JUDGMENT CREDITORS ATTORNEY Form

Understanding the Judgment Creditors Attorney

A judgment creditors attorney specializes in representing clients who have obtained a court judgment against a debtor. This legal professional assists in the collection of debts owed as a result of a court ruling. Their role includes advising clients on the best course of action to enforce the judgment, which may involve garnishing wages, placing liens on property, or seizing assets. The attorney ensures that all actions taken comply with state and federal laws, protecting the rights of the creditor while navigating the complexities of debt recovery.

Steps to Complete the Judgment Creditors Attorney Form

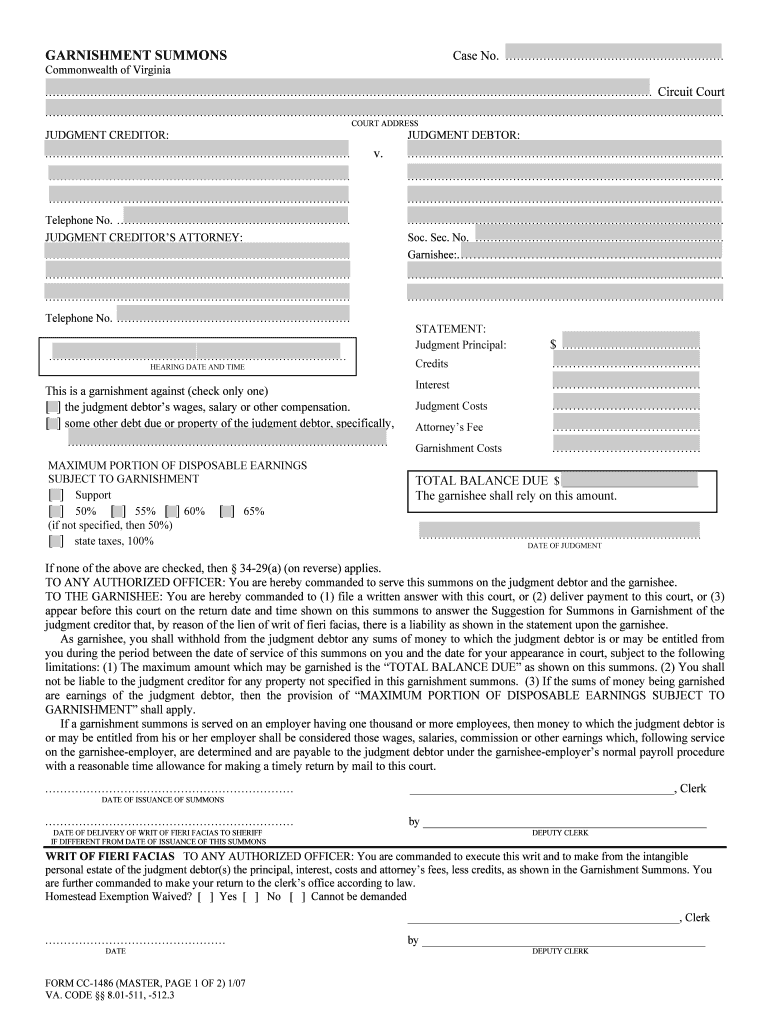

Completing the judgment creditors attorney form requires careful attention to detail to ensure its legal validity. Here are the steps to follow:

- Gather necessary information: Collect all pertinent details, including the debtor's name, address, and the specifics of the judgment.

- Fill out the form: Accurately enter the required information in the appropriate fields. Ensure clarity and correctness to avoid delays.

- Review for accuracy: Double-check all entries for any errors or omissions. This step is crucial to prevent complications during processing.

- Sign the form: Ensure that the form is signed in accordance with legal requirements. Digital signatures are acceptable if using an e-signature platform that complies with legal standards.

- Submit the form: Follow the specified submission methods, whether online, by mail, or in person, as appropriate for your jurisdiction.

Legal Use of the Judgment Creditors Attorney Form

The judgment creditors attorney form serves a critical legal function in the debt collection process. It is essential for enforcing a court judgment, allowing creditors to take legal action to recover owed amounts. The form must be executed in compliance with relevant laws, including the Fair Debt Collection Practices Act (FDCPA) and state-specific regulations. Proper use of the form helps ensure that the creditor's rights are protected while adhering to legal standards, minimizing the risk of disputes or legal challenges from the debtor.

Key Elements of the Judgment Creditors Attorney Form

Understanding the key elements of the judgment creditors attorney form is vital for effective completion and submission. The main components typically include:

- Creditor information: Details about the creditor, including name, address, and contact information.

- Debtor information: Information about the debtor, including name, address, and any known assets.

- Judgment details: Specifics of the court judgment, including the case number, date of judgment, and amount owed.

- Signature section: A designated area for the creditor's signature, which may require notarization depending on state laws.

State-Specific Rules for the Judgment Creditors Attorney Form

Each state in the U.S. has its own rules and regulations governing the use of the judgment creditors attorney form. These may include specific requirements for filing, deadlines for submission, and the need for additional documentation. It is important for creditors to familiarize themselves with their state's laws to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide guidance on navigating these state-specific requirements effectively.

Examples of Using the Judgment Creditors Attorney Form

There are various scenarios in which a judgment creditors attorney form may be utilized. Common examples include:

- Wage garnishment: When a creditor seeks to have a portion of the debtor's wages withheld to satisfy the judgment.

- Property liens: Placing a lien on the debtor's property to secure the debt, preventing the sale of the property without satisfying the judgment.

- Asset seizure: Taking possession of specific assets owned by the debtor as a means of debt recovery.

Quick guide on how to complete judgment creditors attorney

Complete JUDGMENT CREDITORS ATTORNEY effortlessly on any device

Digital document management has surged in popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and without any holdups. Manage JUDGMENT CREDITORS ATTORNEY across any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric workflow today.

How to edit and eSign JUDGMENT CREDITORS ATTORNEY with ease

- Locate JUDGMENT CREDITORS ATTORNEY and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign JUDGMENT CREDITORS ATTORNEY to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What services does a JUDGMENT CREDITORS ATTORNEY provide?

A JUDGMENT CREDITORS ATTORNEY specializes in assisting clients with the process of collecting debts from individuals or businesses that have failed to pay their obligations. They help negotiate settlements, file legal documents, and represent clients in court to secure judgments. Additionally, they advise on the best strategies to enforce a judgment effectively.

-

How much does hiring a JUDGMENT CREDITORS ATTORNEY typically cost?

The costs associated with hiring a JUDGMENT CREDITORS ATTORNEY can vary signNowly based on location, experience, and the complexity of the case. Many attorneys charge hourly rates, while others may work on a contingency fee basis, taking a percentage of the collected amount. It's essential to discuss fees upfront to avoid any surprises.

-

What are the benefits of hiring a JUDGMENT CREDITORS ATTORNEY?

Hiring a JUDGMENT CREDITORS ATTORNEY offers numerous benefits, including professional expertise in debt collection laws and procedures. They can efficiently navigate the legal system, increasing the likelihood of successfully securing payments. By working with an attorney, you can save time and reduce stress associated with debt recovery.

-

How can airSlate SignNow assist a JUDGMENT CREDITORS ATTORNEY?

airSlate SignNow provides a streamlined solution for a JUDGMENT CREDITORS ATTORNEY to electronically sign and manage legal documents efficiently. Our platform enhances productivity by enabling the quick and secure exchange of contracts and agreements. This functionality is crucial for attorneys aiming to streamline their workflow and improve communication with clients.

-

What features should I look for in a JUDGMENT CREDITORS ATTORNEY?

When selecting a JUDGMENT CREDITORS ATTORNEY, look for expertise in debt recovery, excellent negotiation skills, and a solid reputation in your jurisdiction. Their experience with similar cases is also essential, as it directly impacts the outcomes. Additionally, consider their communication style and willingness to provide regular updates about your case.

-

Are there any additional costs associated with hiring a JUDGMENT CREDITORS ATTORNEY?

Yes, in addition to attorney fees, hiring a JUDGMENT CREDITORS ATTORNEY may involve court filing fees, costs for service of process, and expenses related to pursuing judgments. These costs can add up, so make sure to discuss all potential expenses during your initial consultation. Understanding these details will help you budget accordingly.

-

How do I know if I need a JUDGMENT CREDITORS ATTORNEY?

If you are having difficulty collecting a debt that has already been legally established, hiring a JUDGMENT CREDITORS ATTORNEY is advisable. They can provide guidance on whether further legal action is necessary and the best approach for your situation. Seeking professional help can signNowly increase your chances of successful recovery.

Get more for JUDGMENT CREDITORS ATTORNEY

Find out other JUDGMENT CREDITORS ATTORNEY

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form