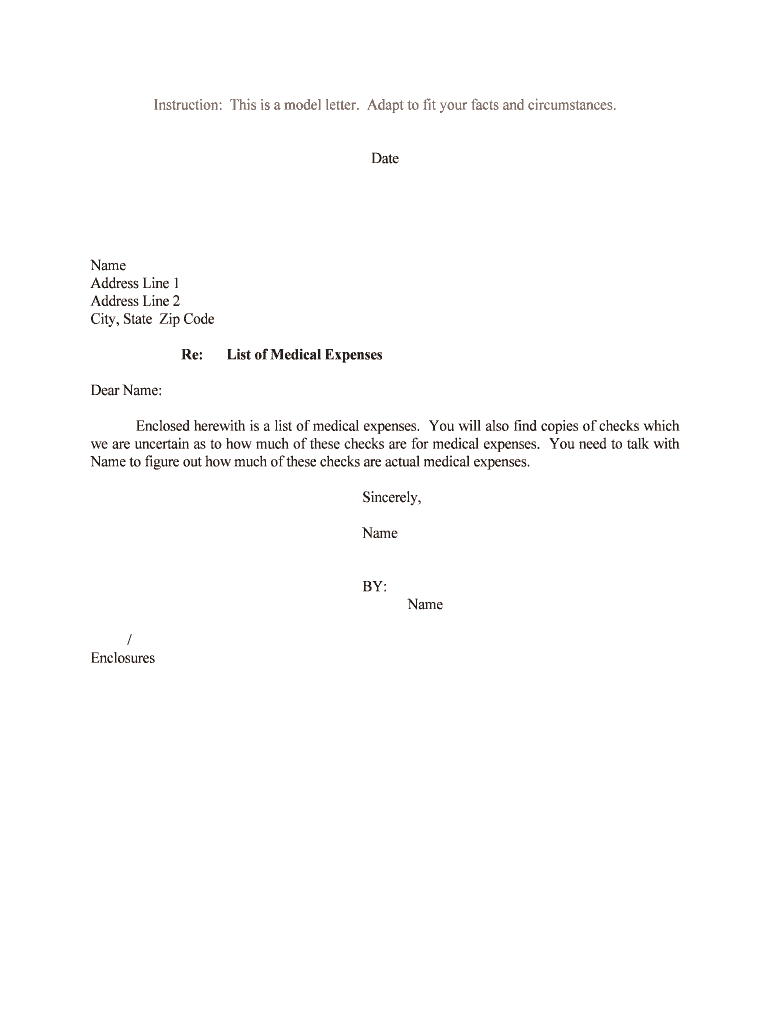

List of Medical Expenses Form

What is the list of medical expenses

The list of medical expenses is a comprehensive document that outlines various healthcare costs incurred by an individual. This list typically includes expenses related to medical care, treatments, and services that may be eligible for tax deductions or reimbursement. Common entries on this list can encompass hospital bills, prescription medications, dental care, and preventive services. Understanding this list is essential for individuals seeking to manage their healthcare finances effectively.

How to use the list of medical expenses

Using the list of medical expenses involves compiling all relevant healthcare costs for a specific tax year or for reimbursement purposes. Individuals should gather receipts, invoices, and any supporting documentation related to their medical expenses. Once compiled, this list can be utilized when filing tax returns or submitting claims to insurance providers. Accurate record-keeping ensures that all eligible expenses are accounted for, maximizing potential deductions or reimbursements.

Steps to complete the list of medical expenses

Completing the list of medical expenses requires a systematic approach. Begin by collecting all receipts and invoices for medical services received throughout the year. Next, categorize these expenses into groups such as hospital visits, medications, and preventive care. Each entry should include the date of service, provider name, and total cost. Finally, review the compiled list for accuracy and completeness before submitting it for tax purposes or insurance claims.

Legal use of the list of medical expenses

The legal use of the list of medical expenses is primarily tied to tax deductions and insurance claims. For tax purposes, the Internal Revenue Service (IRS) allows individuals to deduct certain medical expenses that exceed a specific percentage of their adjusted gross income. Additionally, insurance providers may require a detailed list of medical expenses to process claims. It is crucial to ensure that all entries comply with IRS guidelines and insurance policies to avoid issues during audits or claims processing.

IRS guidelines

The IRS provides specific guidelines regarding which medical expenses are deductible. According to IRS Publication 502, qualifying expenses must be primarily for the prevention or alleviation of physical or mental defects or illnesses. This includes payments for doctors, hospitals, and prescription drugs. It is essential for individuals to familiarize themselves with these guidelines to ensure that their list of medical expenses meets federal requirements and maximizes potential deductions.

Required documents

To effectively complete the list of medical expenses, certain documents are necessary. These include:

- Receipts for all medical services and products purchased.

- Invoices from healthcare providers detailing services rendered.

- Insurance statements showing what was paid or reimbursed.

- Any documentation related to tax deductions claimed in previous years.

Having these documents organized and readily available will facilitate the completion of the list and ensure compliance with tax regulations.

Form submission methods

Submitting the list of medical expenses can be done through various methods, depending on the intended use. For tax purposes, individuals typically include the list as part of their annual tax return, which can be filed online or via mail. For insurance claims, submission methods may vary by provider, with options for online uploads, faxing, or mailing physical copies. It is important to follow the specific submission guidelines provided by the relevant tax authority or insurance company to ensure proper processing.

Quick guide on how to complete list of medical expenses

Finalize List Of Medical Expenses seamlessly on any gadget

Managing documents online has gained traction among enterprises and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, alter, and eSign your documents swiftly without hindrances. Handle List Of Medical Expenses on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to adjust and eSign List Of Medical Expenses effortlessly

- Obtain List Of Medical Expenses and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow sections of the documents or conceal sensitive details with features that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to submit your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign List Of Medical Expenses and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the List Of Medical Expenses feature in airSlate SignNow?

The List Of Medical Expenses feature allows users to easily create and manage documents related to medical expenditure. This helps streamline the process of documenting and tracking medical costs, ensuring compliance and easy access to all necessary information.

-

How can airSlate SignNow help with tracking a List Of Medical Expenses?

With airSlate SignNow, businesses can electronically sign and send documents that include a List Of Medical Expenses. This digital approach ensures that all medical expenses are recorded accurately and can be accessed at any time for auditing and reimbursement purposes.

-

Is there a cost associated with using the List Of Medical Expenses feature?

airSlate SignNow offers various pricing plans that include access to the List Of Medical Expenses feature. These plans are designed to accommodate businesses of all sizes, with cost-effective options that cater to specific needs in managing medical documentation.

-

What are the benefits of using airSlate SignNow for List Of Medical Expenses?

Using airSlate SignNow for List Of Medical Expenses provides numerous benefits, including time savings, improved accuracy, and enhanced document security. The platform allows for efficient organization and retrieval of medical expense documents, facilitating better financial management.

-

Can airSlate SignNow integrate with other healthcare software for managing List Of Medical Expenses?

Yes, airSlate SignNow can seamlessly integrate with various healthcare and accounting software to enhance the management of List Of Medical Expenses. This integration ensures that all data is synchronized and accessible across platforms, improving efficiency and accuracy.

-

How does airSlate SignNow ensure the security of my List Of Medical Expenses documentation?

AirSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your List Of Medical Expenses documentation. This ensures that sensitive information remains confidential and is accessible only to authorized users.

-

What types of documents can I create related to my List Of Medical Expenses?

Users can create a variety of documents related to the List Of Medical Expenses, such as invoices, receipts, and compliance forms. airSlate SignNow provides customizable templates to help users efficiently produce the necessary documentation for their medical expenses.

Get more for List Of Medical Expenses

- Ap 2 universal application for paad senior gold and other newjersey form

- Part time to full time form

- Registration forms tumwater school district

- Pennsylvania application for the supplemental nutrition form

- 650 8997 10 18 satop comparablle program completion form

- California medical mileage expense form download fillable

- Application for calfresh cash aid andor medi form

- Form 402p

Find out other List Of Medical Expenses

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile