0510 Mississippi Non Resident or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex or Photocopie Form

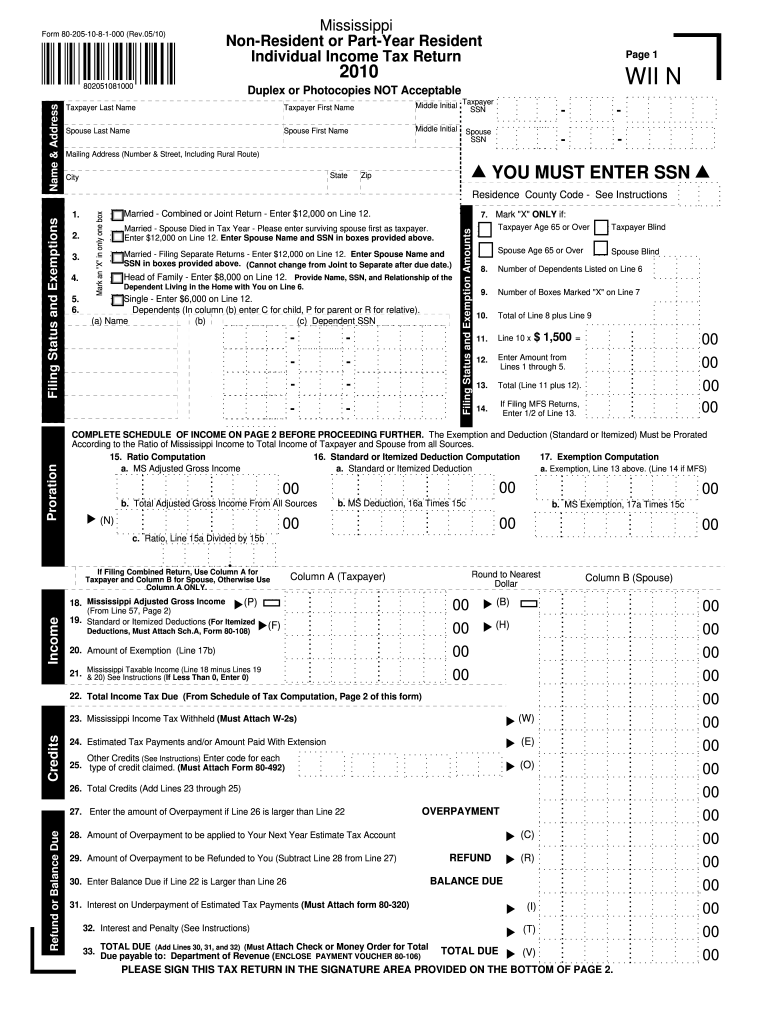

What is the Mississippi Form 80-205?

The Mississippi Form 80-205 is a tax form specifically designed for non-residents or part-year residents who need to file their individual income tax return in Mississippi. This form is essential for individuals who have earned income in the state but do not reside there full-time. It allows the Mississippi Department of Revenue to assess the appropriate tax obligations based on the income earned while in the state.

Steps to Complete the Mississippi Form 80-205

Completing the Mississippi Form 80-205 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out your personal information, including your name, address, and Social Security number. Then, report all income earned in Mississippi, followed by any applicable deductions. Finally, review the form for accuracy before signing and submitting it.

Required Documents for Mississippi Form 80-205

To successfully complete the Mississippi Form 80-205, you will need specific documents. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income earned in Mississippi

- Documentation for any deductions you plan to claim

Filing Deadlines for Mississippi Form 80-205

It is crucial to be aware of the filing deadlines for the Mississippi Form 80-205 to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Always check for any updates or changes to the filing schedule from the Mississippi Department of Revenue.

Legal Use of the Mississippi Form 80-205

The legal use of the Mississippi Form 80-205 is governed by state tax laws. It is important to ensure that the form is filled out accurately and submitted on time to maintain compliance with Mississippi tax regulations. Failure to file the form or inaccuracies in reporting income can lead to penalties, including fines and interest on unpaid taxes.

Form Submission Methods for Mississippi Form 80-205

The Mississippi Form 80-205 can be submitted through various methods. Taxpayers have the option to file the form electronically via the Mississippi Department of Revenue's online portal, or they can choose to print and mail the completed form to the appropriate address. In-person submissions may also be possible at designated tax offices.

Quick guide on how to complete 0510 mississippi non resident or part year resident individual income tax return page 1 2010 802051081000 duplex or photocopies

Easily prepare 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie effortlessly

- Obtain 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie and maintain effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 0510 mississippi non resident or part year resident individual income tax return page 1 2010 802051081000 duplex or photocopies

How to create an eSignature for the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 2010 802051081000 Duplex Or Photocopies in the online mode

How to create an electronic signature for your 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 2010 802051081000 Duplex Or Photocopies in Chrome

How to generate an eSignature for signing the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 2010 802051081000 Duplex Or Photocopies in Gmail

How to make an eSignature for the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 2010 802051081000 Duplex Or Photocopies from your smartphone

How to make an electronic signature for the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 2010 802051081000 Duplex Or Photocopies on iOS

How to make an eSignature for the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 2010 802051081000 Duplex Or Photocopies on Android devices

People also ask

-

What is the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie?

The 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie is a specific tax form designed for individuals who are filing as non-residents or part-year residents in Mississippi. This form is crucial for accurately reporting income earned in the state, ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie?

airSlate SignNow provides an efficient way to electronically sign and send the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie. By using our platform, you can streamline the signing process, making it faster and more secure.

-

Is there a cost associated with using airSlate SignNow for the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie?

Yes, while airSlate SignNow offers various pricing plans, the cost will depend on the features you choose. We provide affordable options tailored to meet your needs, ensuring you can easily eSign and manage your 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie without overspending.

-

What features does airSlate SignNow offer for managing the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and real-time tracking for the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie. These functionalities help simplify the document management process, ensuring everything is organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for my tax forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie alongside your favorite software. This integration enhances your workflow by connecting your tax forms with accounting software and other tools.

-

What are the benefits of using airSlate SignNow for my tax return forms?

Using airSlate SignNow for your 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie provides numerous benefits, including increased efficiency, reduced paperwork, and improved security. Our platform ensures that your documents are safely stored and easily retrievable when needed.

-

Is it easy to eSign the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie with airSlate SignNow?

Yes! airSlate SignNow is designed to be user-friendly, making it simple to eSign the 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie. With just a few clicks, you can send, sign, and manage your tax forms without any hassle.

Get more for 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie

- On this day of 20 i certify that the preceding following attached form

- Massachusetts acknowledgmentsindividualus legal forms

- Request to add attorney or amend attorney information

- Petition for forfeiture c90 s24w form

- To the clerk magistrate form

- Criminal procedure rule 12 pleas and plea massgov form

- Federal habeas corpus a study in massachusetts jstor form

- Application for criminal complaint form

Find out other 0510 Mississippi Non Resident Or Part Year Resident Individual Income Tax Return Page 1 802051081000 Duplex Or Photocopie

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document