A Comprehensive Guide to Due Diligence Issues in Mergers Form

What is the A Comprehensive Guide To Due Diligence Issues In Mergers

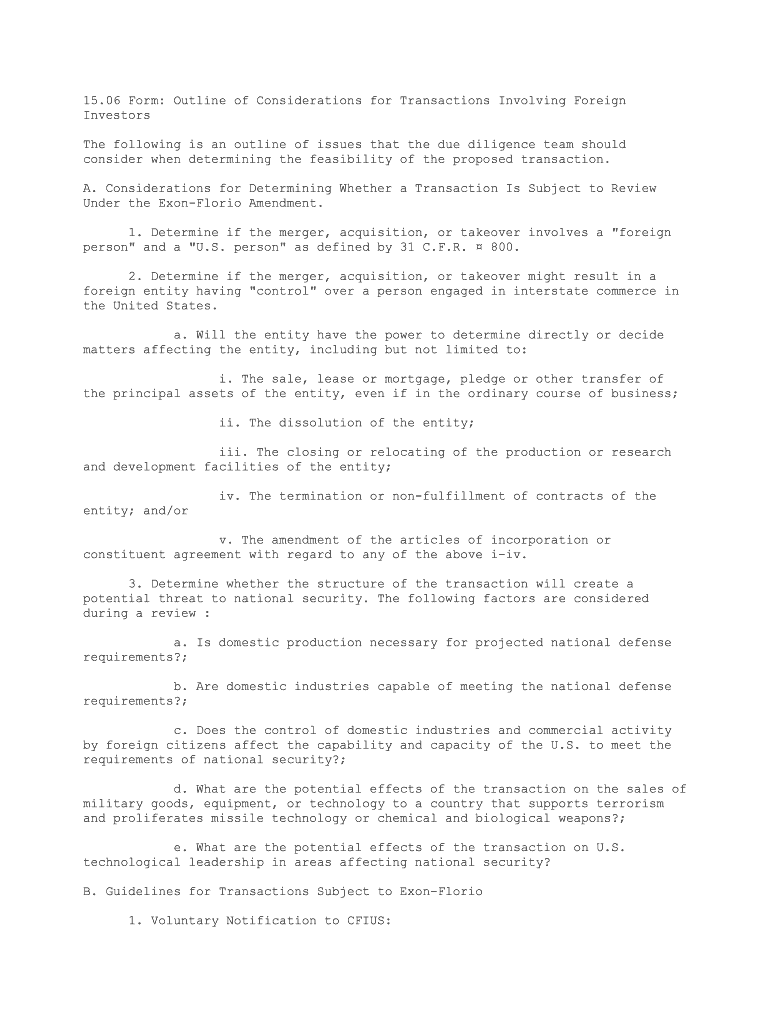

The A Comprehensive Guide To Due Diligence Issues In Mergers serves as an essential resource for businesses involved in merger and acquisition activities. This guide outlines the critical aspects of due diligence, which includes the examination of financial records, legal obligations, and operational practices of the entities involved. Understanding these elements helps stakeholders identify potential risks and opportunities, ensuring informed decision-making throughout the merger process.

Key elements of the A Comprehensive Guide To Due Diligence Issues In Mergers

Several key elements are crucial when utilizing the A Comprehensive Guide To Due Diligence Issues In Mergers. These include:

- Financial Analysis: Review of financial statements, tax returns, and cash flow projections to assess the financial health of the target company.

- Legal Compliance: Examination of contracts, licenses, and any pending litigation to ensure that the target company adheres to legal standards.

- Operational Assessment: Evaluation of the target's operational processes, including supply chain management and employee relations.

- Market Position: Analysis of the competitive landscape and market trends to understand the target's position within the industry.

Steps to complete the A Comprehensive Guide To Due Diligence Issues In Mergers

Completing the A Comprehensive Guide To Due Diligence Issues In Mergers involves several structured steps:

- Define the scope of due diligence based on the specific merger or acquisition.

- Gather relevant documents and data from both parties.

- Conduct thorough analyses of financial, legal, and operational information.

- Identify potential risks and liabilities associated with the merger.

- Compile findings into a comprehensive report for stakeholders.

Legal use of the A Comprehensive Guide To Due Diligence Issues In Mergers

The legal use of the A Comprehensive Guide To Due Diligence Issues In Mergers is paramount for ensuring compliance with regulatory requirements. This guide should be utilized to navigate the legal landscape surrounding mergers, including adherence to antitrust laws and securities regulations. Proper documentation and adherence to legal standards help mitigate risks and protect all parties involved in the transaction.

How to use the A Comprehensive Guide To Due Diligence Issues In Mergers

Using the A Comprehensive Guide To Due Diligence Issues In Mergers effectively requires a systematic approach. Start by familiarizing yourself with the guide's structure and key components. Next, apply the insights and frameworks provided to assess the target company thoroughly. This process involves collecting necessary documentation, engaging with relevant stakeholders, and utilizing analytical tools to interpret the data. Finally, ensure that all findings are documented clearly for future reference and decision-making.

Examples of using the A Comprehensive Guide To Due Diligence Issues In Mergers

Real-world examples of utilizing the A Comprehensive Guide To Due Diligence Issues In Mergers can illustrate its practical applications. For instance, a technology company considering the acquisition of a smaller startup may use the guide to evaluate the startup's intellectual property rights, existing contracts, and employee agreements. Another example could involve a healthcare organization assessing compliance with regulations and potential liabilities related to patient care during a merger. These examples highlight the guide's versatility across various industries.

Quick guide on how to complete a comprehensive guide to due diligence issues in mergers

Manage A Comprehensive Guide To Due Diligence Issues In Mergers seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly replacement for traditional printed and signed papers, as you can easily find the right form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle A Comprehensive Guide To Due Diligence Issues In Mergers on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign A Comprehensive Guide To Due Diligence Issues In Mergers effortlessly

- Find A Comprehensive Guide To Due Diligence Issues In Mergers and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign A Comprehensive Guide To Due Diligence Issues In Mergers and ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Comprehensive Guide To Due Diligence Issues In Mergers?

A Comprehensive Guide To Due Diligence Issues In Mergers is a detailed resource that outlines essential considerations during the merger process. It helps businesses understand potential risks and liabilities while ensuring all necessary information is transparently shared. This guide is invaluable for legal teams, finance departments, and executives involved in mergers.

-

How can airSlate SignNow assist with due diligence during mergers?

airSlate SignNow streamlines the document signing process, which is crucial for effective due diligence in mergers. By enabling businesses to send and eSign documents quickly, it ensures that all necessary agreements are legally binding and efficiently processed. This saves time and helps mitigate risks associated with incomplete documentation.

-

What features does airSlate SignNow offer for managing due diligence documents?

airSlate SignNow offers robust features such as templates for standard agreements, team collaboration tools, and advanced tracking of document statuses. These features are designed to enhance the efficiency of managing due diligence documents during mergers. This aligns perfectly with the objectives outlined in A Comprehensive Guide To Due Diligence Issues In Mergers.

-

Is the pricing for airSlate SignNow suitable for small businesses involved in mergers?

Yes, airSlate SignNow offers flexible pricing plans that cater to small and medium-sized businesses, making it a cost-effective solution for managing merger documents. By using a resource like A Comprehensive Guide To Due Diligence Issues In Mergers, businesses can maximize their investment in this software, ensuring they meet legal requirements without overspending.

-

What benefits can I expect from using airSlate SignNow in the due diligence process?

Using airSlate SignNow for the due diligence process provides several benefits, such as improved document accuracy and faster turnaround times. It helps teams work collaboratively while reducing paper waste, leading to an environmentally friendly approach. This operational efficiency complements the strategies outlined in A Comprehensive Guide To Due Diligence Issues In Mergers.

-

Can airSlate SignNow integrate with other tools for managing mergers?

Yes, airSlate SignNow easily integrates with various software applications, such as CRM systems and project management tools. This integration helps centralize all documents and data relating to the merger, facilitating adherence to recommendations in A Comprehensive Guide To Due Diligence Issues In Mergers.

-

What types of documents can I manage with airSlate SignNow during due diligence?

With airSlate SignNow, you can manage a wide range of documents, including non-disclosure agreements, purchase agreements, and financial statements. This flexibility ensures that you have all necessary paperwork efficiently organized during the due diligence process, aligning with considerations from A Comprehensive Guide To Due Diligence Issues In Mergers.

Get more for A Comprehensive Guide To Due Diligence Issues In Mergers

- Form 9014 2 notice of req of response generalpdf us bankruptcy ganb uscourts

- Instructions uncontested divorce packet without children form

- Hawaii 1d p motion form

- State of hawaii subpoena circuit court of the state hi form

- Writ of execution exhibit a hawaii state judiciary form

- 1 form 9 certificate from testing organization to be

- Iowa no contact order form

- Ada county blank motion form

Find out other A Comprehensive Guide To Due Diligence Issues In Mergers

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy