Subordination Agreement Subordinating Existing Mortgage to New Mortgage Form

What is the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

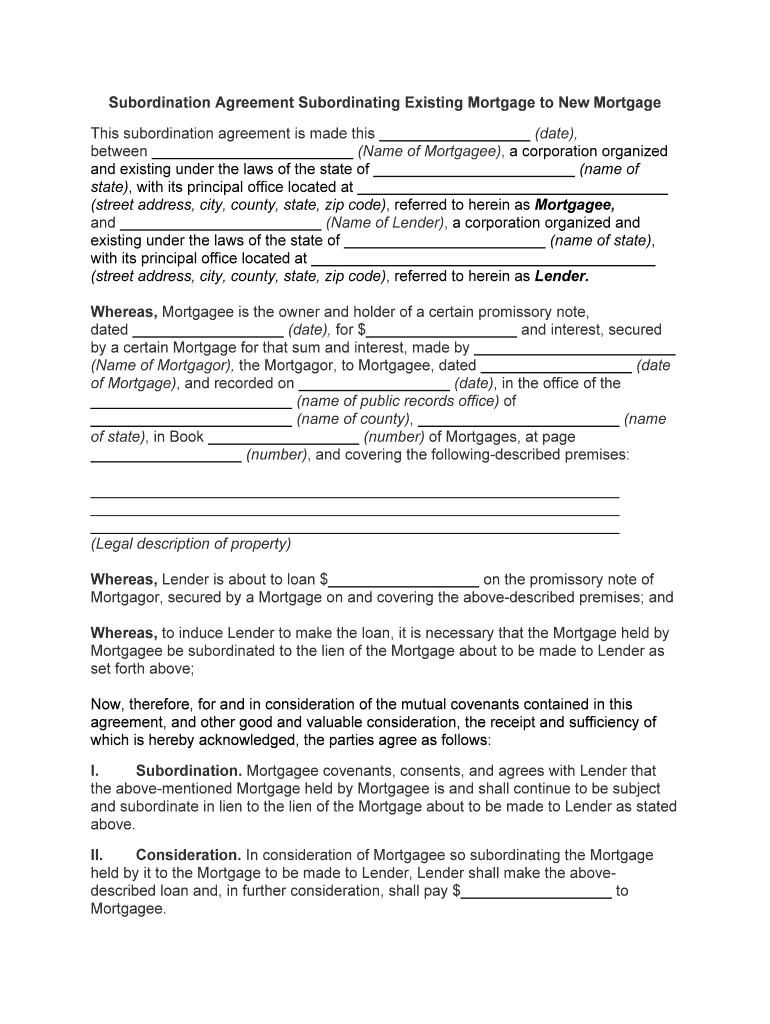

A subordination agreement subordinating an existing mortgage to a new mortgage is a legal document that allows a new loan to take priority over an existing one. This is particularly relevant when a homeowner seeks to refinance or obtain a second mortgage. By executing this agreement, the lender of the new mortgage can secure a higher claim on the property, which is essential for approving the new loan. The subordination agreement must be signed by all parties involved, including the existing lender, to ensure its validity and enforceability.

How to use the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

Using a subordination agreement involves several steps. First, the homeowner must identify the need for a new mortgage, often for refinancing or obtaining additional funds. Next, they should contact their existing lender to discuss the subordination process and obtain the necessary forms. Once the agreement is drafted, all parties must review the terms carefully. After securing signatures, the completed document should be filed with the appropriate county office to ensure it is officially recognized. This process helps protect the homeowner's interests while allowing for the new financing.

Steps to complete the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

Completing a subordination agreement involves a clear set of steps:

- Consult with a financial advisor or attorney to understand the implications of subordination.

- Contact your existing mortgage lender to request a subordination agreement.

- Review the terms of the new mortgage to ensure compatibility with the existing loan.

- Fill out the subordination agreement form, ensuring all required information is accurate.

- Obtain signatures from all relevant parties, including the new lender and existing lender.

- File the signed agreement with the local county recorder's office to establish priority.

Key elements of the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

Several key elements must be included in a subordination agreement to ensure its effectiveness:

- Identification of Parties: Clearly state the names and addresses of all parties involved, including the existing lender and the new lender.

- Property Description: Provide a detailed description of the property that is subject to the mortgages.

- Terms of Subordination: Outline the specific terms under which the existing mortgage will be subordinated to the new mortgage.

- Signatures: Ensure all parties sign the agreement, as this is crucial for its legal validity.

- Recording Information: Include details on how and where the agreement will be recorded.

Legal use of the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

The legal use of a subordination agreement is essential for protecting the rights of all parties involved. This document must comply with state laws and regulations governing mortgage agreements. It serves to clarify the priority of claims against the property, which is critical in the event of a foreclosure. By properly executing and recording the subordination agreement, homeowners can ensure that their new mortgage is legally recognized and enforceable, providing them with the financial flexibility they need.

State-specific rules for the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

Each state may have specific rules and regulations regarding subordination agreements. It is important for homeowners to familiarize themselves with local laws, as these can affect the execution and enforceability of the agreement. For example, some states may require additional disclosures or specific language to be included in the document. Consulting with a local attorney or real estate professional can help ensure compliance with state-specific requirements, thereby avoiding potential legal issues in the future.

Quick guide on how to complete subordination agreement subordinating existing mortgage to new mortgage

Complete Subordination Agreement Subordinating Existing Mortgage To New Mortgage effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Subordination Agreement Subordinating Existing Mortgage To New Mortgage on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Subordination Agreement Subordinating Existing Mortgage To New Mortgage with ease

- Locate Subordination Agreement Subordinating Existing Mortgage To New Mortgage and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Subordination Agreement Subordinating Existing Mortgage To New Mortgage and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

A Subordination Agreement Subordinating Existing Mortgage To New Mortgage is a legal document that allows the new mortgage to take priority over an existing mortgage. This process is essential for homeowners looking to refinance or obtain new financing while keeping their current loan in place. It ensures the new lender's interest is secured ahead of the existing lender’s interest.

-

How does airSlate SignNow facilitate the signing of a Subordination Agreement?

airSlate SignNow makes it easy to manage and eSign a Subordination Agreement Subordinating Existing Mortgage To New Mortgage through its intuitive platform. Users can upload documents, add signers, and send documents for eSignature seamlessly. Our secure solution guarantees that your documents remain protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for Subordination Agreements?

Using airSlate SignNow for your Subordination Agreement Subordinating Existing Mortgage To New Mortgage offers various benefits, including efficiency, cost-effectiveness, and enhanced security. The platform allows for faster completion of documents, reducing turnaround time. It also minimizes paper use and physical storage needs, aligning with modern digital practices.

-

Is there a cost associated with creating a Subordination Agreement on airSlate SignNow?

Yes, there is a nominal fee for utilizing airSlate SignNow’s services to create a Subordination Agreement Subordinating Existing Mortgage To New Mortgage. However, our pricing plans are designed to be affordable and scalable, ensuring you can find a solution that fits your business needs without breaking the bank. You can explore various plans, including monthly or annual subscriptions.

-

Can I integrate airSlate SignNow with other applications for managing Subordination Agreements?

Absolutely! airSlate SignNow offers integrations with a range of applications such as Google Drive, Salesforce, and others, allowing you to streamline your overall workflow when managing a Subordination Agreement Subordinating Existing Mortgage To New Mortgage. These integrations help consolidate your business processes and enhance productivity by allowing seamless data transfer across platforms.

-

How secure is the signing process for Subordination Agreements on airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. When you create a Subordination Agreement Subordinating Existing Mortgage To New Mortgage, all data is encrypted using advanced security protocols. Our platform complies with industry standards to ensure that your documents are safe from unauthorized access during the signing process.

-

What types of businesses can benefit from using airSlate SignNow for Subordination Agreements?

Any business looking to handle real estate transactions involving a Subordination Agreement Subordinating Existing Mortgage To New Mortgage can benefit from airSlate SignNow, including real estate agencies, lenders, and law firms. Our platform simplifies document management for various sectors, ensuring quick, efficient, and legally binding eSignatures that cater to both small and large enterprises.

Get more for Subordination Agreement Subordinating Existing Mortgage To New Mortgage

- If applicable current parking location and permit number form

- Dental patient forms jackson dental professionals

- 55b23 form

- 300h 55555 e g5003 e form

- Training verification form template

- Process of obtaining water meters for single family residences form

- Certificate of insurance certificate of insurance form

- Pdf cannot save form information or can only save blank copy

Find out other Subordination Agreement Subordinating Existing Mortgage To New Mortgage

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online