Any Statutory Duty of My Personal Representative to Pay Debts Form

Understanding the Any Statutory Duty Of My Personal Representative To Pay Debts

The Any Statutory Duty Of My Personal Representative To Pay Debts form is a crucial document that outlines the responsibilities of a personal representative in settling the debts of a deceased individual. This form ensures that the personal representative, often an executor or administrator of an estate, is legally obligated to address outstanding debts before distributing assets to beneficiaries. Understanding this duty is essential for both the personal representative and the beneficiaries, as it clarifies financial responsibilities and the order in which debts must be paid.

Steps to Complete the Any Statutory Duty Of My Personal Representative To Pay Debts

Completing the Any Statutory Duty Of My Personal Representative To Pay Debts form involves several key steps. First, the personal representative should gather all relevant financial documents, including the deceased's debts, assets, and any existing estate plans. Next, the representative must accurately fill out the form, ensuring all required information is included. This may involve detailing the nature and amount of each debt, as well as providing information about the estate's assets. After completing the form, the personal representative should sign and date it, potentially in the presence of a notary, depending on state requirements.

Legal Use of the Any Statutory Duty Of My Personal Representative To Pay Debts

The legal use of the Any Statutory Duty Of My Personal Representative To Pay Debts form is vital in the probate process. This form serves as a formal declaration of the personal representative's commitment to fulfilling their obligations regarding the deceased's debts. By submitting this form, the representative gains legal authority to manage the estate's finances, including negotiating with creditors and making payments. Additionally, this form may be necessary for court proceedings, ensuring that the estate is administered in compliance with state laws.

Key Elements of the Any Statutory Duty Of My Personal Representative To Pay Debts

Several key elements define the Any Statutory Duty Of My Personal Representative To Pay Debts form. These include the identification of the personal representative, a detailed list of the deceased's debts, and an inventory of the estate's assets. The form should also outline the process for prioritizing debt repayment, which typically follows state laws regarding creditor claims. Furthermore, the personal representative may need to provide documentation supporting the debts listed, ensuring transparency and accountability throughout the estate administration process.

State-Specific Rules for the Any Statutory Duty Of My Personal Representative To Pay Debts

State-specific rules play a significant role in the use of the Any Statutory Duty Of My Personal Representative To Pay Debts form. Each state has its own probate laws that dictate how debts must be handled, including the order of payment and the time frame for settling claims. Personal representatives should familiarize themselves with these regulations to ensure compliance. This may involve consulting with an attorney or a probate specialist to navigate state-specific requirements effectively.

Examples of Using the Any Statutory Duty Of My Personal Representative To Pay Debts

Examples of using the Any Statutory Duty Of My Personal Representative To Pay Debts form can provide clarity on its application. For instance, if a deceased individual had outstanding credit card debts, the personal representative would list these debts on the form and outline the available estate assets to cover them. Another example could involve settling medical bills incurred before the individual's passing. By accurately documenting these debts, the personal representative can ensure that all financial obligations are met before distributing any remaining assets to heirs.

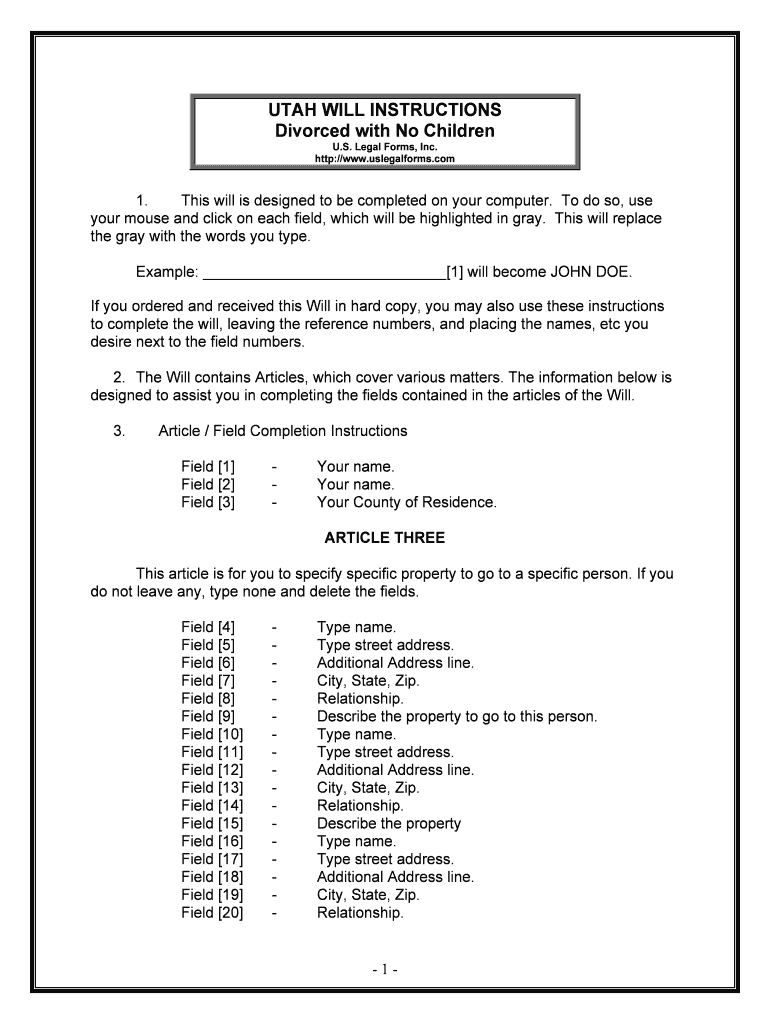

Quick guide on how to complete any statutory duty of my personal representative to pay debts

Prepare Any Statutory Duty Of My Personal Representative To Pay Debts effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork since you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Any Statutory Duty Of My Personal Representative To Pay Debts across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Any Statutory Duty Of My Personal Representative To Pay Debts effortlessly

- Obtain Any Statutory Duty Of My Personal Representative To Pay Debts and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form—by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and eSign Any Statutory Duty Of My Personal Representative To Pay Debts and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the statutory duty of a personal representative when it comes to paying debts?

Any statutory duty of my personal representative to pay debts requires them to settle outstanding obligations of the deceased using the estate's assets. This duty ensures that all valid claims against the estate are addressed before any distributions to heirs. It is crucial for personal representatives to understand their responsibilities in managing these debts.

-

How can airSlate SignNow help in managing estate documents?

Using airSlate SignNow, personal representatives can easily create, send, and eSign essential estate documents related to any statutory duty of my personal representative to pay debts. The platform streamlines document management and ensures all paperwork is legally binding and securely stored. This access to essential tools simplifies the administrative process involved in settling debts.

-

What features does airSlate SignNow offer for estate management?

airSlate SignNow offers various features like customizable templates, electronic signatures, and audit trails, all of which are vital for managing estate documents. These features are particularly relevant to the statutory duties of a personal representative in paying debts. They help ensure compliance and facilitate effective communication among all parties involved.

-

Is airSlate SignNow cost-effective for personal representatives managing estates?

Yes, airSlate SignNow provides a cost-effective solution for personal representatives managing estates. The pricing plans are designed to meet various needs, allowing users to choose one that fits their budget while fulfilling any statutory duty of my personal representative to pay debts. This affordability makes it an attractive option for both individuals and small businesses.

-

Can airSlate SignNow be integrated with other tools for managing estate tasks?

Absolutely! airSlate SignNow seamlessly integrates with various applications and tools to enhance your workflow. This functionality allows personal representatives to connect their existing software solutions, making it easier to uphold any statutory duty of my personal representative to pay debts without the need for redundant data entry.

-

How does airSlate SignNow ensure the security of estate documents?

Security is a priority for airSlate SignNow, which uses advanced encryption methods and secure cloud storage to protect all estate documents. Personal representatives can confidently manage sensitive information, knowing they can fulfill any statutory duty of my personal representative to pay debts while keeping data safe from unauthorized access.

-

What support options does airSlate SignNow offer to users?

airSlate SignNow provides robust customer support through various channels, including live chat, email, and comprehensive help documentation. This support is essential for personal representatives navigating their statutory duties regarding debt payments. Users can get quick assistance, ensuring smooth operation of their document management tasks.

Get more for Any Statutory Duty Of My Personal Representative To Pay Debts

- Printable 2020 arizona form 348 credit for contributions to certified school tuition organization individuals

- Printable 2020 arizona form 322 credit for contributions made or fees paid to public schools

- Printable 2020 arizona form 321 credit for contributions to qualifying charitable organizations

- Arizona form 339 credit for water conservation systems

- Form 911 request for taxpayer advocate service assistance contact us taxpayer advocate servicecontact us taxpayer advocate

- Rental verification form fill out and sign printable pdf

- Form 8867 paid preparers due diligence checklistsupportpreparer due diligenceearned income tax creditpreparer due

- Pdf form 540nr franchise tax board cagov

Find out other Any Statutory Duty Of My Personal Representative To Pay Debts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors