Current Deferment & Forbearance Forms NCHER 2021-2026

Understanding Deferment and Forbearance

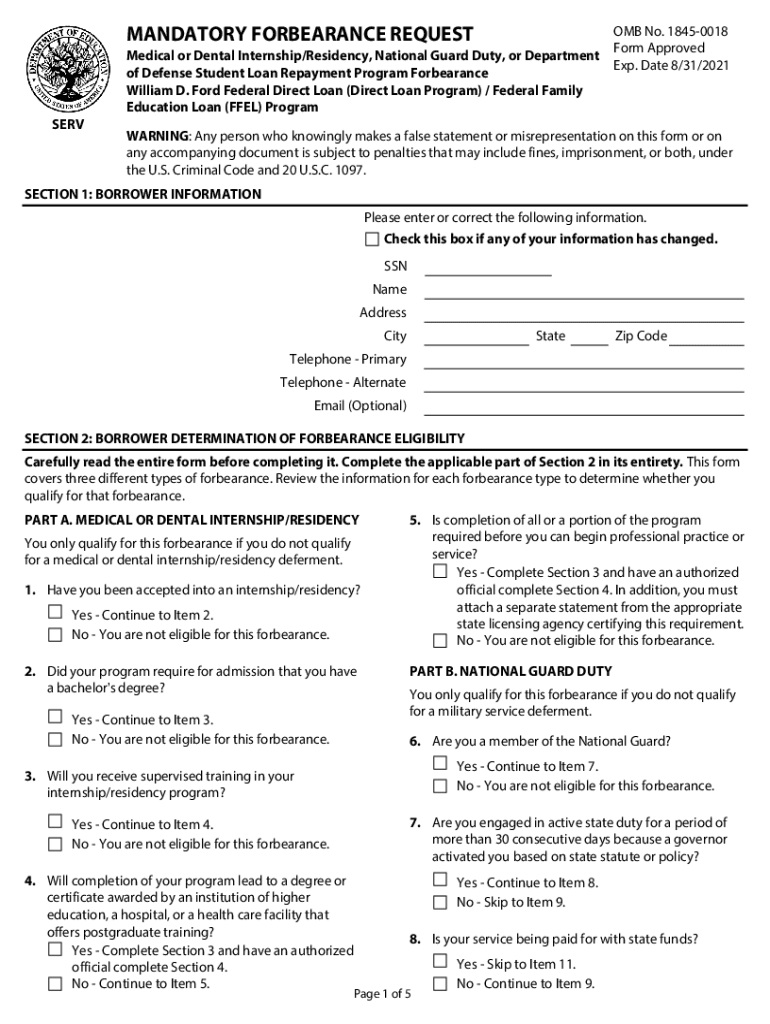

Deferment and forbearance are two options available to borrowers facing financial difficulties, particularly with student loans. While both provide temporary relief from payments, they differ in their implications and conditions. Deferment allows borrowers to temporarily suspend payments without accruing interest on certain types of loans, while forbearance permits borrowers to pause payments but typically results in interest accruing on all loan types. Understanding these differences is crucial for making informed decisions regarding student loan management.

Steps to Complete the Current Deferment and Forbearance Forms

Completing the deferment or forbearance forms involves several key steps to ensure proper processing. First, gather all necessary documentation, including proof of financial hardship or other qualifying circumstances. Next, accurately fill out the required forms, ensuring all information is complete and correct. After filling out the forms, review them for accuracy and clarity. Finally, submit the forms through the specified method, whether online, by mail, or in person, and keep copies for your records.

Eligibility Criteria for Deferment and Forbearance

Eligibility for deferment and forbearance varies based on the type of loan and the borrower's circumstances. Common eligibility criteria include financial hardship, unemployment, or enrollment in school. For deferment, borrowers may need to provide documentation proving their status, such as a letter from an employer or school. For forbearance, borrowers must typically demonstrate that they cannot make their payments due to temporary financial difficulties. Understanding these criteria helps borrowers determine which option is best for their situation.

Legal Use of Deferment and Forbearance Forms

Deferment and forbearance forms must be completed and submitted according to legal guidelines to ensure they are valid. These forms serve as official requests to the loan servicer for a temporary pause in payments. It is essential to provide accurate information and necessary documentation to avoid delays or denials. Borrowers should also be aware of their rights and responsibilities concerning these forms, including the potential impact on their credit and loan balance.

Examples of Using Deferment and Forbearance Forms

Borrowers may find themselves in various situations where deferment or forbearance is applicable. For example, a recent graduate who is struggling to find a job may apply for forbearance to temporarily halt payments until they secure employment. Conversely, a borrower facing medical issues may qualify for deferment if they can provide documentation of their condition. These examples illustrate how understanding the options can lead to better financial management during challenging times.

Form Submission Methods for Deferment and Forbearance

Submitting deferment and forbearance forms can be done through various methods, depending on the loan servicer's policies. Common submission methods include online applications via the servicer's website, mailing the completed forms to the designated address, or delivering them in person to a local office. Each method has its own processing times, so borrowers should choose the one that best fits their needs and ensure they follow up to confirm receipt of their request.

Quick guide on how to complete current deferment ampamp forbearance forms ncher

Complete Current Deferment & Forbearance Forms NCHER with ease on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the desired form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Current Deferment & Forbearance Forms NCHER on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Current Deferment & Forbearance Forms NCHER effortlessly

- Obtain Current Deferment & Forbearance Forms NCHER and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with features specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you choose. Edit and eSign Current Deferment & Forbearance Forms NCHER to ensure smooth communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct current deferment ampamp forbearance forms ncher

Create this form in 5 minutes!

How to create an eSignature for the current deferment ampamp forbearance forms ncher

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the main difference between deferment vs forbearance?

The main difference between deferment vs forbearance lies in the way interest is handled. During deferment, interest usually does not accrue on certain types of loans, making it a preferable option for borrowers. In contrast, forbearance allows borrowers to temporarily pause payments, but interest may continue to accumulate, potentially leading to a larger balance later.

-

How does airSlate SignNow help with document management related to deferment vs forbearance?

airSlate SignNow simplifies document management, making it easy to create, send, and eSign various documents related to deferment vs forbearance. Users can ensure all necessary paperwork is signed and securely stored in one platform, enhancing their overall experience. Our intuitive interface allows for quick access to important financial documents.

-

Are there any costs associated with using airSlate SignNow for deferment vs forbearance documents?

airSlate SignNow offers cost-effective pricing plans that vary based on features. Regardless of your needs related to deferment vs forbearance documents, our solutions provide excellent value without hidden fees. It allows businesses to manage their signing processes without breaking the bank.

-

What features does airSlate SignNow offer to streamline the signing process for deferment vs forbearance agreements?

Our platform offers various features to streamline the signing process for deferment vs forbearance agreements, including templates, reminders, and real-time tracking. Users can customize documents to fit their specific needs, ensuring that they collect all necessary signatures efficiently. These features signNowly reduce turnaround time.

-

Can I integrate airSlate SignNow with other applications for managing deferment and forbearance?

Yes, airSlate SignNow seamlessly integrates with various applications and services to assist in managing deferment vs forbearance. This interoperability allows businesses to connect their workflows, making it easier to track documents across platforms. Popular integrations include CRM tools, cloud storage systems, and productivity software.

-

Is airSlate SignNow secure for handling sensitive documents related to deferment vs forbearance?

Absolutely, airSlate SignNow prioritizes security, ensuring that sensitive documents related to deferment vs forbearance are protected. We utilize industry-standard encryption and authentication methods to safeguard your information. Our commitment to security allows users to focus on their business without worrying about data bsignNowes.

-

What are the benefits of using airSlate SignNow for deferment vs forbearance agreements?

Using airSlate SignNow for deferment vs forbearance agreements offers numerous benefits, including quicker processing times and enhanced document tracking. Additionally, our platform minimizes paperwork errors and ensures compliance with legal standards. This efficiency allows businesses to better serve their clients and manage their workflows.

Get more for Current Deferment & Forbearance Forms NCHER

- Wisconsin landlord tenant package form

- Housing assistance office tarrant county texas form

- Oklahoma legal forms oklahoma legal documents uslegalforms

- Forms rhode island department of state nellie m gorbea secretary

- Control number oh 008 d form

- Prenuptial agreement formspackages available for filingsivia law

- Kansas landlord tenant package form

- Landlord tenant package form

Find out other Current Deferment & Forbearance Forms NCHER

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe