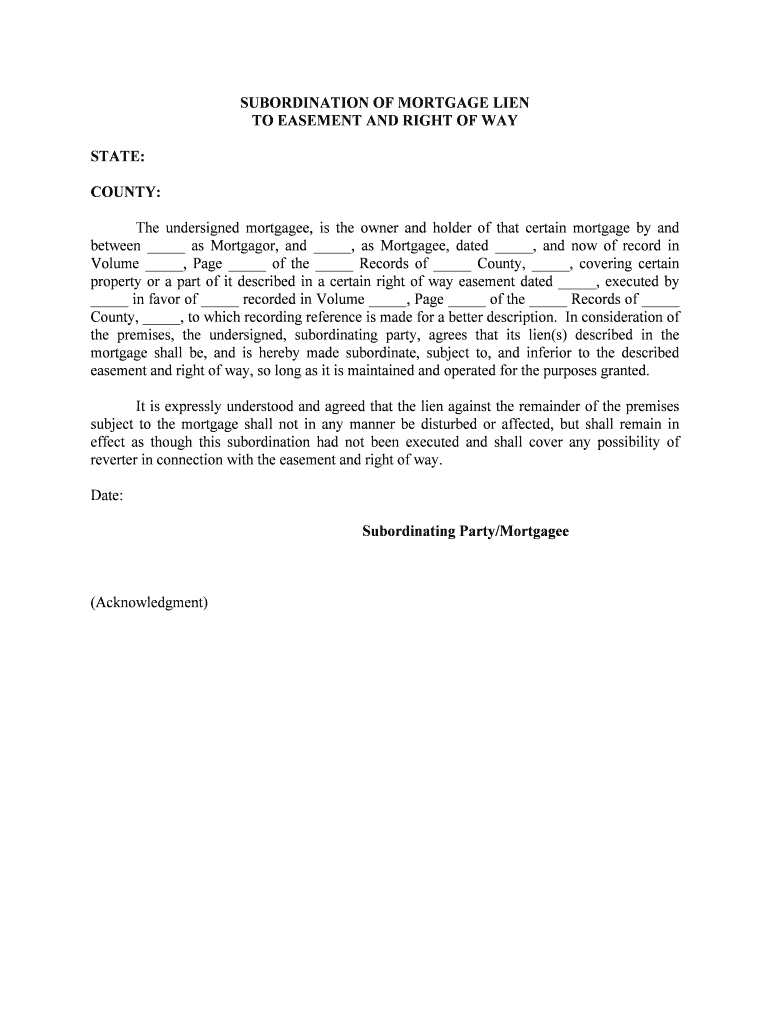

SUBORDINATION of MORTGAGE LIEN Form

What is the subordination of mortgage lien

The subordination of mortgage lien refers to the legal process that allows a secondary mortgage to take priority over a primary mortgage. This often occurs when a homeowner wishes to refinance their primary mortgage or take out a home equity line of credit. By subordinating the mortgage lien, the lender of the secondary mortgage agrees to accept a lower priority in the event of foreclosure, meaning they will be paid after the primary mortgage lender. This process is crucial for homeowners seeking to access additional funds while maintaining their existing mortgage agreements.

How to use the subordination of mortgage lien

Using the subordination of mortgage lien involves several steps to ensure that all parties understand their rights and obligations. First, the homeowner must contact their primary mortgage lender to request subordination. The lender will review the request and may require specific documentation, such as proof of income or the reason for refinancing. Once approved, the homeowner will need to complete the appropriate subordination form, which outlines the terms of the agreement. After filling out the form, it must be signed by all parties involved and submitted to the relevant authorities for processing.

Steps to complete the subordination of mortgage lien

Completing the subordination of mortgage lien involves a series of systematic steps:

- Contact your primary mortgage lender to discuss the subordination process.

- Gather necessary documentation, including your current mortgage details and financial information.

- Obtain the subordination of mortgage lien form from your lender or legal advisor.

- Fill out the form accurately, ensuring all required information is included.

- Have all parties sign the completed form, which may include the primary lender and the secondary mortgage lender.

- Submit the signed form to the appropriate local or state authority for official processing.

Legal use of the subordination of mortgage lien

The legal use of the subordination of mortgage lien is governed by state laws and regulations. It is essential to ensure compliance with these laws to avoid potential legal issues. The subordination agreement must be clearly documented and signed by all parties involved. Additionally, it is advisable to consult with a legal professional to understand the implications of the subordination and ensure that all legal requirements are met. This helps protect the rights of all parties and ensures the enforceability of the agreement in the event of a dispute.

Key elements of the subordination of mortgage lien

Key elements of the subordination of mortgage lien include:

- Priority of Claims: Defines the order in which lenders will be paid in case of foreclosure.

- Terms of Agreement: Specifies the conditions under which the subordination is granted.

- Signatures: Requires signatures from all involved parties, including lenders and borrowers.

- Legal Compliance: Must adhere to state-specific laws regarding mortgage subordination.

State-specific rules for the subordination of mortgage lien

State-specific rules for the subordination of mortgage lien can vary significantly. Each state may have different requirements regarding documentation, processing times, and legal obligations. For instance, some states may require additional disclosures or specific forms to be filed. It is crucial for homeowners to familiarize themselves with their state's regulations to ensure compliance and avoid delays in the subordination process. Consulting with a local real estate attorney or mortgage professional can provide valuable insights into these state-specific rules.

Quick guide on how to complete subordination of mortgage lien

Effortlessly prepare SUBORDINATION OF MORTGAGE LIEN on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage SUBORDINATION OF MORTGAGE LIEN on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Steps to modify and electronically sign SUBORDINATION OF MORTGAGE LIEN with ease

- Find SUBORDINATION OF MORTGAGE LIEN and select Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign SUBORDINATION OF MORTGAGE LIEN and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the subordination of mortgage lien and how does it work?

The subordination of mortgage lien is a legal process that allows a new mortgage to take priority over an existing lien. This can be essential for refinancing or securing additional funding on a property. By using airSlate SignNow, you can easily prepare and execute the documents necessary for this process, ensuring a smooth transition.

-

How does airSlate SignNow facilitate the subordination of mortgage lien?

airSlate SignNow provides a user-friendly platform that enables businesses to create, sign, and manage documents related to the subordination of mortgage lien efficiently. Our solution streamlines the entire process by allowing users to send documents for eSignature, track their status, and maintain compliance—all in one place.

-

Is there a cost associated with using airSlate SignNow for subordination of mortgage lien?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Our plans include various features for managing documents related to the subordination of mortgage lien, ensuring you get the best value for your investment. Consider trying our free trial to explore our offerings before committing.

-

What features does airSlate SignNow offer for managing document workflows?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking to effectively manage the subordination of mortgage lien documentation. These tools simplify the signing process and enhance productivity, allowing you to focus on closing deals rather than paperwork.

-

Can I integrate airSlate SignNow with other software for subordination of mortgage lien?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular software solutions, including CRM systems and accounting platforms. This ensures that the management of the subordination of mortgage lien documents fits smoothly into your existing workflows.

-

What are the benefits of using airSlate SignNow for subordination of mortgage lien?

Using airSlate SignNow for the subordination of mortgage lien offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents. Our platform not only simplifies the signing process but also provides a legally binding way to execute necessary documents.

-

How can I ensure compliance when handling subordination of mortgage lien documents?

airSlate SignNow is designed with compliance in mind, featuring advanced security measures and audit trails to ensure that all documents related to the subordination of mortgage lien are handled properly. You can easily track changes and maintain an accurate record of all actions taken on your documents.

Get more for SUBORDINATION OF MORTGAGE LIEN

- Contra costa temporary form

- Socoalert opt out request form emergency notifications

- California application paratransit form

- Returning ministry volunteer packet st nicholas greek form

- Indemnity waiver and release of liability form

- Working draftscript when talking with parentguardian regarding threat to student form

- Muni seniors form

- Professional services agreement 9 19 form

Find out other SUBORDINATION OF MORTGAGE LIEN

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer