RESPONDENT'S REQUEST for INCOME DEDUCTION ORDER Case No Form

What is the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No

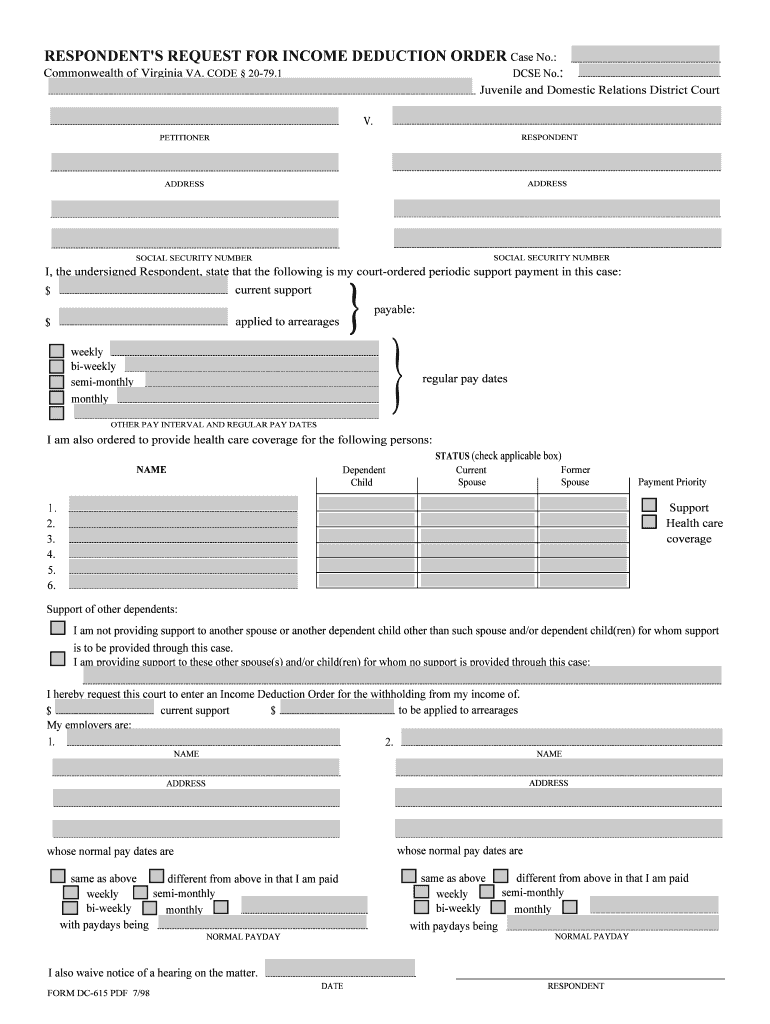

The RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No is a legal document used in family law cases, particularly in situations involving child support or spousal support. This form is designed to request the court to issue an order for income deduction from the respondent's wages to ensure timely and consistent payment of support obligations. It serves to streamline the payment process and provide a reliable method for fulfilling financial responsibilities mandated by the court.

Steps to complete the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No

Completing the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No involves several key steps:

- Gather necessary information, including case details, parties involved, and financial information.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the document for any errors or omissions before submission.

- Sign the form to validate the request, which may require notarization depending on state laws.

- Submit the completed form to the appropriate court or agency handling the case.

Legal use of the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No

This form is legally binding once it is filed with the court and an order is issued. It is important to ensure that the request complies with state laws and regulations governing income deductions. The court must review and approve the request, after which the employer is legally obligated to comply with the income deduction order. This legal framework protects the rights of both the payee and the payer, ensuring that financial obligations are met consistently.

Required Documents

When submitting the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No, it is essential to include supporting documents, which may vary by jurisdiction. Typically, these documents include:

- Proof of income for the respondent, such as pay stubs or tax returns.

- Existing court orders related to child support or spousal support.

- Any relevant financial statements or affidavits.

Form Submission Methods (Online / Mail / In-Person)

The RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No can typically be submitted through various methods, depending on the court's requirements:

- Online submission via the court's electronic filing system, if available.

- Mailing the completed form to the appropriate court address.

- Delivering the form in person to the court clerk's office.

Eligibility Criteria

To file the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No, certain eligibility criteria must be met. Generally, the requester must:

- Be a party involved in a support case, such as a custodial parent or spouse.

- Have a valid court order for child support or spousal support in place.

- Provide evidence that the respondent has a source of income that can be deducted.

Quick guide on how to complete respondents request for income deduction order case no

Easily Prepare RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and store it securely online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and Electronically Sign RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No Effortlessly

- Locate RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal significance as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No.?

A RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. is a legal document submitted by a respondent in a child support case, requesting a specific income deduction order. It typically outlines the respondent's income details and may include their request for adjustments based on their financial situation.

-

How can airSlate SignNow help with the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No.?

airSlate SignNow streamlines the process of creating and signing the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. by providing easy-to-use templates and electronic signatures. Our platform ensures that all documents are securely stored and easily accessible, enhancing the efficiency of legal processes.

-

What features does airSlate SignNow offer for managing RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No.?

With airSlate SignNow, users can take advantage of features such as automated document creation, customizable templates, and secure eSignatures for the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. This helps reduce errors and speeds up the filing process while keeping all parties informed and engaged.

-

Is there a cost associated with using airSlate SignNow for legal documents like the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No.?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including plans specifically designed for legal professionals managing documents like the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. By choosing the appropriate plan, users can benefit from a cost-effective solution for their document management.

-

Are there any integrations available with airSlate SignNow when working with RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No.?

Absolutely! airSlate SignNow offers integrations with numerous applications and platforms, allowing seamless collaboration when handling the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. This means you can connect your existing software solutions to enhance productivity and data management.

-

How secure is airSlate SignNow for handling sensitive documents like the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No.?

Security is a top priority for airSlate SignNow. We utilize bank-grade encryption for all documents, including the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No., ensuring that sensitive information protects against unauthorized access while in transit and at rest.

-

Can multiple parties sign the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to securely sign the RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No. This feature facilitates collaboration and approval processes, making it easy for all relevant stakeholders to participate in the signing and review stages.

Get more for RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No

Find out other RESPONDENT'S REQUEST FOR INCOME DEDUCTION ORDER Case No

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document