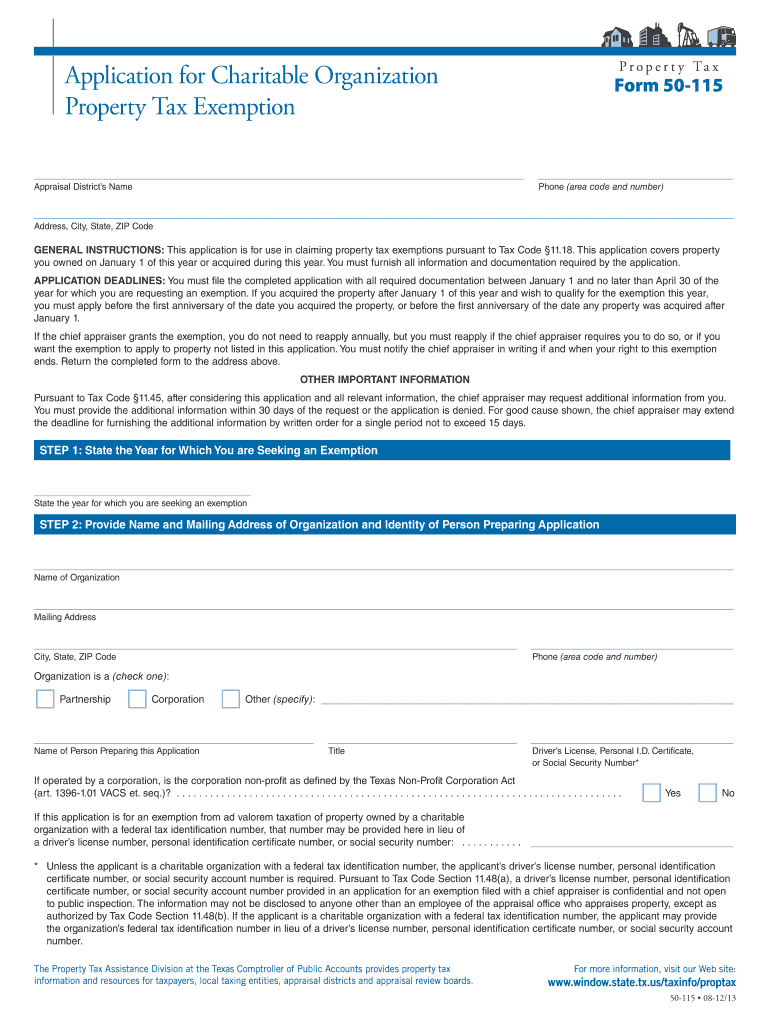

Application for Charitable Organization Property Tax Exemption Fillable Form

What is the exemption application form?

The exemption application form is a crucial document used by charitable organizations to request property tax exemptions. This form allows eligible entities to demonstrate their qualifications for tax relief based on their nonprofit status and the nature of their activities. By completing this form, organizations can potentially reduce their tax burden, enabling them to allocate more resources toward their charitable missions.

Eligibility criteria for the exemption application form

To qualify for property tax exemptions, organizations must meet specific eligibility criteria. Generally, these criteria include:

- Being a recognized nonprofit organization under state or federal law.

- Operating primarily for charitable, religious, educational, or scientific purposes.

- Using the property exclusively for exempt purposes.

- Providing documentation to support the claim for exemption.

Each state may have additional requirements, so it is essential for organizations to review local regulations before applying.

Steps to complete the exemption application form

Completing the exemption application form involves several key steps to ensure accuracy and compliance:

- Gather required documentation, including proof of nonprofit status and financial statements.

- Fill out the exemption application form accurately, providing all requested information.

- Review the form for completeness and accuracy before submission.

- Submit the form by the designated deadline, either online or via mail, depending on state requirements.

Following these steps can help streamline the application process and improve the chances of approval.

Required documents for the exemption application form

When submitting the exemption application form, organizations typically need to provide various supporting documents, which may include:

- Proof of nonprofit status (e.g., IRS determination letter).

- Bylaws and articles of incorporation.

- Financial statements or budgets demonstrating the organization's activities.

- Evidence of property use, such as lease agreements or property deeds.

Having these documents ready can facilitate a smoother application process and help substantiate the request for exemption.

Legal use of the exemption application form

The exemption application form must be used in accordance with state and federal laws governing property tax exemptions. This includes ensuring that the information provided is truthful and accurate. Misrepresentation or failure to comply with legal requirements can result in penalties or denial of the exemption. Organizations should familiarize themselves with relevant laws and regulations to ensure proper use of the form.

Form submission methods

Organizations can typically submit the exemption application form through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s tax authority website.

- Mailing a physical copy of the completed form to the appropriate office.

- In-person submission at designated tax authority locations.

Understanding the available submission methods can help organizations choose the most efficient option for their needs.

Quick guide on how to complete application for charitable organization property tax exemption fillable form

Complete Application For Charitable Organization Property Tax Exemption Fillable Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Application For Charitable Organization Property Tax Exemption Fillable Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to edit and eSign Application For Charitable Organization Property Tax Exemption Fillable Form with ease

- Locate Application For Charitable Organization Property Tax Exemption Fillable Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form: by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Application For Charitable Organization Property Tax Exemption Fillable Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the application for charitable organization property tax exemption fillable form

How to create an eSignature for your Application For Charitable Organization Property Tax Exemption Fillable Form in the online mode

How to generate an eSignature for your Application For Charitable Organization Property Tax Exemption Fillable Form in Google Chrome

How to create an electronic signature for signing the Application For Charitable Organization Property Tax Exemption Fillable Form in Gmail

How to generate an electronic signature for the Application For Charitable Organization Property Tax Exemption Fillable Form from your smartphone

How to generate an eSignature for the Application For Charitable Organization Property Tax Exemption Fillable Form on iOS

How to make an eSignature for the Application For Charitable Organization Property Tax Exemption Fillable Form on Android

People also ask

-

What is the exemption application form provided by airSlate SignNow?

The exemption application form is a customizable template within airSlate SignNow that allows users to create, send, and eSign exemption requests effortlessly. This form streamlines the process by ensuring that all necessary information is captured efficiently, reducing delays in approvals.

-

How much does it cost to use the exemption application form feature?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including features for the exemption application form. Users can choose a plan that suits their budget, ensuring they get the most value from our easy-to-use platform.

-

Can I integrate the exemption application form with other software tools?

Yes, airSlate SignNow provides seamless integrations with a variety of third-party software, allowing you to connect the exemption application form with tools you already use. This enhances your workflow and ensures that all your documents are managed in one place.

-

What are the benefits of using the exemption application form with airSlate SignNow?

Using the exemption application form through airSlate SignNow enables faster processing times and ensures that your requests are organized and easily accessible. The platform’s features also enhance compliance and security, giving you peace of mind with every document you handle.

-

Is the exemption application form user-friendly for non-technical users?

Absolutely! The exemption application form in airSlate SignNow is designed with user experience in mind, making it simple for anyone to create and manage forms. No technical expertise is required, allowing all team members to participate in the signing process.

-

Can I track the status of my exemption application form submissions?

Yes, airSlate SignNow allows you to track the status of your exemption application form submissions in real-time. You'll receive notifications when forms are viewed and signed, keeping you informed throughout the entire process.

-

How secure is the exemption application form data?

The exemption application form data is protected with industry-leading security measures, including encryption and secure cloud storage. airSlate SignNow prioritizes the safety of your information, ensuring compliance with data protection regulations.

Get more for Application For Charitable Organization Property Tax Exemption Fillable Form

Find out other Application For Charitable Organization Property Tax Exemption Fillable Form

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free