140X Individual Amended Income Tax Return DO Azdor Gov Form

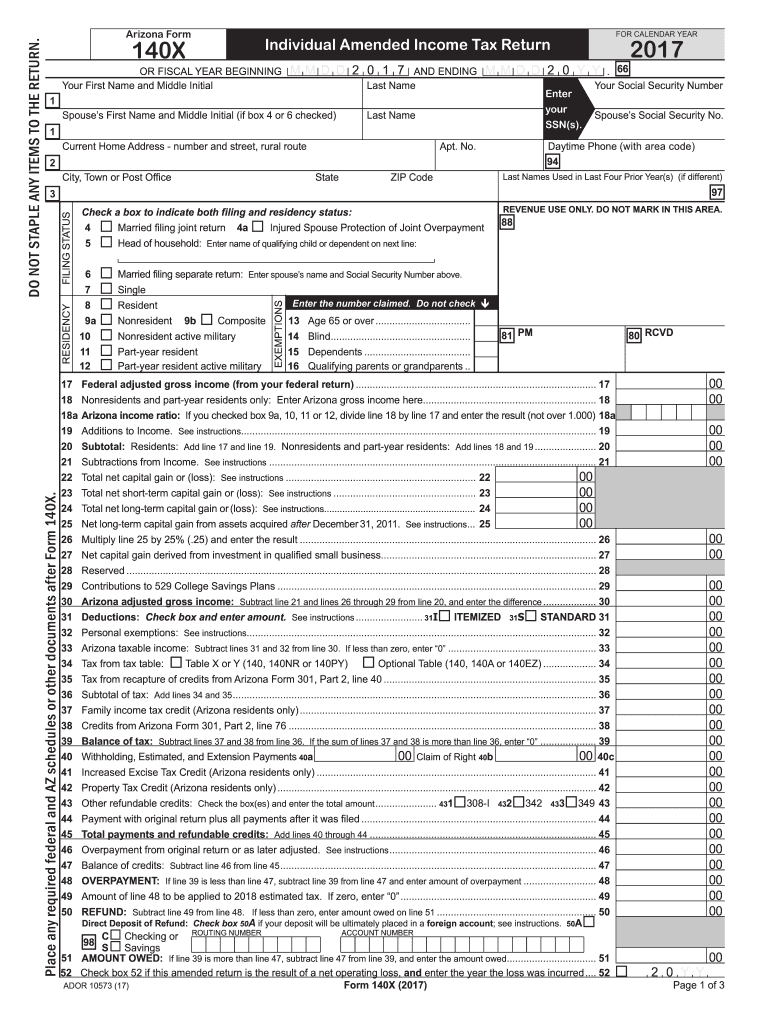

What is the 140X Individual Amended Income Tax Return?

The 140X Individual Amended Income Tax Return is a form used by Arizona taxpayers to amend their previously filed individual income tax returns. This form allows taxpayers to correct errors, claim additional deductions, or report changes in income. It is essential for ensuring that the tax records are accurate and up to date, which can affect tax liabilities and potential refunds.

Steps to Complete the 140X Individual Amended Income Tax Return

Completing the 140X form involves several key steps:

- Gather your original tax return and any supporting documents related to the changes you intend to make.

- Clearly indicate the changes on the 140X form, providing detailed explanations for each amendment.

- Calculate the new tax liability based on the amended information.

- Sign and date the form to validate your submission.

- Submit the completed form either online, by mail, or in person, depending on your preference.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 140X form. Generally, amended returns must be filed within three years from the original return's due date or within two years from the date the tax was paid, whichever is later. Missing these deadlines can result in the inability to claim refunds or make necessary corrections.

Required Documents for the 140X Form

When filing the 140X Individual Amended Income Tax Return, you will need several documents to support your amendments:

- Your original tax return.

- Any additional forms or schedules that relate to the changes being made.

- Documentation for any new deductions or credits you are claiming.

- Proof of payment for any additional tax owed.

Legal Use of the 140X Individual Amended Income Tax Return

The 140X form is legally recognized for amending tax returns in Arizona. To ensure that your amendments are accepted, it is important to follow the guidelines set forth by the Arizona Department of Revenue. This includes providing accurate information and submitting the form within the designated time frame. Failure to comply with these regulations may result in penalties or delays in processing your amended return.

Form Submission Methods

The 140X Individual Amended Income Tax Return can be submitted through various methods:

- Online submission via the Arizona Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Arizona Department of Revenue offices.

Quick guide on how to complete 140x individual amended income tax return 2017 do azdorgov

Effortlessly Prepare 140X Individual Amended Income Tax Return DO Azdor gov on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly and without interruptions. Handle 140X Individual Amended Income Tax Return DO Azdor gov on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign 140X Individual Amended Income Tax Return DO Azdor gov with Ease

- Find 140X Individual Amended Income Tax Return DO Azdor gov and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or obscure sensitive data with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional written signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would prefer to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Update and electronically sign 140X Individual Amended Income Tax Return DO Azdor gov while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the 140x individual amended income tax return 2017 do azdorgov

How to create an eSignature for your 140x Individual Amended Income Tax Return 2017 Do Azdorgov online

How to create an electronic signature for the 140x Individual Amended Income Tax Return 2017 Do Azdorgov in Chrome

How to make an eSignature for signing the 140x Individual Amended Income Tax Return 2017 Do Azdorgov in Gmail

How to make an electronic signature for the 140x Individual Amended Income Tax Return 2017 Do Azdorgov straight from your smart phone

How to make an eSignature for the 140x Individual Amended Income Tax Return 2017 Do Azdorgov on iOS devices

How to make an eSignature for the 140x Individual Amended Income Tax Return 2017 Do Azdorgov on Android devices

People also ask

-

What is the 140X Individual Amended Income Tax Return DO Azdor gov?

The 140X Individual Amended Income Tax Return DO Azdor gov is a specific form used in Arizona for filing an amended income tax return. This form allows taxpayers to correct errors or make changes to their originally filed individual income tax returns. Understanding how to complete this form correctly can help ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with the 140X Individual Amended Income Tax Return DO Azdor gov?

airSlate SignNow streamlines the process of completing and eSigning the 140X Individual Amended Income Tax Return DO Azdor gov. With our easy-to-use platform, you can quickly upload your documents, fill out the necessary information, and securely send them for eSignature. This saves time and reduces the hassle of paper-based processes.

-

Is there a cost associated with using airSlate SignNow for the 140X Individual Amended Income Tax Return DO Azdor gov?

Yes, while airSlate SignNow offers a free trial, there may be a subscription fee for ongoing use of its services. The pricing is competitive and designed to provide value for users needing to manage documents like the 140X Individual Amended Income Tax Return DO Azdor gov efficiently. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for the 140X Individual Amended Income Tax Return DO Azdor gov?

AirSlate SignNow offers a variety of features to assist with the 140X Individual Amended Income Tax Return DO Azdor gov, including customizable templates, secure eSignatures, and document tracking. These features ensure that your amended tax returns are completed accurately and submitted on time. Plus, the platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software for filing the 140X Individual Amended Income Tax Return DO Azdor gov?

Yes, airSlate SignNow offers integrations with a wide range of third-party applications, enabling users to work seamlessly across different platforms. Whether you use accounting software or document management tools, you can integrate them with airSlate SignNow to facilitate the completion of the 140X Individual Amended Income Tax Return DO Azdor gov.

-

What are the benefits of using airSlate SignNow for tax documents like the 140X Individual Amended Income Tax Return DO Azdor gov?

Using airSlate SignNow provides numerous benefits for filing tax documents, including increased efficiency, enhanced security, and reduced paper usage. By utilizing our eSignature capabilities, you can finalize documents quickly, ensuring that your 140X Individual Amended Income Tax Return DO Azdor gov is submitted on time and with minimal stress.

-

Is airSlate SignNow secure for handling sensitive tax forms like the 140X Individual Amended Income Tax Return DO Azdor gov?

Absolutely! AirSlate SignNow prioritizes security, utilizing encryption and secure cloud storage to protect your sensitive information, including the 140X Individual Amended Income Tax Return DO Azdor gov. Our platform complies with industry standards to ensure the confidentiality and integrity of your tax documents.

Get more for 140X Individual Amended Income Tax Return DO Azdor gov

Find out other 140X Individual Amended Income Tax Return DO Azdor gov

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online