What is an Lq1 Form 2008

What is an LQ1 Form?

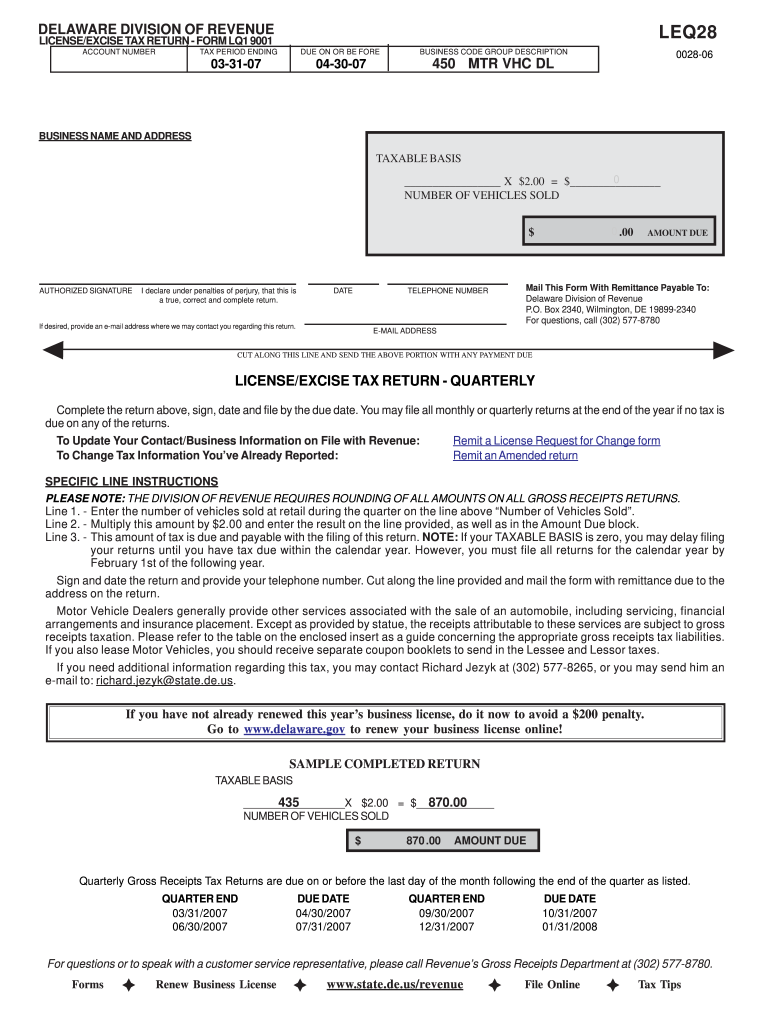

The LQ1 form, officially known as the License Excise Form, is a crucial document used in Delaware for reporting specific excise taxes. This form is particularly relevant for businesses operating within the state, as it helps them comply with state tax regulations. The LQ1 form is utilized by various entities, including corporations and partnerships, to report their excise tax obligations accurately.

How to Use the LQ1 Form

Using the LQ1 form involves several steps to ensure compliance with Delaware tax laws. First, businesses must gather all necessary financial information related to their operations. This includes revenue figures and any applicable deductions. Once the data is compiled, the form can be filled out online or printed for manual completion. It is essential to review the completed form for accuracy before submission to avoid potential penalties.

Steps to Complete the LQ1 Form

Completing the LQ1 form involves a systematic approach:

- Gather all relevant financial documents, including revenue reports and previous tax filings.

- Access the LQ1 form through the Delaware Division of Revenue website or obtain a physical copy.

- Fill in the required fields, ensuring all information is accurate and complete.

- Calculate the total excise tax owed based on the provided guidelines.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form either electronically or by mail, following the instructions provided by the Delaware Division of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the LQ1 form are critical for businesses to avoid penalties. Typically, the form must be submitted by the last day of the month following the end of the reporting period. For example, if the reporting period ends on December 31, the form is due by January 31 of the following year. It is advisable for businesses to mark these dates on their calendars to ensure timely compliance.

Penalties for Non-Compliance

Failure to file the LQ1 form on time can result in significant penalties. Delaware imposes fines for late submissions, which can accumulate over time. Additionally, businesses may face interest charges on any unpaid excise taxes. To mitigate these risks, it is crucial for businesses to adhere to the filing deadlines and ensure that their forms are accurate and complete.

Form Submission Methods

The LQ1 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Delaware Division of Revenue's website, which is often the quickest method.

- Mailing a physical copy of the completed form to the appropriate division.

- In-person submission at designated state offices, if preferred.

Who Issues the Form

The LQ1 form is issued by the Delaware Division of Revenue, which is responsible for administering state tax laws. This division provides resources and support for businesses to ensure compliance with tax regulations. It is advisable for businesses to consult the Division of Revenue's website for the most current information regarding the LQ1 form and related tax obligations.

Quick guide on how to complete licenseexcise tax return form lq1 9001 revenue delaware

Your assistance manual on how to prepare your What Is An Lq1 Form

If you’re interested in learning how to finalize and submit your What Is An Lq1 Form, here are some brief guidelines on how to simplify your tax declaration process.

To begin with, all you need is to sign up for your airSlate SignNow account to revolutionize your online documentation. airSlate SignNow is an extremely user-friendly and robust document management tool that allows you to modify, create, and complete your tax forms with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify responses as necessary. Optimize your tax processing with advanced PDF manipulation, eSigning, and seamless sharing.

Follow the instructions below to finish your What Is An Lq1 Form within just a few minutes:

- Establish your account and begin working on PDFs shortly.

- Browse our library to find any IRS tax form; review variations and schedules.

- Select Get form to access your What Is An Lq1 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and amend any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper may lead to return errors and delay refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct licenseexcise tax return form lq1 9001 revenue delaware

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the licenseexcise tax return form lq1 9001 revenue delaware

How to create an eSignature for your Licenseexcise Tax Return Form Lq1 9001 Revenue Delaware online

How to make an eSignature for the Licenseexcise Tax Return Form Lq1 9001 Revenue Delaware in Google Chrome

How to make an eSignature for signing the Licenseexcise Tax Return Form Lq1 9001 Revenue Delaware in Gmail

How to make an eSignature for the Licenseexcise Tax Return Form Lq1 9001 Revenue Delaware from your mobile device

How to make an electronic signature for the Licenseexcise Tax Return Form Lq1 9001 Revenue Delaware on iOS devices

How to generate an electronic signature for the Licenseexcise Tax Return Form Lq1 9001 Revenue Delaware on Android devices

People also ask

-

What is Delaware income tax and how does it affect my business?

Delaware income tax refers to the taxes imposed by the state of Delaware on personal income and corporate earnings. Understanding Delaware income tax is crucial for businesses as it affects your overall financial planning and profitability. Using airSlate SignNow, you can quickly eSign and send important tax documentation, ensuring compliance with Delaware laws.

-

How can airSlate SignNow help with managing Delaware income tax documents?

airSlate SignNow simplifies the process of managing Delaware income tax documents by allowing you to create, send, and eSign forms securely. This reduces paper clutter and enhances organization, making it easier to keep track of your tax obligations. The platform's automation features can also help remind you of important deadlines related to Delaware income tax submissions.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs and budgets. Whether you are a small business or a larger organization, you can choose a plan that aligns with your requirements for eSigning and document management, ensuring you stay compliant with Delaware income tax regulations without overspending.

-

What features does airSlate SignNow provide for tax document management?

With airSlate SignNow, you can access features such as customizable templates, real-time tracking, and secure cloud storage for your Delaware income tax documents. These features streamline the signing process, enhance collaboration among team members, and ensure that your vital documents are easy to retrieve when needed. It also supports compliance by maintaining robust security standards.

-

Does airSlate SignNow offer integration with accounting software?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing for efficient management of financial documents related to Delaware income tax. This integration simplifies the workflow between document signing and financial reporting, making it easier for your team to handle tax-related tasks. You can keep all your financial data in one place while ensuring it's readily accessible.

-

Is airSlate SignNow secure for storing sensitive tax documents?

Absolutely, airSlate SignNow employs industry-leading security measures to safeguard sensitive tax documents, including those related to Delaware income tax. Advanced encryption, secure cloud storage, and compliance with regulatory standards ensure that your data remains protected. Trusting airSlate SignNow means you can focus on your business, knowing that your information is secure.

-

Can I access airSlate SignNow from any device?

Yes, airSlate SignNow is designed for accessibility across various devices, including desktops, tablets, and smartphones. This flexibility means you can manage your Delaware income tax documents on the go, making it easy to send or eSign documents whenever necessary. The platform's user-friendly interface ensures a consistent experience across all devices.

Get more for What Is An Lq1 Form

- Cosigner agreement law for landlords free landlord forms

- To help you heres a list of items you should thoroughly clean before moving form

- Timely pay rent form

- The lease is recorded form

- Free tenant renter background check form wordpdf

- To order cable tv service call form

- Divorce and resumption of my maiden name form

- All guardianship forms wisconsin court system circuit

Find out other What Is An Lq1 Form

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement