ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca Form

What is the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca

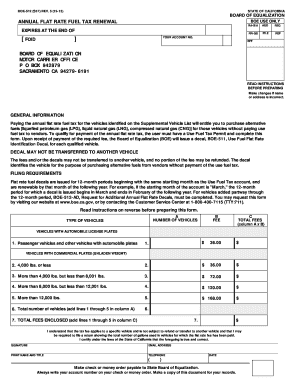

The ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca is a form used primarily by businesses in California to report and renew their fuel tax obligations. This form is essential for entities that operate vehicles or equipment using fuel, as it helps ensure compliance with state tax regulations. The flat rate structure simplifies the tax calculation process, allowing businesses to pay a predetermined amount based on their fuel usage rather than tracking actual consumption. This form is particularly relevant for companies involved in transportation, construction, and other industries reliant on fuel.

Steps to complete the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca

Completing the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca involves several key steps:

- Gather Required Information: Collect all necessary details regarding your fuel usage, including vehicle identification numbers and estimated fuel consumption for the year.

- Access the Form: Obtain the latest version of the BOE 512 form from the official California Department of Tax and Fee Administration website or through authorized channels.

- Fill Out the Form: Carefully enter the required information, ensuring accuracy to avoid potential penalties. Include your business details and any relevant tax identification numbers.

- Review and Verify: Double-check all entries for correctness, as errors can lead to delays or compliance issues.

- Submit the Form: Follow the submission guidelines, which may include online submission, mailing the form, or delivering it in person to the appropriate office.

Legal use of the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca

The legal use of the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca is governed by California state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated deadlines. Compliance with the legal requirements surrounding this form helps prevent penalties and ensures that businesses remain in good standing with tax authorities. It is advisable to maintain copies of submitted forms and any correspondence related to fuel tax obligations for record-keeping and potential audits.

How to obtain the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca

Obtaining the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca is straightforward. Businesses can access the form through the California Department of Tax and Fee Administration's official website. The form is typically available in a downloadable PDF format, which can be printed and filled out manually or completed electronically if the option is provided. Additionally, businesses may contact their local tax office for assistance in acquiring the form or for any specific inquiries related to their fuel tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca are crucial for compliance. Typically, the form must be submitted annually by a specified date, often aligned with the end of the fiscal year. Businesses should mark their calendars for these deadlines to avoid late fees or penalties. It is advisable to check the California Department of Tax and Fee Administration's website for the most current deadlines and any changes to the filing schedule.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action from tax authorities. To mitigate these risks, it is essential to file the form accurately and on time. Understanding the specific penalties associated with non-compliance can help businesses prioritize their tax responsibilities and maintain their operational integrity.

Quick guide on how to complete annual flat rate fuel tax renewal boe 512 boe ca

Complete ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca seamlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca with ease

- Locate ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca and then click Get Form to begin.

- Utilize the available tools to complete your document.

- Highlight essential sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.?

The ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca. is a tax form used by businesses in California to report annual fuel taxes. It's essential for those who want to maintain compliance with state regulations while taking advantage of applicable tax benefits.

-

How does airSlate SignNow facilitate the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca. process?

airSlate SignNow streamlines the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca. process by providing an easy-to-use platform for eSigning and managing documents. This ensures your tax forms are completed quickly and securely, saving time for other important tasks.

-

What are the pricing options for using airSlate SignNow with the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.?

AirSlate SignNow offers flexible pricing plans tailored for businesses of all sizes, making it affordable to handle the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca. The plan you choose will cover all necessary features to simplify your documentation needs.

-

What features does airSlate SignNow offer to support the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.?

Key features of airSlate SignNow include customizable templates, automated workflows, and advanced security measures. These features ensure that your ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca. documents are handled efficiently and securely.

-

How can I ensure compliance while completing the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.?

Using airSlate SignNow helps ensure compliance by providing timestamped eSignatures, audit trails, and secure storage for your documents. This way, you can easily demonstrate proper completion of the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.

-

Can airSlate SignNow integrate with other tools I use for tax management?

Yes, airSlate SignNow offers integrations with various tax management and accounting software. This compatibility can enhance your overall workflow, especially when dealing with documents like the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.

-

What benefits does eSigning provide for the ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca.?

eSigning with airSlate SignNow provides speed, convenience, and security for your ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca. documents. It eliminates the hassle of printing and scanning while ensuring that your signed documents are legally binding.

Get more for ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca

- Dmv insurance services bureau form

- Free wisconsin residential lease agreement with option to form

- Var form 300 rental application final

- Please fill in all information completely docplayernet

- Free virginia lease agreementsresidential ampampamp commercial form

- Assessors office forms city and county of denver

- Fillable online nccde small estate affidavit mail in form

- Small estate affidavit mail in request form

Find out other ANNUAL FLAT RATE FUEL TAX RENEWAL BOE 512 Boe Ca

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking