Fiscal Year Definition What is Fiscal Year Shopify Form

Understanding the Fiscal Year Definition

The fiscal year meaning refers to a twelve-month period used by organizations for accounting and financial reporting purposes. Unlike the calendar year, which runs from January to December, a fiscal year can start and end in any month. For instance, a company might choose a fiscal year that begins on July 1 and ends on June 30 of the following year. This flexibility allows businesses to align their reporting periods with their operational cycles, which can be beneficial for various financial analyses and tax planning.

Key Elements of the Fiscal Year Definition

Several key elements define a fiscal year:

- Duration: A fiscal year lasts for twelve months.

- Start and End Dates: Organizations can select any start date, which may not coincide with the calendar year.

- Financial Reporting: Companies use the fiscal year to prepare financial statements, budgets, and tax returns.

- Regulatory Compliance: Businesses must adhere to specific regulations regarding fiscal year reporting, which can vary by industry.

Examples of Using the Fiscal Year Definition

Understanding the fiscal year meaning is crucial for various organizations. For example:

- A retail company may choose a fiscal year that ends after the holiday season to capture all sales data from peak shopping.

- A nonprofit organization might align its fiscal year with grant cycles to better manage funding and reporting.

- Corporations often select a fiscal year that aligns with their business operations, allowing for more accurate financial forecasting.

IRS Guidelines for Fiscal Year Reporting

The Internal Revenue Service (IRS) provides specific guidelines for businesses regarding fiscal year reporting. Organizations must indicate their chosen fiscal year when filing tax returns, which can impact tax obligations and deadlines. It is essential for businesses to comply with IRS regulations to avoid penalties. For example, corporations typically must file their tax returns on the 15th day of the fourth month after the end of their fiscal year.

Legal Use of the Fiscal Year Definition

The fiscal year meaning is not just an accounting term; it has legal implications as well. For instance, businesses must adhere to state and federal regulations concerning financial disclosures and reporting timelines. Additionally, the choice of fiscal year can influence compliance with various laws, such as those governing tax filings and corporate governance. Understanding these legal aspects ensures that organizations remain compliant and avoid potential legal issues.

Steps to Complete Fiscal Year Reporting

Completing fiscal year reporting involves several steps:

- Determine Fiscal Year Dates: Choose the start and end dates for your fiscal year based on business needs.

- Collect Financial Data: Gather all relevant financial information, including income, expenses, and assets.

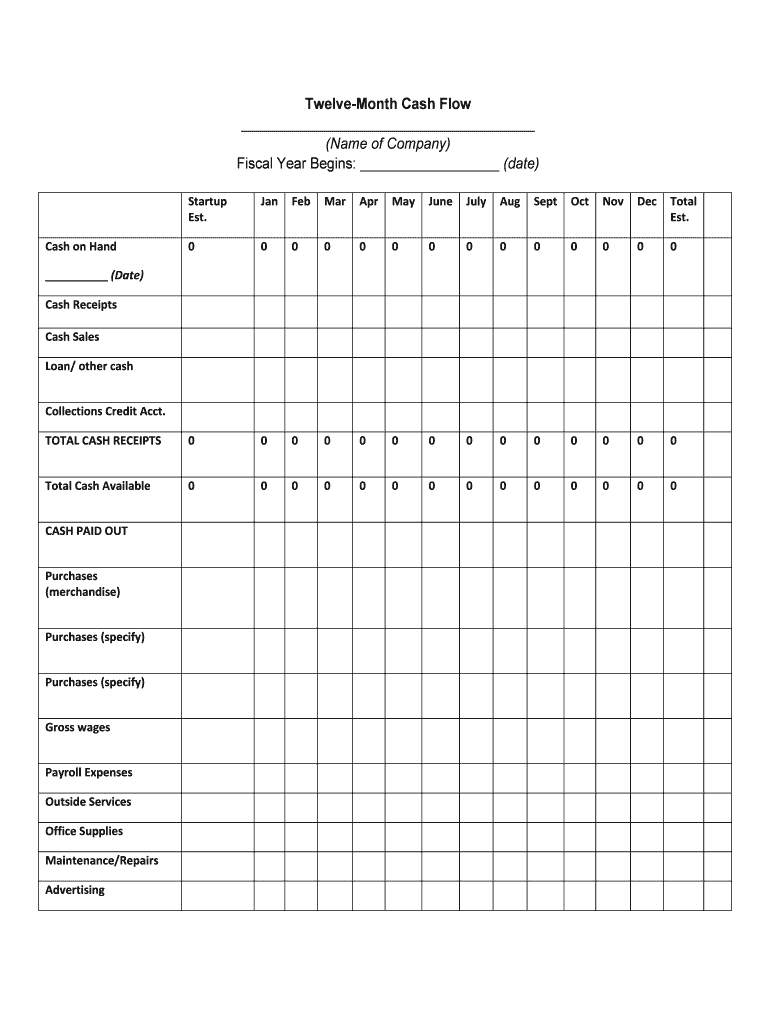

- Prepare Financial Statements: Create balance sheets, income statements, and cash flow statements for the fiscal year.

- File Tax Returns: Submit the necessary tax documents to the IRS by the required deadlines.

- Review and Analyze: Conduct a thorough review of financial performance and adjust future strategies accordingly.

Quick guide on how to complete fiscal year definition what is fiscal year shopify

Complete Fiscal Year Definition What Is Fiscal Year Shopify effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Fiscal Year Definition What Is Fiscal Year Shopify on any gadget using airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Fiscal Year Definition What Is Fiscal Year Shopify without hassle

- Find Fiscal Year Definition What Is Fiscal Year Shopify and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fiscal Year Definition What Is Fiscal Year Shopify to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the fiscal year meaning and how does it affect my business?

The fiscal year meaning refers to the 12-month period used by organizations for financial reporting and budgeting. Understanding your fiscal year is crucial as it helps businesses track financial performance, make strategic decisions, and comply with tax regulations. Choosing the right fiscal year can align better with your business cycles and maximize efficiency.

-

How does airSlate SignNow help in managing fiscal year-related documents?

airSlate SignNow simplifies the process of sending and eSigning documents related to your fiscal year. With its user-friendly interface, businesses can easily prepare, send, and store critical documents like budgets and financial reports. This ensures that all fiscal year documentation is accurately handled and readily accessible.

-

Is there a free trial available for airSlate SignNow to understand its benefits for fiscal year planning?

Yes, airSlate SignNow offers a free trial that allows businesses to explore its features without commitment. This trial is an excellent opportunity to see how the platform can streamline your document management and support your fiscal year planning needs. Experience the ease of eSigning while ensuring your fiscal documents are well-managed.

-

What features does airSlate SignNow offer for enhancing fiscal year financial reporting?

airSlate SignNow includes features like templates, audit trails, and integrations that facilitate the fiscal year financial reporting process. These tools ensure that documents related to the fiscal year are standardized and secure, reducing the risk of errors. Additionally, automated workflows help maintain efficiency and compliance throughout your reporting cycle.

-

Can airSlate SignNow integrate with accounting software for managing fiscal year data?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, which is essential for managing fiscal year data. This integration ensures that all eSigned documents are automatically archived and linked to your financial records, making it easier to track year-end reports and budgets. Streamlining these processes helps organizations save time and increase accuracy.

-

What are the pricing options for airSlate SignNow, especially for businesses focused on fiscal year management?

airSlate SignNow offers various pricing plans tailored to businesses of all sizes, including options that cater specifically to fiscal year management needs. Competitive pricing ensures that organizations can leverage eSigning technology without breaking the bank. By choosing the right plan, businesses can enhance their document workflows for the fiscal year at a manageable cost.

-

How can airSlate SignNow improve collaboration during the fiscal year?

AirSlate SignNow enhances collaboration by allowing multiple users to review and sign documents in real-time, facilitating fiscal year discussions and decisions. With features like comments and version control, teams can easily communicate regarding fiscal documents. This collaboration improves transparency and speeds up the decision-making process during critical financial periods.

Get more for Fiscal Year Definition What Is Fiscal Year Shopify

Find out other Fiscal Year Definition What Is Fiscal Year Shopify

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer