Utilization by a REIT of Partnership Structures in Financing Five Form

What is the Utilization By A REIT Of Partnership Structures In Financing Five

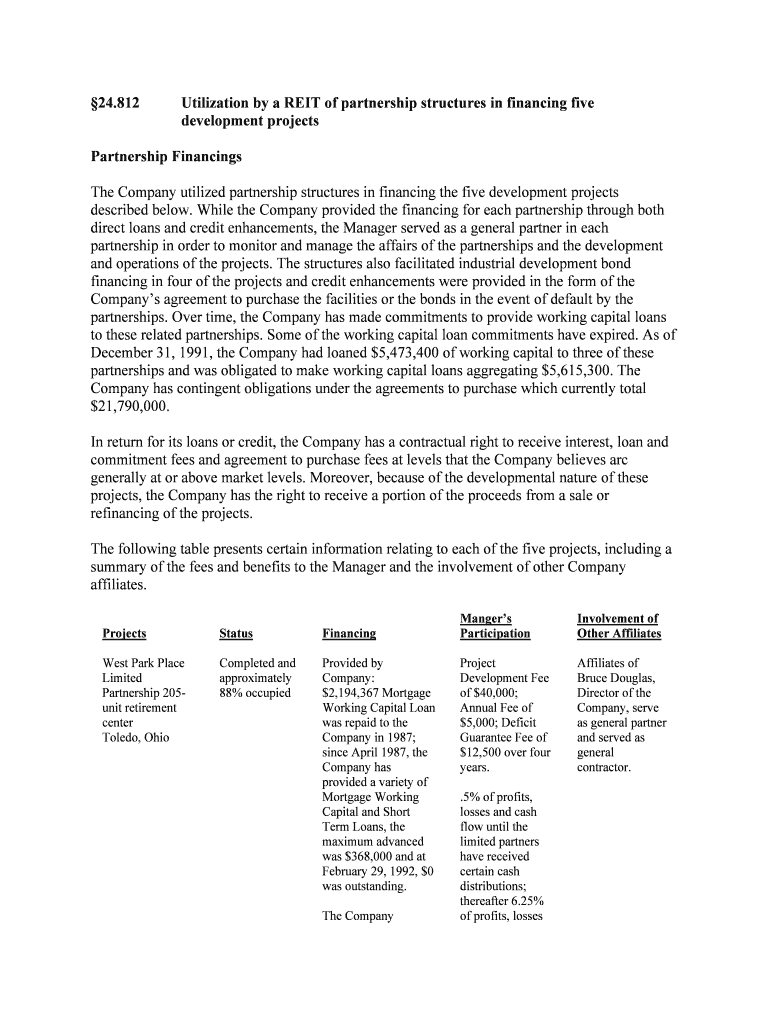

The utilization by a REIT of partnership structures in financing five refers to the strategic approach that Real Estate Investment Trusts (REITs) adopt to leverage partnership entities for financing purposes. This structure allows REITs to pool resources, share risks, and optimize tax benefits. By forming partnerships, REITs can access diverse capital sources while maintaining compliance with regulatory requirements. This method is particularly advantageous in real estate transactions, where large sums are often necessary for acquisitions and developments.

Key Elements of the Utilization By A REIT Of Partnership Structures In Financing Five

Several key elements define the utilization by a REIT of partnership structures in financing five. These include:

- Partnership Types: Common structures include limited partnerships and joint ventures, each offering unique benefits in terms of liability and tax implications.

- Tax Efficiency: Utilizing partnership structures can lead to favorable tax treatment, allowing profits to be passed through to partners without double taxation.

- Capital Flexibility: Partnerships can attract various investors, enhancing capital availability for large-scale projects.

- Risk Sharing: By partnering, REITs can distribute financial risks among multiple entities, reducing individual exposure.

Steps to Complete the Utilization By A REIT Of Partnership Structures In Financing Five

Completing the utilization by a REIT of partnership structures in financing five involves several critical steps:

- Determine Partnership Structure: Identify the most suitable partnership type based on the REIT's goals and the nature of the investment.

- Draft Partnership Agreement: Create a comprehensive agreement outlining the roles, responsibilities, and profit-sharing arrangements among partners.

- Conduct Due Diligence: Perform thorough research on potential partners to ensure alignment of interests and financial stability.

- File Necessary Documentation: Submit required forms and agreements to relevant regulatory bodies to formalize the partnership.

- Monitor Compliance: Regularly review partnership activities to ensure adherence to legal and financial obligations.

Legal Use of the Utilization By A REIT Of Partnership Structures In Financing Five

The legal use of the utilization by a REIT of partnership structures in financing five is governed by federal and state laws. Compliance with the Internal Revenue Code is essential to ensure that the partnership maintains its tax status. Additionally, REITs must adhere to regulations set forth by the Securities and Exchange Commission (SEC) regarding disclosures and reporting. Legal counsel is often involved to navigate these complexities and ensure that all agreements are enforceable and compliant with applicable laws.

Examples of Using the Utilization By A REIT Of Partnership Structures In Financing Five

Examples of how REITs utilize partnership structures in financing five include:

- Joint Ventures: A REIT may enter a joint venture with a local developer to finance a new commercial property, sharing both the investment and profits.

- Limited Partnerships: A REIT can form a limited partnership with investors to pool funds for a large acquisition, allowing limited partners to invest without taking on active management roles.

- Tax Credit Partnerships: Engaging in partnerships that focus on tax credits, such as those for affordable housing, can provide additional financial incentives and funding sources.

IRS Guidelines

IRS guidelines play a crucial role in the utilization by a REIT of partnership structures in financing five. The IRS outlines specific rules regarding the taxation of partnerships, including how income, deductions, and credits are allocated among partners. Understanding these guidelines is essential for REITs to maximize tax benefits while ensuring compliance. Additionally, REITs must be aware of the regulations surrounding the distribution of dividends to shareholders, as these can impact overall financial strategies.

Quick guide on how to complete utilization by a reit of partnership structures in financing five

Complete Utilization By A REIT Of Partnership Structures In Financing Five effortlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without interruptions. Manage Utilization By A REIT Of Partnership Structures In Financing Five from any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Utilization By A REIT Of Partnership Structures In Financing Five without hassle

- Obtain Utilization By A REIT Of Partnership Structures In Financing Five and click on Get Form to begin.

- Utilize the resources we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and select the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Utilization By A REIT Of Partnership Structures In Financing Five and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the utilization by a REIT of partnership structures in financing five?

The utilization by a REIT of partnership structures in financing five involves leveraging partnership arrangements to optimize financing strategies. This approach allows REITs to access capital efficiently while sharing risks with partners. Understanding this concept is crucial for maximizing potential returns and enhancing financial stability.

-

How does airSlate SignNow support the utilization by a REIT of partnership structures in financing five?

airSlate SignNow provides an intuitive platform that allows REITs to easily create, send, and eSign the necessary documents related to partnership financing. By streamlining the document workflow, REITs can focus more on strategic financial collaboration. This helps facilitate easier partnerships and enhances the overall financing process.

-

What are the costs associated with using airSlate SignNow for REIT documentation?

AirSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of businesses, including REITs utilizing partnership structures in financing five. By opting for a plan that fits your operational requirements, you can benefit from a cost-effective solution. Pricing is transparent, allowing businesses to budget effectively while taking advantage of all available features.

-

What features does airSlate SignNow offer for document management in REIT partnerships?

AirSlate SignNow includes a range of features such as real-time tracking, customizable templates, and secure cloud storage to support REITs in managing their partnership financing documents. These features are designed to enhance collaboration and ensure that all parties are on the same page throughout the financing process. Utilizing these tools can signNowly streamline partnership applications.

-

Are there any integrations available with airSlate SignNow for REITs?

Yes, airSlate SignNow integrates seamlessly with various CRM and project management tools, enhancing the utilization by a REIT of partnership structures in financing five. These integrations facilitate a more organized workflow, allowing REITs to manage their partnerships and finances efficiently. This connectivity helps in centralizing data and improving overall efficiency.

-

How does airSlate SignNow ensure security for REIT documents?

AirSlate SignNow prioritizes document security, utilizing encryption and secure authentication methods to protect sensitive information related to the utilization by a REIT of partnership structures in financing five. This ensures that all electronic signatures and document exchanges are safe from unauthorized access. Compliance with industry standards adds an extra layer of trust for users.

-

What benefits can REITs expect from using airSlate SignNow in partnership dealings?

By utilizing airSlate SignNow, REITs can expect increased efficiency in document processing, reduced time for obtaining signatures, and enhanced collaboration among partners. These benefits directly support the effective utilization by a REIT of partnership structures in financing five. Overall, it leads to faster decision-making and improved financial agreements.

Get more for Utilization By A REIT Of Partnership Structures In Financing Five

Find out other Utilization By A REIT Of Partnership Structures In Financing Five

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement