Deductions for Relocation Expense Form

What is the Deductions For Relocation Expense

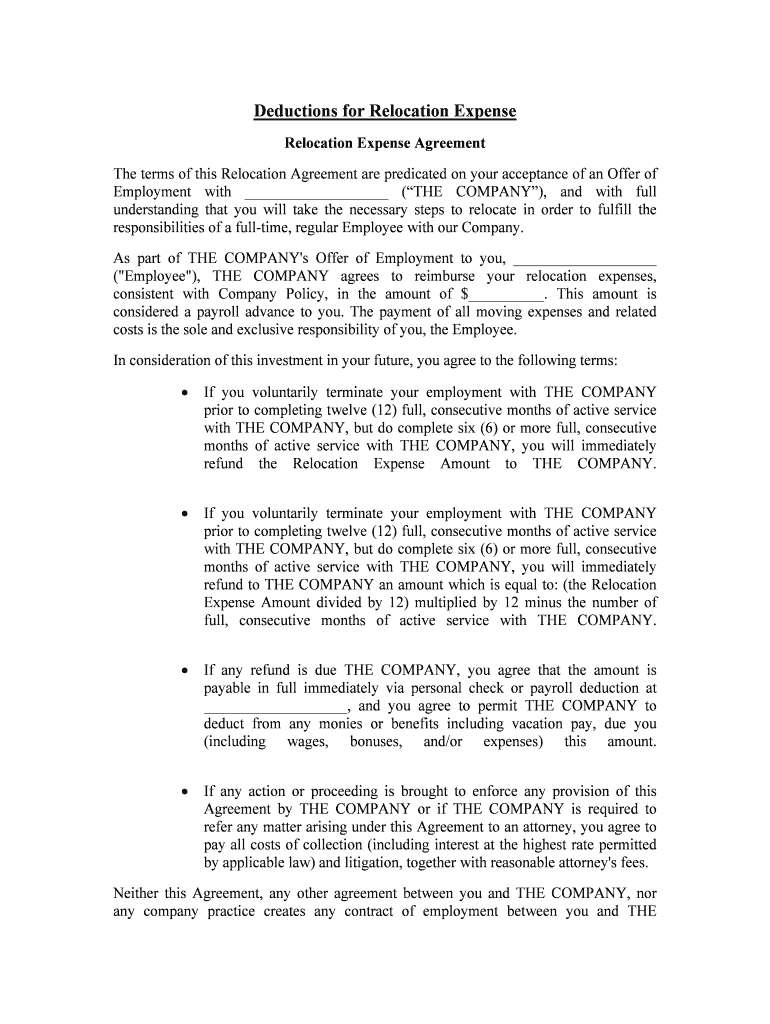

The Deductions For Relocation Expense form is a crucial document for individuals who have incurred costs related to moving for work-related reasons. This form allows taxpayers to claim eligible expenses on their federal tax returns. The types of expenses that can be deducted typically include transportation costs, storage fees, and certain travel expenses incurred during the move. Understanding the specifics of what qualifies as a deductible expense is essential for maximizing potential tax benefits.

How to use the Deductions For Relocation Expense

Using the Deductions For Relocation Expense form involves several key steps. First, gather all relevant documentation, including receipts and invoices for moving expenses. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to categorize expenses correctly to align with IRS guidelines. Finally, submit the form with your tax return, either electronically or by mail, depending on your filing method.

Steps to complete the Deductions For Relocation Expense

Completing the Deductions For Relocation Expense form requires careful attention to detail. Follow these steps for a successful submission:

- Collect all necessary documents, including receipts for moving services and travel costs.

- Review IRS guidelines to determine which expenses are eligible for deduction.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check for any errors or omissions before submission.

- Submit the form with your tax return, ensuring you meet any filing deadlines.

IRS Guidelines

The IRS provides specific guidelines regarding the Deductions For Relocation Expense. Taxpayers must ensure they meet the criteria set forth by the IRS, which includes the distance test and the time test. The distance test requires that the new job location is at least fifty miles farther from the old home than the previous job location. The time test stipulates that the taxpayer must work full-time for at least thirty-nine weeks during the first twelve months after the move. Familiarizing oneself with these guidelines is crucial for a successful deduction claim.

Eligibility Criteria

To qualify for the Deductions For Relocation Expense, individuals must meet certain eligibility criteria. The move must be closely related to starting a new job, and the taxpayer must have incurred qualifying expenses. Additionally, the moving expenses must not be reimbursed by the employer. Understanding these criteria helps ensure that taxpayers can accurately determine their eligibility and avoid potential issues with their claims.

Required Documents

When filing for the Deductions For Relocation Expense, specific documents are necessary to support the claim. Required documents typically include:

- Receipts for moving services, such as moving truck rentals or professional movers.

- Invoices for storage fees if applicable.

- Travel expenses documentation, including mileage logs or travel itineraries.

Having these documents readily available can streamline the filing process and enhance the accuracy of the claim.

Quick guide on how to complete deductions for relocation expense

Complete Deductions For Relocation Expense seamlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional paper-based paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, revise, and electronically sign your documents swiftly without interruptions. Handle Deductions For Relocation Expense on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The simplest method to adjust and eSign Deductions For Relocation Expense effortlessly

- Find Deductions For Relocation Expense and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Adjust and eSign Deductions For Relocation Expense and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Deductions For Relocation Expense?

Deductions For Relocation Expense are tax deductions that individuals can claim for moving expenses incurred due to a job-related relocation. These deductions can include costs such as moving household goods and related travel expenses. Understanding how to document these expenses can signNowly reduce your taxable income.

-

How does airSlate SignNow help with Deductions For Relocation Expense?

airSlate SignNow allows businesses to efficiently manage and sign documents related to Deductions For Relocation Expense. With our platform, you can securely eSign tax documents and ensure compliance with IRS regulations. This helps streamline your relocation process and keep your paperwork organized.

-

Are there any costs associated with using airSlate SignNow for managing relocating expenses?

Yes, airSlate SignNow offers various pricing plans to fit your business needs. Our cost-effective solution provides you with features specifically designed for managing Deductions For Relocation Expense while remaining budget-friendly. You can choose a plan that includes all the essential tools for your document management.

-

Can I integrate airSlate SignNow with other accounting software for tracking relocation expenses?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software platforms. This ensures that any documents related to Deductions For Relocation Expense are easily accessible and properly recorded for your financial records.

-

What features does airSlate SignNow offer to simplify the claims process for relocation expenses?

Our platform offers features like document templates, automated workflows, and secure storage to simplify the claims process for Deductions For Relocation Expense. With intuitive navigation, you can quickly create, send, and manage all of your relocation-related documents in one place.

-

How can I ensure my Deductions For Relocation Expense claims are accurate?

By using airSlate SignNow, you can create precise documentation and keep track of all related expenses. Our platform also allows for easy collaboration with your tax advisor or accountant, ensuring that your claims for Deductions For Relocation Expense are accurate and well-supported.

-

Does airSlate SignNow provide support for users unfamiliar with tax deductions?

Yes, airSlate SignNow offers excellent customer support resources to help users navigate the complexities of Deductions For Relocation Expense. We provide guides, FAQs, and personalized support to ensure you utilize our platform effectively for all your relocation documentation needs.

Get more for Deductions For Relocation Expense

Find out other Deductions For Relocation Expense

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word