Prorated between Grantors and Grantees as of the Date Form

What is the Prorated Between Grantors And Grantees As Of The Date

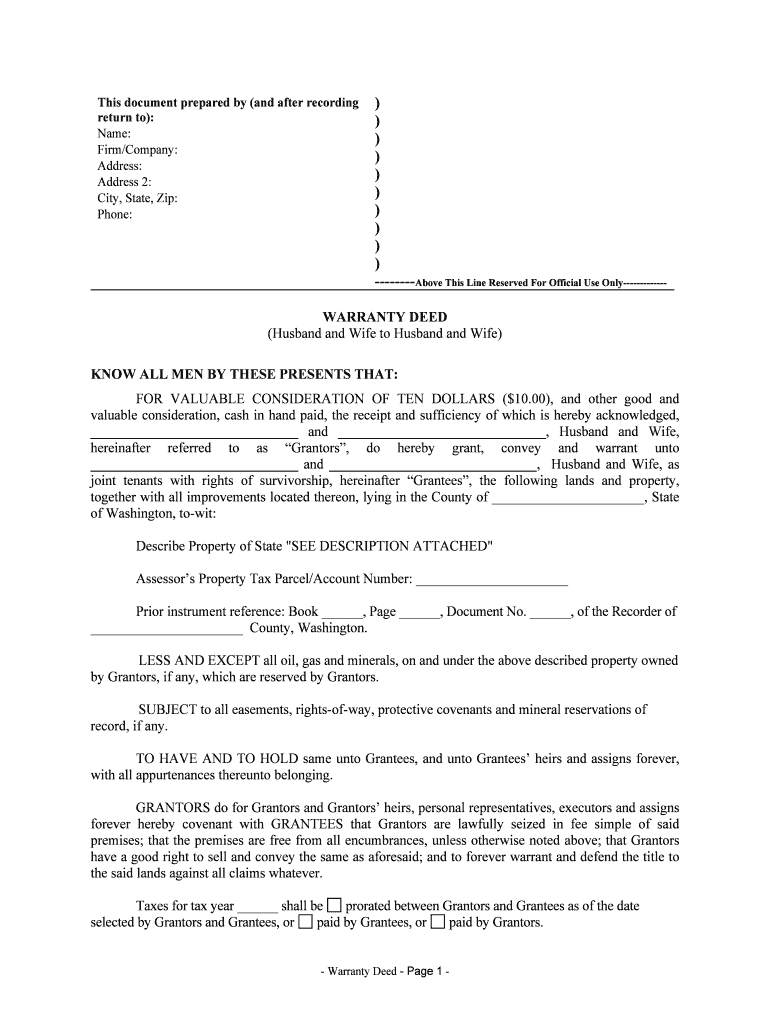

The prorated between grantors and grantees as of the date form is a legal document used primarily in real estate transactions. This form outlines the allocation of costs and responsibilities between the seller (grantor) and the buyer (grantee) as of a specific date. It ensures that both parties understand their financial obligations, particularly regarding property taxes, utilities, and other prorated expenses. By defining these terms, the form helps prevent disputes and clarifies the financial responsibilities of each party involved in the transaction.

How to use the Prorated Between Grantors And Grantees As Of The Date

Using the prorated between grantors and grantees as of the date form involves several key steps. First, both parties should gather relevant financial information, including property tax statements and utility bills. Next, they need to determine the closing date of the transaction, which is crucial for calculating prorated amounts. After that, the parties can fill out the form by entering the agreed-upon prorated amounts for each expense. Finally, both grantors and grantees should sign the document to make it legally binding. It is advisable to keep a copy for each party’s records.

Steps to complete the Prorated Between Grantors And Grantees As Of The Date

Completing the prorated between grantors and grantees as of the date form requires careful attention to detail. Here are the steps involved:

- Gather all necessary financial documents related to the property.

- Identify the closing date for the transaction.

- Calculate the prorated amounts for property taxes, utilities, and any other relevant expenses based on the closing date.

- Fill out the form with the calculated amounts, ensuring accuracy.

- Have both parties review the form for correctness.

- Sign the form to finalize the agreement.

Legal use of the Prorated Between Grantors And Grantees As Of The Date

The prorated between grantors and grantees as of the date form is legally binding when completed correctly. For it to hold up in court or during transactions, it must be signed by both parties and include accurate financial details. Compliance with state laws regarding real estate transactions is essential, as different states may have specific requirements for such documents. Ensuring that the form is filled out properly and signed can protect both parties from potential disputes regarding financial responsibilities.

Key elements of the Prorated Between Grantors And Grantees As Of The Date

Several key elements are essential when completing the prorated between grantors and grantees as of the date form:

- Closing Date: The date on which the property transfer occurs.

- Prorated Amounts: Specific financial figures for taxes and utilities that need to be divided between the parties.

- Signatures: Both grantors and grantees must sign to validate the form.

- Contact Information: Names and addresses of both parties for clarity and record-keeping.

Examples of using the Prorated Between Grantors And Grantees As Of The Date

Examples of using the prorated between grantors and grantees as of the date form can be found in various real estate transactions. For instance, if a property is sold on June 15, the property taxes for the year may need to be prorated between the seller and buyer based on the number of days each party owns the property. Another example could involve utility bills that need to be divided based on the closing date. These examples illustrate how important it is to have a clear understanding of financial responsibilities to avoid conflicts.

Quick guide on how to complete prorated between grantors and grantees as of the date

Complete Prorated Between Grantors And Grantees As Of The Date effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your papers swiftly without interruptions. Manage Prorated Between Grantors And Grantees As Of The Date on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Prorated Between Grantors And Grantees As Of The Date effortlessly

- Find Prorated Between Grantors And Grantees As Of The Date and then click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Finish button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Prorated Between Grantors And Grantees As Of The Date and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Prorated Between Grantors And Grantees As Of The Date' mean?

The term 'Prorated Between Grantors And Grantees As Of The Date' refers to the allocation of financial responsibilities or benefits based on the specific date of a transaction. Understanding this concept is crucial for accurate document preparation and ensuring that both parties are fairly represented. With airSlate SignNow, you can seamlessly manage and eSign documents that include these vital terms.

-

How can airSlate SignNow assist with agreements involving 'Prorated Between Grantors And Grantees As Of The Date'?

airSlate SignNow simplifies the process of creating and managing agreements that involve 'Prorated Between Grantors And Grantees As Of The Date.' Our platform enables users to customize templates, add necessary clauses, and ensure accuracy in all documentation. This helps prevent misunderstandings and disputes between parties.

-

Is there an integration feature for handling 'Prorated Between Grantors And Grantees As Of The Date' documents?

Yes, airSlate SignNow offers integration with multiple applications that assist in managing transactions involving 'Prorated Between Grantors And Grantees As Of The Date.' Whether you are using CRM systems or document storage solutions, our integrations keep your workflow smooth and efficient. This ultimately leads to better organization of your important documents.

-

What pricing plans does airSlate SignNow offer for document eSigning?

airSlate SignNow provides flexible pricing plans to accommodate various business needs, including those requiring management of 'Prorated Between Grantors And Grantees As Of The Date' documents. Our plans range from basic to advanced, allowing users to choose based on their document transaction volume and feature requirements. Explore our website for detailed pricing information tailored to your business.

-

Can airSlate SignNow support bulk signing, particularly for agreements involving prorations?

Absolutely! airSlate SignNow supports bulk signing, which is especially beneficial when dealing with a large number of agreements that include 'Prorated Between Grantors And Grantees As Of The Date.' This feature saves time and ensures that all necessary documents are signed efficiently. You can easily upload multiple documents and send them out for eSignature simultaneously.

-

What security measures does airSlate SignNow implement for sensitive agreements?

Security is a top priority at airSlate SignNow, particularly for sensitive agreements that involve 'Prorated Between Grantors And Grantees As Of The Date.' We utilize advanced encryption methods and secure storage to protect your documents and data. Additionally, compliance with industry standards ensures that your information remains confidential and secure.

-

How does airSlate SignNow enhance collaboration on documents with prorated terms?

airSlate SignNow enhances collaboration by allowing multiple stakeholders to review and sign documents that include 'Prorated Between Grantors And Grantees As Of The Date.' With features like role assignments and commenting, teams can efficiently work together and provide feedback in real time. This streamlines the process and leads to quicker decision-making and document completion.

Get more for Prorated Between Grantors And Grantees As Of The Date

Find out other Prorated Between Grantors And Grantees As Of The Date

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure