After Tax Reform, Do Business Meals Remain Deductible CLA

What is the After Tax Reform, Do Business Meals Remain Deductible CLA

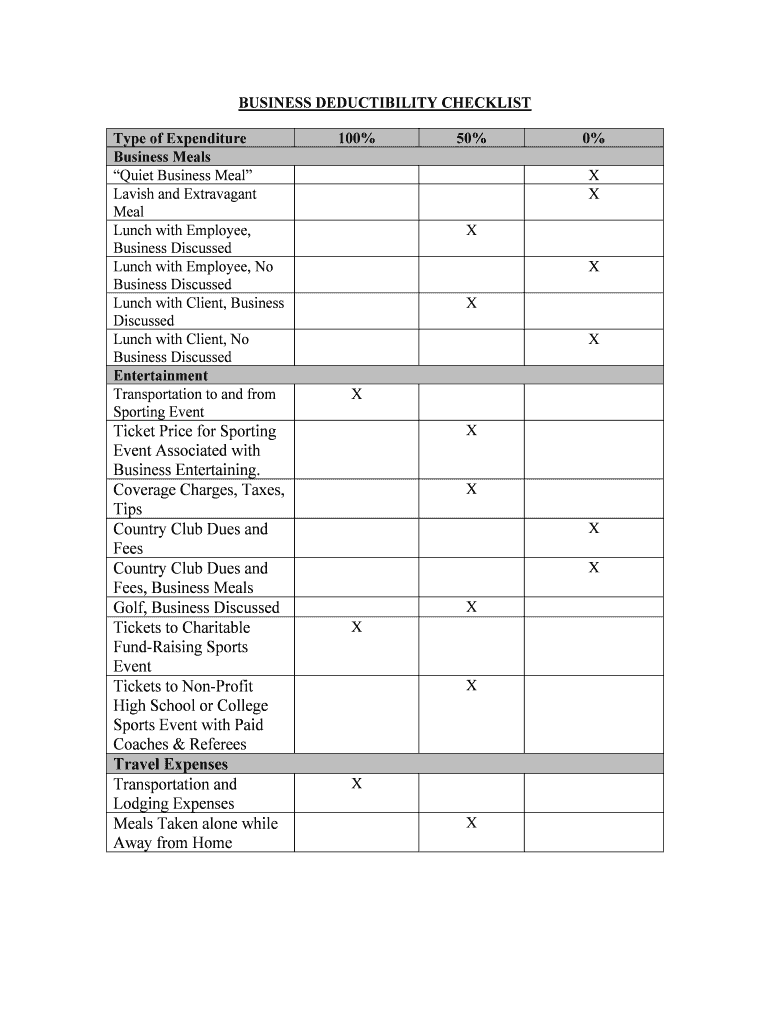

The After Tax Reform, Do Business Meals Remain Deductible CLA refers to guidelines established after significant tax reforms that dictate how business meals can be deducted for tax purposes. Under the Tax Cuts and Jobs Act, the rules around deducting business meals changed, impacting how businesses can account for these expenses. Generally, business meals are 50% deductible if they meet specific criteria, such as being directly related to the active conduct of a trade or business. Understanding these regulations is crucial for businesses to ensure compliance and optimize their tax deductions.

How to Use the After Tax Reform, Do Business Meals Remain Deductible CLA

Utilizing the After Tax Reform, Do Business Meals Remain Deductible CLA involves understanding the specific requirements for deducting business meal expenses. Businesses should keep detailed records of meal expenses, including the date, location, attendees, and purpose of the meal. This documentation is essential for substantiating deductions during tax filing. Additionally, businesses should ensure that meals are not extravagant and are directly related to business activities to qualify for the deduction.

IRS Guidelines

The IRS provides specific guidelines regarding the deductibility of business meals under the After Tax Reform. According to IRS regulations, meals must be directly associated with the active conduct of a trade or business to be considered deductible. The IRS also requires that the taxpayer or an employee must be present at the meal. Furthermore, the expense must not be lavish or extravagant under the circumstances. Familiarizing oneself with these guidelines helps ensure compliance and maximizes potential deductions.

Steps to Complete the After Tax Reform, Do Business Meals Remain Deductible CLA

Completing the After Tax Reform, Do Business Meals Remain Deductible CLA involves several key steps:

- Document each business meal with the date, location, attendees, and business purpose.

- Ensure that the meal expense does not exceed the IRS limit of 50% deductible.

- Retain receipts and any other relevant documentation to support the deduction.

- Review IRS guidelines to confirm compliance with the current tax laws.

- Include the meal expenses in the appropriate section of your tax return.

Legal Use of the After Tax Reform, Do Business Meals Remain Deductible CLA

The legal use of the After Tax Reform, Do Business Meals Remain Deductible CLA is crucial for businesses to avoid penalties and ensure proper tax compliance. Businesses must adhere to IRS regulations regarding documentation and the nature of the meals to qualify for deductions. Non-compliance can result in disallowed deductions and potential audits. Therefore, understanding the legal requirements surrounding business meal deductions is essential for maintaining good standing with tax authorities.

Penalties for Non-Compliance

Failing to comply with the guidelines set forth in the After Tax Reform, Do Business Meals Remain Deductible CLA can lead to various penalties. If the IRS determines that a business has improperly claimed meal deductions, it may disallow those deductions, resulting in increased taxable income. Additionally, businesses may face interest and penalties on any unpaid taxes resulting from disallowed deductions. Maintaining accurate records and adhering to IRS guidelines is vital to mitigate these risks.

Quick guide on how to complete after tax reform do business meals remain deductible cla

Complete After Tax Reform, Do Business Meals Remain Deductible CLA seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle After Tax Reform, Do Business Meals Remain Deductible CLA on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign After Tax Reform, Do Business Meals Remain Deductible CLA effortlessly

- Locate After Tax Reform, Do Business Meals Remain Deductible CLA and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature utilizing the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form: via email, text (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Modify and eSign After Tax Reform, Do Business Meals Remain Deductible CLA and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the impact of the After Tax Reform on business meal deductions?

After Tax Reform, business meals are still subject to specific IRS guidelines. While most meals can be deducted, there are restrictions, and it's essential to keep proper documentation to ensure compliance. Consult with a tax professional to understand how the After Tax Reform may affect your specific situation.

-

How can airSlate SignNow help manage documents related to business meals deductions?

airSlate SignNow simplifies the process of documenting and signing any necessary paperwork related to business meal deductions. With our easy-to-use platform, you can ensure that all documents are organized and compliant with tax regulations after the After Tax Reform. This efficiency can help protect your business from audits and discrepancies.

-

Are there specific business meal categories that are still deductible after tax reform?

Yes, after tax reform, certain business meal categories remain deductible, such as meals with clients for business purposes. However, it's crucial to be aware that entertainment expenses may no longer be deductible. Always check with a tax advisor to confirm your deductions align with IRS guidelines following the After Tax Reform.

-

How does airSlate SignNow support my business with pricing related to eSignatures?

Our pricing structure for airSlate SignNow is designed to provide cost-effective solutions for businesses of all sizes. With flexible plans, you can choose the one that best suits your eSignature needs while ensuring that all business meal documentation is easily managed. Clarity in cost helps you allocate resources efficiently in light of tax reforms.

-

What features in airSlate SignNow can aid in preparing for tax-related documentation?

airSlate SignNow includes features like document templates, secure storage, and automated workflows that simplify tax-related documentation. These features can help users effectively prepare and track their business meals and related deductions post-After Tax Reform. This efficiency allows businesses to focus on growth while staying compliant.

-

Can multiple users access business meal documentation in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to access and collaborate on business meal documentation. This functionality is essential for teams needing to manage expenses incur to secure deductions under the After Tax Reform regulations. Collaboration enhances accuracy and ensures that all relevant information is captured.

-

Are integrations available in airSlate SignNow for accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software to streamline your workflow related to business meal deductions. This capability ensures that all your documents are easily tracked and recorded for tax purposes after the After Tax Reform. Integration simplifies data transfer and minimizes the risk of errors.

Get more for After Tax Reform, Do Business Meals Remain Deductible CLA

- Florida family law rules of procedure 12910 2000 form

- Georgia instructions standard form

- Divorce decree without minor andor dependent children courts state hi form

- Request to remove a case from the court annexed arbitration program courts state hi form

- Ad dui form

- Form representation adlro form

- 1f p 738 form

- Model opgaaf gegevens voor de loonheffingen vanaf lh 008 2z11fol form

Find out other After Tax Reform, Do Business Meals Remain Deductible CLA

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney