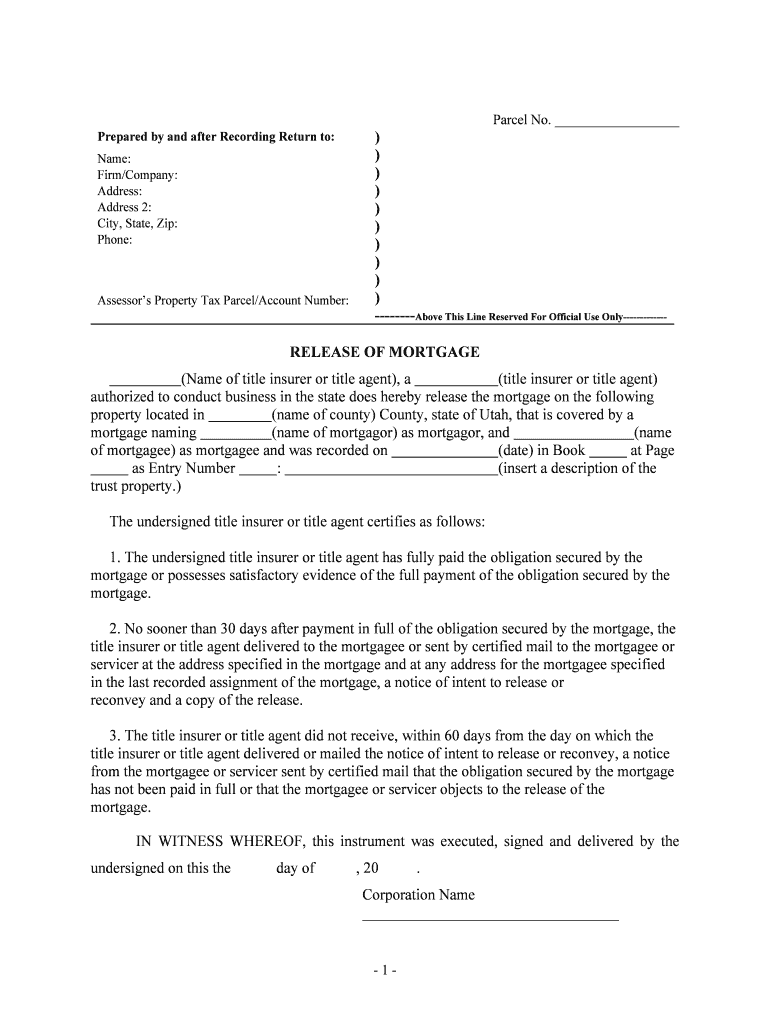

Title Insurer or Title Agent Form

What is the title insurer or title agent?

The title insurer or title agent plays a crucial role in real estate transactions. A title insurer provides insurance that protects against losses arising from defects in the title to real property. This can include issues such as outstanding liens, claims of ownership, or errors in public records. A title agent acts as an intermediary between the buyer, seller, and the title insurer, ensuring that all necessary documents are prepared and executed correctly. Understanding the distinctions between these roles is essential for anyone involved in buying or selling property.

How to use the title insurer or title agent

Using the title insurer or title agent involves several key steps. First, when entering a real estate transaction, you should engage a title agent early in the process. The agent will conduct a title search to identify any potential issues that may affect the property title. Once the search is complete, the title insurer will issue a title insurance policy, which protects the buyer and lender from future claims. It is essential to review the policy carefully and understand the coverage it provides. Throughout the transaction, the title agent will facilitate communication between all parties and ensure that all legal requirements are met.

Steps to complete the title insurer or title agent form

Completing the title insurer or title agent form involves a systematic approach to ensure accuracy and compliance. Start by gathering all necessary information, including property details, buyer and seller information, and any relevant financial documents. Next, fill out the form carefully, ensuring that all fields are completed accurately. Review the form for any errors or omissions before submitting it. Once completed, the form may need to be signed by all parties involved, and it should be submitted to the title insurer or agent for processing. Keeping a copy for your records is advisable.

Legal use of the title insurer or title agent

The legal use of the title insurer or title agent is governed by state laws and regulations. Title insurance is typically required by lenders to protect their investment in a property. The title agent must ensure that all documentation complies with local laws, including any disclosure requirements. Furthermore, the title insurer is responsible for issuing a policy that meets legal standards, providing protection against potential claims. Understanding these legal frameworks is essential for ensuring that the title process is conducted correctly and that all parties are protected.

Key elements of the title insurer or title agent

Several key elements define the role of the title insurer and title agent. These include conducting thorough title searches, issuing title insurance policies, and facilitating the closing process. Title searches involve examining public records to identify any issues affecting the property title. The title insurer provides financial protection against claims, while the title agent ensures that all documents are properly executed and filed. Additionally, both parties must maintain compliance with applicable laws and regulations to protect the interests of all stakeholders involved in the transaction.

State-specific rules for the title insurer or title agent

State-specific rules regarding title insurers and title agents can vary significantly. Each state has its own regulations governing the licensing of title agents and the requirements for title insurance. It is important for buyers and sellers to be aware of these regulations, as they can affect the title process. For instance, some states may require specific disclosures or have unique processes for handling title issues. Consulting with a knowledgeable title agent familiar with local laws can help ensure compliance and a smoother transaction.

Examples of using the title insurer or title agent

Examples of using the title insurer or title agent can be found in various real estate transactions. For instance, when purchasing a home, a buyer typically engages a title agent to conduct a title search and facilitate the closing process. The title insurer then issues a policy that protects the buyer and lender from any future claims against the title. In another scenario, a seller may need to resolve outstanding liens before transferring the property, and the title agent can assist in negotiating these issues. These examples highlight the importance of both roles in ensuring a successful real estate transaction.

Quick guide on how to complete title insurer or title agent

Effortlessly Prepare title Insurer Or Title Agent on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage title Insurer Or Title Agent on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Easily Modify and eSign title Insurer Or Title Agent

- Locate title Insurer Or Title Agent and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign title Insurer Or Title Agent and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the difference between a title insurer and a title agent?

A title insurer provides insurance to protect against losses related to title defects, while a title agent acts as an intermediary between the buyer and the title insurer, facilitating the transaction process. Understanding this distinction is crucial when choosing a professional for your real estate needs.

-

How can airSlate SignNow benefit a title insurer or title agent?

airSlate SignNow offers title insurers and title agents a streamlined solution for sending and signing documents electronically. This helps to enhance efficiency, reduce paperwork, and improve the overall client experience, making it a valuable tool for professionals in the title insurance industry.

-

What features should I look for in a title insurer or title agent?

When selecting a title insurer or title agent, look for features like comprehensive insurance coverage, experience in the local market, and excellent customer service. Additionally, consider whether they use modern technology tools, such as airSlate SignNow, to improve service delivery and document management.

-

Is airSlate SignNow affordable for title insurers and agents?

Yes, airSlate SignNow offers a cost-effective eSignature solution suitable for title insurers and title agents of all sizes. With flexible pricing plans, it can accommodate different budgets, helping professionals save time and reduce costs associated with traditional document signing methods.

-

Does airSlate SignNow integrate with other tools used by title insurers or agents?

Absolutely! airSlate SignNow provides seamless integrations with various software platforms commonly used by title insurers and title agents. This ensures that document management and signing processes can be easily incorporated into your existing workflows for maximum efficiency.

-

How can eSigning benefit title insurers or title agents?

eSigning allows title insurers and title agents to speed up transactions by eliminating the need for physical document exchanges. This not only accelerates closing times but also enhances the client experience by providing convenience and flexibility in the signing process.

-

What types of documents do title insurers or agents typically need to eSign?

Title insurers and title agents typically eSign documents such as title commitments, settlement statements, and closing disclosures. Utilizing eSigning with airSlate SignNow simplifies the process, ensuring secure and compliant handling of these important documents.

Get more for title Insurer Or Title Agent

- Drms healthful living student medical profile for form

- Drms healthful living student medical profile for pe wcpss form

- Sign your name on back of tickets form

- Easter letters to fill form

- Heat pump maintenance checklist pdf form

- Statement of qualifications adm 035a state of new jersey nj form

- Nj gambling self exclusion list form

- Nj self exclusion removal list form

Find out other title Insurer Or Title Agent

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document