Oil Rendition Form Kansas Department of Revenue Ksrevenue

What is the Oil Rendition Form Kansas Department of Revenue ksrevenue

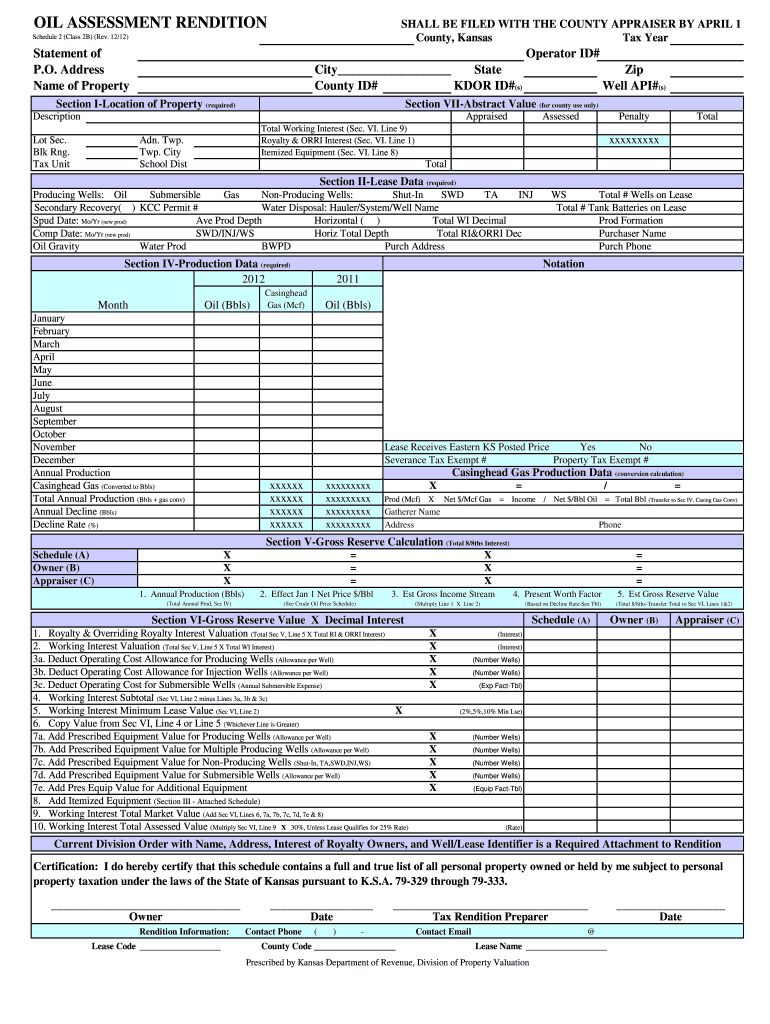

The Oil Rendition Form is a crucial document required by the Kansas Department of Revenue for reporting the value of oil production. This form is essential for property tax assessment purposes, ensuring that oil producers accurately declare their production levels to the state. By completing this form, businesses comply with state regulations and contribute to the accurate assessment of property taxes related to oil production activities.

How to use the Oil Rendition Form Kansas Department of Revenue ksrevenue

Using the Oil Rendition Form involves several steps to ensure compliance with Kansas tax regulations. First, gather all necessary information regarding oil production, including production volumes and associated values. Next, accurately fill out the form, ensuring that all data is complete and correct. Once completed, the form can be submitted electronically or via mail, depending on the preferences outlined by the Kansas Department of Revenue.

Steps to complete the Oil Rendition Form Kansas Department of Revenue ksrevenue

Completing the Oil Rendition Form requires careful attention to detail. Here are the steps to follow:

- Collect production data: Gather information on the quantity of oil produced and its market value.

- Fill out the form: Enter the required information in the designated fields, ensuring accuracy.

- Review for completeness: Check that all sections are filled out and that the information is correct.

- Submit the form: Choose your preferred submission method, either electronically or by mail.

Key elements of the Oil Rendition Form Kansas Department of Revenue ksrevenue

The Oil Rendition Form includes several key elements that must be accurately reported. These elements typically consist of:

- Identification of the producer: Name and contact information of the oil producer.

- Production details: Total volume of oil produced during the reporting period.

- Market value: The assessed value of the oil production based on current market rates.

- Signature: The form must be signed by an authorized representative to validate the information provided.

Legal use of the Oil Rendition Form Kansas Department of Revenue ksrevenue

The legal use of the Oil Rendition Form is governed by Kansas state law, which mandates that oil producers report their production accurately. Failing to comply with these regulations can result in penalties or fines. It is essential for producers to understand their legal obligations and ensure that all information submitted is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Oil Rendition Form are critical for compliance. Typically, producers must submit the form by a specific date each year, often aligned with the property tax assessment calendar. It is advisable to check the Kansas Department of Revenue's official guidelines for the exact deadlines to ensure timely submission and avoid any penalties.

Quick guide on how to complete 2013 oil rendition form kansas department of revenue ksrevenue

Complete Oil Rendition Form Kansas Department Of Revenue Ksrevenue effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Oil Rendition Form Kansas Department Of Revenue Ksrevenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Oil Rendition Form Kansas Department Of Revenue Ksrevenue with ease

- Locate Oil Rendition Form Kansas Department Of Revenue Ksrevenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Oil Rendition Form Kansas Department Of Revenue Ksrevenue while ensuring clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2013 oil rendition form kansas department of revenue ksrevenue

How to create an eSignature for the 2013 Oil Rendition Form Kansas Department Of Revenue Ksrevenue online

How to make an eSignature for your 2013 Oil Rendition Form Kansas Department Of Revenue Ksrevenue in Google Chrome

How to make an eSignature for putting it on the 2013 Oil Rendition Form Kansas Department Of Revenue Ksrevenue in Gmail

How to generate an electronic signature for the 2013 Oil Rendition Form Kansas Department Of Revenue Ksrevenue from your mobile device

How to create an eSignature for the 2013 Oil Rendition Form Kansas Department Of Revenue Ksrevenue on iOS devices

How to make an eSignature for the 2013 Oil Rendition Form Kansas Department Of Revenue Ksrevenue on Android

People also ask

-

What is the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

The Oil Rendition Form Kansas Department Of Revenue Ksrevenue is a document required for reporting oil production and related information for taxation purposes in Kansas. This form helps ensure compliance with state regulations and allows businesses to accurately report their oil assets.

-

How can airSlate SignNow help me with the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign the Oil Rendition Form Kansas Department Of Revenue Ksrevenue efficiently. With our solution, you can streamline the signing process, ensuring that all required signatures are collected promptly and securely.

-

Is there a cost associated with using airSlate SignNow for the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

Yes, there is a subscription fee for using airSlate SignNow; however, it is a cost-effective solution for managing documents like the Oil Rendition Form Kansas Department Of Revenue Ksrevenue. We offer various pricing plans to accommodate businesses of all sizes, allowing you to choose a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for managing the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage to help manage the Oil Rendition Form Kansas Department Of Revenue Ksrevenue efficiently. Our platform also includes real-time tracking and notifications, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with my existing software for the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

Yes, airSlate SignNow can be easily integrated with various software applications and tools commonly used in businesses. This flexibility allows you to streamline the process of completing and submitting the Oil Rendition Form Kansas Department Of Revenue Ksrevenue without disrupting your existing workflows.

-

What are the benefits of using airSlate SignNow for the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

Using airSlate SignNow for the Oil Rendition Form Kansas Department Of Revenue Ksrevenue offers several benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire signing process, allowing you to focus on your core business activities while ensuring compliance with state regulations.

-

How secure is the airSlate SignNow platform for the Oil Rendition Form Kansas Department Of Revenue Ksrevenue?

airSlate SignNow prioritizes security, utilizing advanced encryption and authentication measures to protect your documents, including the Oil Rendition Form Kansas Department Of Revenue Ksrevenue. Your data is safe with us, ensuring that only authorized users have access to sensitive information.

Get more for Oil Rendition Form Kansas Department Of Revenue Ksrevenue

- Linking the kentucky k prep assessments to nwea map form

- Fillable online case no court fax email print pdffiller form

- Informal final settlement

- Affidavit of waiver of form

- In re estate of a unmarried minor under the age of 18 form

- Q guardian or conservator for minor form

- Official and local forms united states courts

- Warranty bill of sale insured aircraft title service form

Find out other Oil Rendition Form Kansas Department Of Revenue Ksrevenue

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template