FORM 139G

What is the FORM 139G

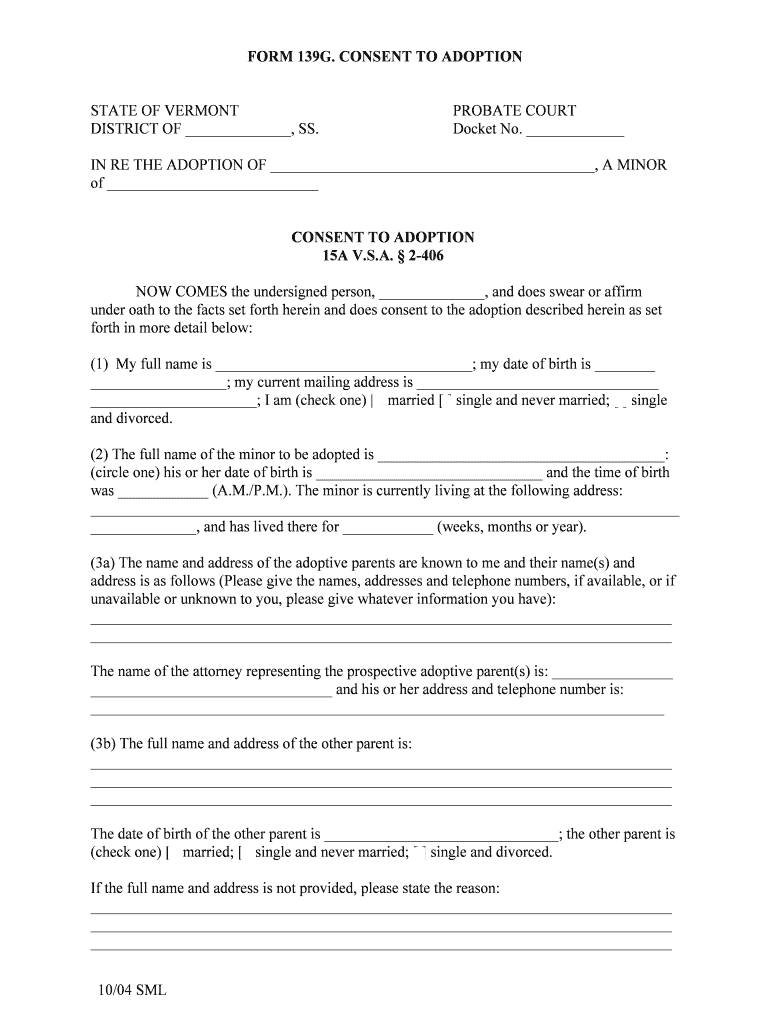

The FORM 139G is a specific document used primarily for tax-related purposes in the United States. It is designed to assist individuals and businesses in reporting certain financial information to the Internal Revenue Service (IRS). The form serves as a declaration of eligibility for specific tax benefits or deductions, often related to business expenses or credits. Understanding the purpose and requirements of FORM 139G is essential for ensuring compliance with tax regulations and maximizing potential tax advantages.

How to use the FORM 139G

Using the FORM 139G involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that support the information you will report on the form. This may include income statements, receipts for expenses, and any relevant tax documentation. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submitting it to the IRS. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Steps to complete the FORM 139G

Completing the FORM 139G can be streamlined by following a series of organized steps:

- Gather necessary documentation, including income and expense records.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check all entries for accuracy, particularly numerical figures.

- Sign and date the form where indicated to validate your submission.

- Submit the completed form to the appropriate IRS office, either online or by mail.

Legal use of the FORM 139G

The legal use of FORM 139G is governed by IRS regulations, which dictate how the form should be completed and submitted. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal repercussions. The form is recognized as a legitimate document for tax reporting purposes, and its proper use can help individuals and businesses comply with federal tax laws. Familiarizing oneself with the legal implications of the form is essential for maintaining compliance and avoiding issues with the IRS.

Required Documents

When preparing to complete the FORM 139G, specific documents are required to substantiate the information reported. These documents may include:

- Income statements, such as W-2s or 1099s.

- Receipts for business-related expenses.

- Previous tax returns for reference.

- Any correspondence from the IRS related to prior filings.

Having these documents readily available can facilitate a smoother completion process and ensure that all claims made on the form are well-supported.

Form Submission Methods

There are several methods available for submitting the FORM 139G to the IRS. These include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing the completed form to the appropriate IRS address, ensuring it is sent via a secure method.

- In-person submission at designated IRS offices, which may require an appointment.

Choosing the right submission method can depend on individual preferences and circumstances, such as the urgency of filing or access to technology.

Quick guide on how to complete form 139g

Complete FORM 139G seamlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage FORM 139G across any platform using airSlate SignNow Android or iOS applications and enhance your document-focused operations today.

How to modify and eSign FORM 139G effortlessly

- Locate FORM 139G and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign FORM 139G while ensuring exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is FORM 139G and how can airSlate SignNow help?

FORM 139G is a document frequently used in various business processes. airSlate SignNow allows users to easily send and eSign FORM 139G, streamlining the signing process and ensuring compliance with legal requirements.

-

What features does airSlate SignNow offer for managing FORM 139G?

airSlate SignNow provides several features tailored for managing FORM 139G, including customizable templates, live tracking of document status, and secure storage options. These features help businesses efficiently handle their paperwork while ensuring that all necessary steps are followed.

-

Is there a cost associated with using airSlate SignNow for FORM 139G?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when using FORM 139G. Pricing is competitive and allows users to choose a plan that fits their budget while still accessing premium features.

-

How can I integrate FORM 139G with other tools using airSlate SignNow?

airSlate SignNow supports integrations with numerous third-party applications, allowing users to seamlessly incorporate FORM 139G into their existing workflows. This versatility ensures that teams can operate efficiently without switching between different platforms.

-

What benefits does airSlate SignNow provide for businesses dealing with FORM 139G?

Using airSlate SignNow for FORM 139G offers several benefits, including faster document turnaround, enhanced security, and the ability to track changes and updates. This efficiency signNowly reduces the time spent on paperwork, allowing businesses to focus on more critical tasks.

-

Can I use airSlate SignNow to automate workflows involving FORM 139G?

Absolutely! airSlate SignNow allows users to create automated workflows that include FORM 139G, reducing manual steps and minimizing errors. This automation helps to ensure that the document process runs smoothly from start to finish.

-

What security measures does airSlate SignNow have for FORM 139G?

airSlate SignNow employs top-notch security protocols, ensuring that all data related to FORM 139G is protected. Features like encryption, secure cloud storage, and user authentication help maintain the confidentiality and integrity of your documents.

Get more for FORM 139G

- Current deferment ampamp forbearance forms ncher

- Please complete this information in full to avoid delay in registration of the patient andor receipt of the information

- Death certificates minnesota dept of healthdeath certificates minnesota dept of healthphysicians handbook on medical form

- Limited scope x ray operators form

- Fill in buy the adopted persons minnesota department of health form

- Opwdd ddro manual form

- State disability review unit fill out and sign printable pdf form

- Sealed file form

Find out other FORM 139G

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer