Notice of Change of Address Awaiting Refund Form

What is the Notice Of Change Of Address Awaiting Refund

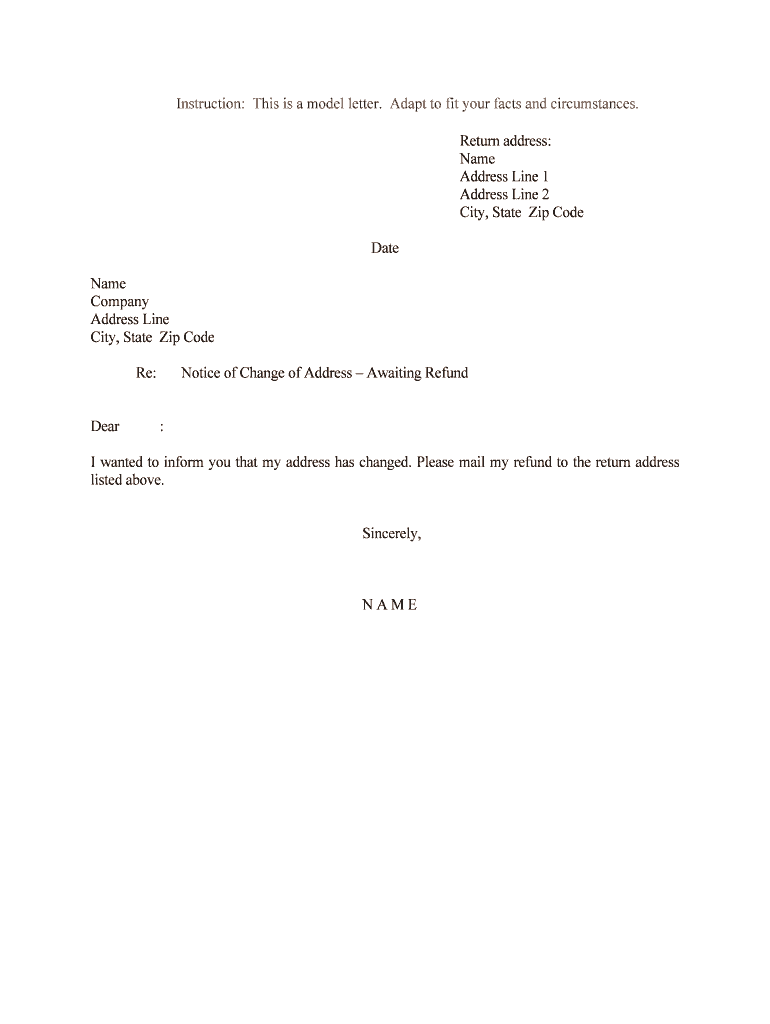

The Notice Of Change Of Address Awaiting Refund is a formal document used by individuals to notify relevant institutions about a change in their residential address while awaiting a refund. This form is particularly important for tax-related refunds, ensuring that the refund is sent to the correct address. It serves as an official record of the address change, helping to prevent delays or misdirection of funds. Completing this form accurately is essential for maintaining clear communication with financial institutions and government agencies.

Steps to complete the Notice Of Change Of Address Awaiting Refund

Completing the Notice Of Change Of Address Awaiting Refund involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your previous and new addresses, Social Security number, and any relevant account numbers. Next, fill out the form carefully, ensuring that all fields are completed without errors. After filling out the form, review it for accuracy, and then sign it digitally if using an electronic format. Finally, submit the form according to the specified method, whether online, by mail, or in person, ensuring it reaches the appropriate agency or institution.

Legal use of the Notice Of Change Of Address Awaiting Refund

The legal use of the Notice Of Change Of Address Awaiting Refund is crucial for ensuring that the change is recognized by the relevant authorities. This form must be submitted to institutions such as the IRS or state tax agencies to officially document the address change. Failure to use this form properly may result in delays in receiving refunds or potential legal issues regarding the misdirection of funds. It is important to comply with all legal requirements when submitting this form to ensure its validity and acceptance.

How to obtain the Notice Of Change Of Address Awaiting Refund

The Notice Of Change Of Address Awaiting Refund can typically be obtained through the official website of the agency or institution you are dealing with, such as the IRS. Many agencies provide downloadable versions of the form in PDF format, which can be printed and filled out manually. Alternatively, some institutions may offer an electronic version of the form that can be completed and submitted online. It is advisable to check the specific requirements and guidelines provided by the relevant agency to ensure you are using the correct version of the form.

Key elements of the Notice Of Change Of Address Awaiting Refund

Key elements of the Notice Of Change Of Address Awaiting Refund include personal identification information, such as your full name, Social Security number, and both old and new addresses. Additionally, the form may require details about the refund you are expecting, including any relevant account numbers or tax years. It is essential to provide accurate and complete information in these fields to avoid complications with the processing of your refund. The signature section is also critical, as it verifies your identity and consent to the address change.

Form Submission Methods (Online / Mail / In-Person)

The Notice Of Change Of Address Awaiting Refund can be submitted through various methods, depending on the agency's guidelines. Online submission is often the quickest and most efficient method, allowing for immediate processing. If submitting by mail, ensure that you send the form to the correct address provided by the agency, and consider using a trackable mailing option for confirmation. In-person submission may also be available at local offices, providing an opportunity to ask questions and confirm receipt of the form. Always check the specific submission guidelines for the agency you are dealing with to ensure compliance.

Quick guide on how to complete notice of change of address awaiting refund

Complete Notice Of Change Of Address Awaiting Refund effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly and without any issues. Manage Notice Of Change Of Address Awaiting Refund on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest method to modify and eSign Notice Of Change Of Address Awaiting Refund with ease

- Locate Notice Of Change Of Address Awaiting Refund and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Notice Of Change Of Address Awaiting Refund and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Change Of Address Awaiting Refund?

A Notice Of Change Of Address Awaiting Refund is a document you submit to inform relevant organizations of your new address while you are pending a refund. This notification ensures that any refunds are sent to your updated address, preventing potential delays. Using airSlate SignNow, you can eSign this notice quickly and securely.

-

How can airSlate SignNow assist with the Notice Of Change Of Address Awaiting Refund?

airSlate SignNow provides a seamless way to create and eSign a Notice Of Change Of Address Awaiting Refund. Our platform simplifies the document process, ensuring you can quickly notify entities of your new address. With our user-friendly interface, you can manage all your forms efficiently.

-

Is there a cost associated with sending a Notice Of Change Of Address Awaiting Refund through airSlate SignNow?

Yes, using airSlate SignNow involves a subscription model with various pricing tiers. Each tier offers different features tailored to business needs, including the ability to manage a Notice Of Change Of Address Awaiting Refund effectively. Explore our pricing page for detailed information about what best suits your requirements.

-

What features does airSlate SignNow offer for managing the Notice Of Change Of Address Awaiting Refund?

airSlate SignNow offers features such as eSignature, document templates, and integration with various applications that facilitate the management of a Notice Of Change Of Address Awaiting Refund. These tools enhance efficiency and accuracy in handling your refund notifications. You can also store and organize documents securely in the cloud.

-

Can I integrate airSlate SignNow with other tools for handling the Notice Of Change Of Address Awaiting Refund?

Absolutely! airSlate SignNow integrates seamlessly with various tools, including Google Drive, Dropbox, and CRM systems. This integration allows you to store and manage your Notice Of Change Of Address Awaiting Refund alongside other important documents, streamlining your workflow signNowly.

-

What are the benefits of using airSlate SignNow for my Notice Of Change Of Address Awaiting Refund?

Using airSlate SignNow for your Notice Of Change Of Address Awaiting Refund provides benefits such as time-saving eSigning, secure document storage, and ease of access from any device. These features help you stay organized and expedite the refund process, ensuring you receive your funds without unnecessary delays.

-

How secure is the eSigning process for a Notice Of Change Of Address Awaiting Refund with airSlate SignNow?

The eSigning process for a Notice Of Change Of Address Awaiting Refund is highly secure with airSlate SignNow. We utilize advanced encryption methods to protect your documents and ensure their integrity during the signing process. You can confidently send sensitive information knowing that it is safeguarded against unauthorized access.

Get more for Notice Of Change Of Address Awaiting Refund

Find out other Notice Of Change Of Address Awaiting Refund

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document