Tax Transcript Form

What is the Tax Transcript

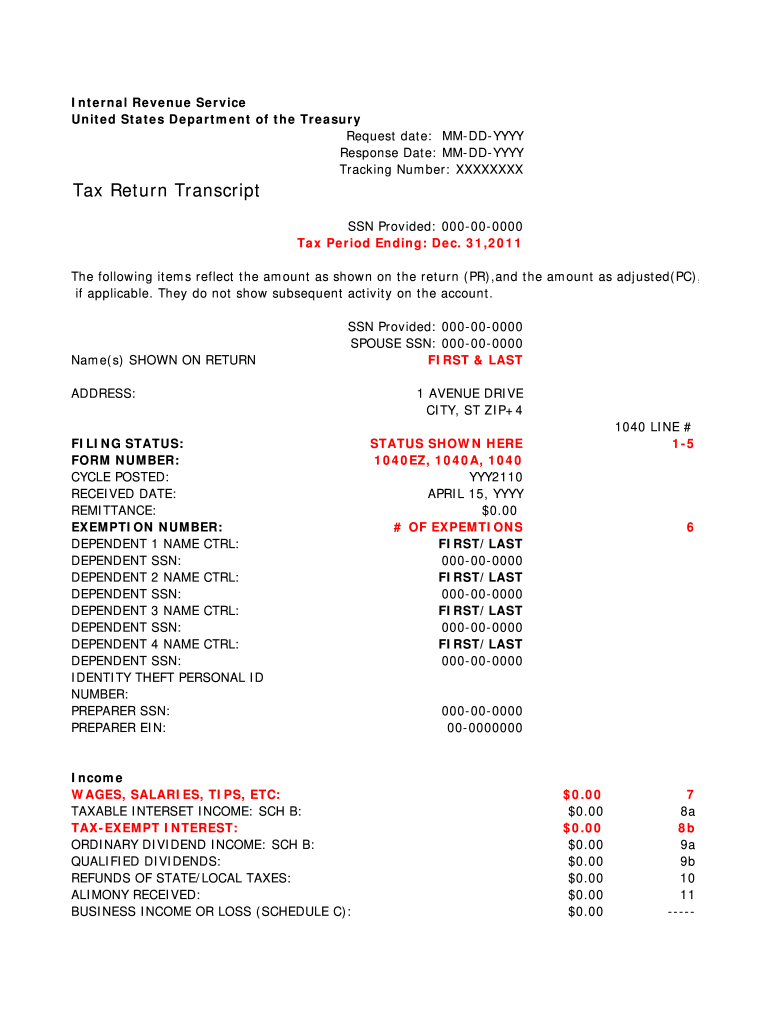

A tax transcript is an official document provided by the Internal Revenue Service (IRS) that summarizes your tax return information. It includes details such as your adjusted gross income (AGI), total payments, and any credits or deductions applied. The tax transcript can be used for various purposes, including verifying income for loan applications or financial aid. There are different types of transcripts, including the tax return transcript, which reflects the information from your filed tax return, and the account transcript, which shows your account status and any changes made.

How to Obtain the Tax Transcript

Obtaining a tax transcript is a straightforward process. You can request it online through the IRS website, by phone, or by mail. To request online, you need to create an account on the IRS website and follow the prompts to access your transcript. If you prefer to request by phone, you can call the IRS directly. For mail requests, you can fill out Form 4506-T and send it to the IRS. Keep in mind that it may take several days to receive your transcript by mail.

Key Elements of the Tax Transcript

Understanding the key elements of a tax transcript is essential for effectively using it. The transcript typically includes:

- Adjusted Gross Income (AGI): This is your total income minus specific deductions, which is crucial for determining your tax liability.

- Total Payments: This section shows the total amount of tax payments made, including withholding and estimated payments.

- Credits and Deductions: Any tax credits or deductions applied to your account will be listed here, impacting your overall tax obligation.

- Filing Status: This indicates whether you filed as single, married filing jointly, or another status.

Steps to Complete the Tax Transcript

Completing a tax transcript involves a few key steps to ensure accuracy. First, gather necessary personal information, such as your Social Security number and filing status. Next, decide how you want to obtain the transcript—online, by phone, or by mail. If you choose the online method, visit the IRS website and follow the instructions to access your account. If requesting by mail, fill out Form 4506-T completely and accurately to avoid delays. Finally, submit your request and wait for the IRS to process it, which may take a few days.

Legal Use of the Tax Transcript

The tax transcript serves various legal purposes, particularly in verifying income. Financial institutions often require a tax transcript when you apply for loans or mortgages, as it provides a reliable source of your financial history. Additionally, tax transcripts can be used in legal proceedings to demonstrate income or tax compliance. It is important to ensure that the information on the transcript is accurate, as discrepancies can lead to complications in legal or financial matters.

IRS Guidelines

The IRS has established guidelines for obtaining and using tax transcripts. It is recommended to keep your personal information secure when requesting a transcript, especially online. The IRS advises against sharing your transcript with unauthorized individuals, as it contains sensitive information. Additionally, if you notice any discrepancies on your transcript, it is crucial to address them promptly by contacting the IRS. Following these guidelines can help ensure that your tax information remains protected and accurate.

Quick guide on how to complete tax transcript form

Complete Tax Transcript easily on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Transcript on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and electronically sign Tax Transcript without hassle

- Locate Tax Transcript and click on Get Form to initiate the process.

- Utilize the tools provided to fill out your form.

- Underline important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Tax Transcript and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How can I get into an American university if I am an American citizen who graduated from high school in a 3rd world country?

First, for all US colleges, the magic phrase is “You are an US citizen”. Therefore, you will follow the application guidelines for an US citizen. However, as others have noted, if English is not your customary language, you should take the TOEFL exam along with either the SAT or the ACT in order to meet the many requirements for US colleges.Unfortunately, you will not be “in-state” for any of the state’s Public universities, unless your parents currently reside in that state.Where you may have some difficulties is applying for financial aid, if you need some. You will be able to apply as an US citizen, but you may get caught in a “Catch-22” if you or your parents have not been filing US income tax forms each year. If your parents are not US citizens than that will complicate the application for financial aid as well. Most likely you will fill out the PROFILE forms and then you will check to see if you are eligible (with your parents) to fill out the FAFSA forms to apply for student aid from the US government (PROFILE is used for student aid from a Private university).The other problem you may encounter is having your guidance counselor submit your official transcript (in English) to the colleges along with a cover letter of recommendation. If your school is not used to students applying to US universities, then you will need to start Early to get them on the same “application wavelength” as you will have to be for the US universities.Start early. Read everything on the colleges’ application web sites, and e-mail questions to the colleges.All the best.

-

How can I get my Tax Return Transcript?

Go to Internal Revenue Service and select the option to get your transcript. The system will ask you some questions that only you will know - a street you might have lived on the past, the amount of a car note you paying for a specific car ,etc. some of these questions might be trick questions and the correct answer is none of the above.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the tax transcript form

How to create an electronic signature for the Tax Transcript Form online

How to make an electronic signature for the Tax Transcript Form in Chrome

How to make an electronic signature for putting it on the Tax Transcript Form in Gmail

How to make an electronic signature for the Tax Transcript Form from your smart phone

How to create an eSignature for the Tax Transcript Form on iOS

How to create an eSignature for the Tax Transcript Form on Android OS

People also ask

-

What is a Tax Transcript and why do I need one?

A Tax Transcript is an official document from the IRS that summarizes your tax return information. It's often required for verifying income when applying for loans, financial aid, or other financial services. Using airSlate SignNow, you can easily send and eSign requests for your Tax Transcript, streamlining the process.

-

How can airSlate SignNow help me obtain my Tax Transcript?

With airSlate SignNow, you can create and send secure requests for your Tax Transcript directly to the IRS. Our platform allows you to eSign the necessary forms quickly, ensuring you receive your transcript without unnecessary delays. This simplifies the documentation process for financial institutions and other entities.

-

Is there a cost associated with obtaining a Tax Transcript through airSlate SignNow?

Obtaining a Tax Transcript itself is free from the IRS, but using airSlate SignNow for document management may incur a subscription fee. Our platform provides a cost-effective solution for managing and eSigning all your documents, including Tax Transcript requests, ensuring you get the most value for your money.

-

What features does airSlate SignNow offer for Tax Transcript management?

airSlate SignNow offers features such as secure eSigning, document tracking, and template creation for Tax Transcript requests. These tools enhance your ability to manage tax-related documents efficiently and securely, making it easier to stay organized during tax season.

-

Can I integrate airSlate SignNow with other applications for Tax Transcript management?

Yes, airSlate SignNow integrates seamlessly with various applications, including cloud storage and accounting software, to facilitate Tax Transcript management. This allows you to streamline your workflow and access your documents from multiple platforms, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for my Tax Transcript requests?

Using airSlate SignNow for Tax Transcript requests ensures a fast, efficient, and secure process. You can easily track the status of your requests and receive notifications, minimizing the risk of missing important deadlines. Plus, our user-friendly interface simplifies the eSigning process.

-

How secure is my information when using airSlate SignNow for Tax Transcript requests?

Security is a priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your information when submitting requests for your Tax Transcript. This ensures your personal and financial information remains confidential and secure throughout the process.

Get more for Tax Transcript

- Answer and counterclaim to motion for modification form

- Answer to counterclaim for citation for contempt form

- File a counterclaim in the probate and family courtmassgov form

- This cause came on for hearing this day during vacation of this court before the form

- Answer to counterclaim for divorce form

- In the chancery court of the first judicial district of hinds form

- Rule 52 findings by the court miss r civ p 52casetext form

- On appeal from the chancery court of rankin county form

Find out other Tax Transcript

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter