Probate Accounting Form

What is the Probate Accounting Form

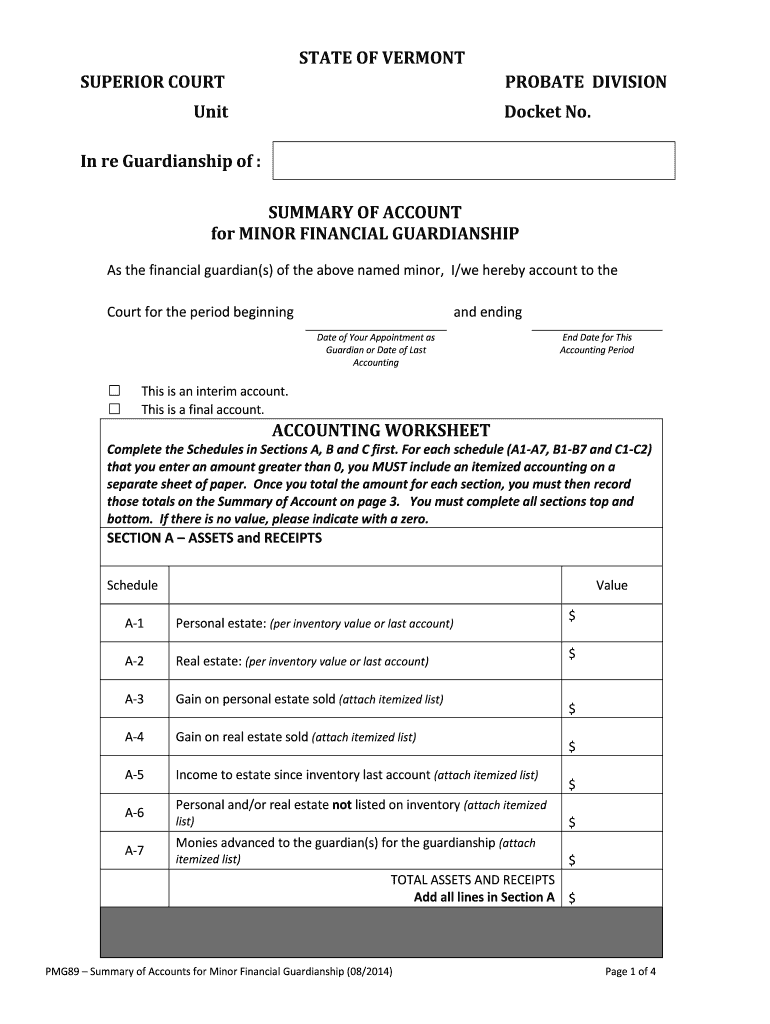

The Probate Accounting Form is a legal document used in the probate process to report the financial activities of an estate. This form provides a detailed account of the assets, liabilities, income, and expenses associated with the estate of a deceased individual. It is essential for ensuring transparency and accountability in the management of the estate, allowing beneficiaries and the court to review the financial status and distribution of assets. The form typically includes sections for listing all assets, debts, and any transactions that occurred during the administration of the estate.

How to use the Probate Accounting Form

Using the Probate Accounting Form involves several key steps. First, gather all necessary financial information related to the estate, including bank statements, property deeds, and records of debts. Next, accurately fill out each section of the form, ensuring that all figures are correct and supported by documentation. Once completed, the form should be submitted to the probate court along with any required supporting documents. It is advisable to retain copies of the submitted form for personal records. If there are multiple beneficiaries, consider sharing the completed form with them to maintain transparency.

Steps to complete the Probate Accounting Form

Completing the Probate Accounting Form requires careful attention to detail. Follow these steps for a thorough submission:

- Gather all financial documents related to the estate.

- Begin with the asset section, listing all properties, bank accounts, and investments.

- Document any debts or liabilities, such as mortgages or outstanding bills.

- Include income generated by the estate, such as rental income or dividends.

- Record all expenses incurred during the probate process, including legal fees and taxes.

- Review the form for accuracy and completeness before submission.

Legal use of the Probate Accounting Form

The Probate Accounting Form serves a critical legal function in the probate process. It must be completed accurately to comply with state laws governing estate administration. Courts require this form to ensure that the executor or administrator of the estate has managed the assets responsibly and in accordance with legal obligations. Failure to provide a complete and accurate accounting can lead to legal repercussions, including potential penalties or challenges from beneficiaries.

Key elements of the Probate Accounting Form

Several key elements are essential to include in the Probate Accounting Form:

- Asset Inventory: A comprehensive list of all estate assets, including real estate, personal property, and financial accounts.

- Liabilities: A detailed account of all debts owed by the estate, including loans and unpaid bills.

- Income: Documentation of any income generated by the estate during the probate process.

- Expenses: A record of all expenses incurred while managing the estate, such as legal fees and maintenance costs.

- Distribution of Assets: Information on how and when assets will be distributed to beneficiaries.

Required Documents

To complete the Probate Accounting Form, several documents are typically required. These may include:

- Death certificate of the deceased.

- Will or trust documents, if applicable.

- Financial statements for all estate accounts.

- Records of any debts and liabilities.

- Receipts for expenses incurred during the probate process.

Quick guide on how to complete probate accounting form

Complete Probate Accounting Form effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Probate Accounting Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to edit and eSign Probate Accounting Form easily

- Obtain Probate Accounting Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device of your choice. Modify and eSign Probate Accounting Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Probate Accounting Form?

A Probate Accounting Form is a legal document used to summarize the financial activities of an estate during the probate process. It helps beneficiaries understand how assets were administered and distributed. Using airSlate SignNow, you can easily create and eSign this form to ensure compliance with legal requirements.

-

How can airSlate SignNow help with Probate Accounting Forms?

airSlate SignNow streamlines the creation, signing, and management of Probate Accounting Forms. With our user-friendly platform, you can provide clear summaries of estate finances while ensuring secure eSignatures from all parties. This eliminates paperwork hassle and maintains legal validity.

-

What features does airSlate SignNow offer for managing Probate Accounting Forms?

airSlate SignNow includes features such as customizable templates, multi-user collaboration, and automated reminder notifications for eSignatures. These features enhance your efficiency in managing Probate Accounting Forms, ensuring quicker turnaround times and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Probate Accounting Forms?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, making it cost-effective for managing Probate Accounting Forms. You can select a plan that fits your organization’s size and volume of documents, ensuring you only pay for what you use.

-

Can I integrate airSlate SignNow with other applications for Probate Accounting Forms?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of applications, including Google Drive, Dropbox, and other document management systems. This allows you to easily access and share your Probate Accounting Forms across platforms, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for Probate Accounting Forms?

Using airSlate SignNow for your Probate Accounting Forms offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that changes and updates are easily tracked, and eSignatures are legally binding, providing peace of mind during the probate process.

-

Is airSlate SignNow user-friendly for creating Probate Accounting Forms?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows anyone, regardless of technical skills, to create and manage Probate Accounting Forms effortlessly. You can navigate through the features without complications, saving time and reducing frustration.

Get more for Probate Accounting Form

- Application for michigan notary public commission state of michigan form

- Release of info authorization 04 18docx form

- Can form mv 104 be faxed or e mailed

- Chcp waiver amendment cost effectiveness approved chcp waiver amendment cost effectiveness approved form

- Income verification form michigan

- Fillable income verification form

- Fillable online mi occupational license application level 1 form

- Renewal state of michigan form

Find out other Probate Accounting Form

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed