense documents?

Choosing airSlate SignNow for foreclosure defense documentation comes with numerous benefits, including enhanced efficiency, legal compliance, and ease of use. The platform facilitates the timely handling of Foreclosure Defenses The Lender's Failure To Comply With, allowing users to focus on their legal strategies without being bogged down by paperwork.

Get more for Foreclosure Defenses The Lender's Failure To Comply With

Find out other Foreclosure Defenses The Lender's Failure To Comply With

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online