WI ET30 Form

What is the WI ET30

The WI ET30 form, also known as the Wisconsin Employee Tax Withholding Exemption Certificate, is a document used by employees in Wisconsin to claim exemption from state income tax withholding. This form is essential for individuals who meet specific criteria that allow them not to have state income tax withheld from their paychecks. By submitting the WI ET30, employees can ensure that their take-home pay reflects their exemption status, which can be beneficial for budgeting and financial planning.

How to use the WI ET30

Using the WI ET30 form involves a straightforward process. Employees must first determine their eligibility for exemption, which typically includes criteria such as having no tax liability in the previous year and expecting none in the current year. Once eligibility is confirmed, employees can obtain the form from their employer or the Wisconsin Department of Revenue website. After completing the form, it should be submitted to the employer, who will then adjust the withholding accordingly. It is important to keep a copy of the submitted form for personal records.

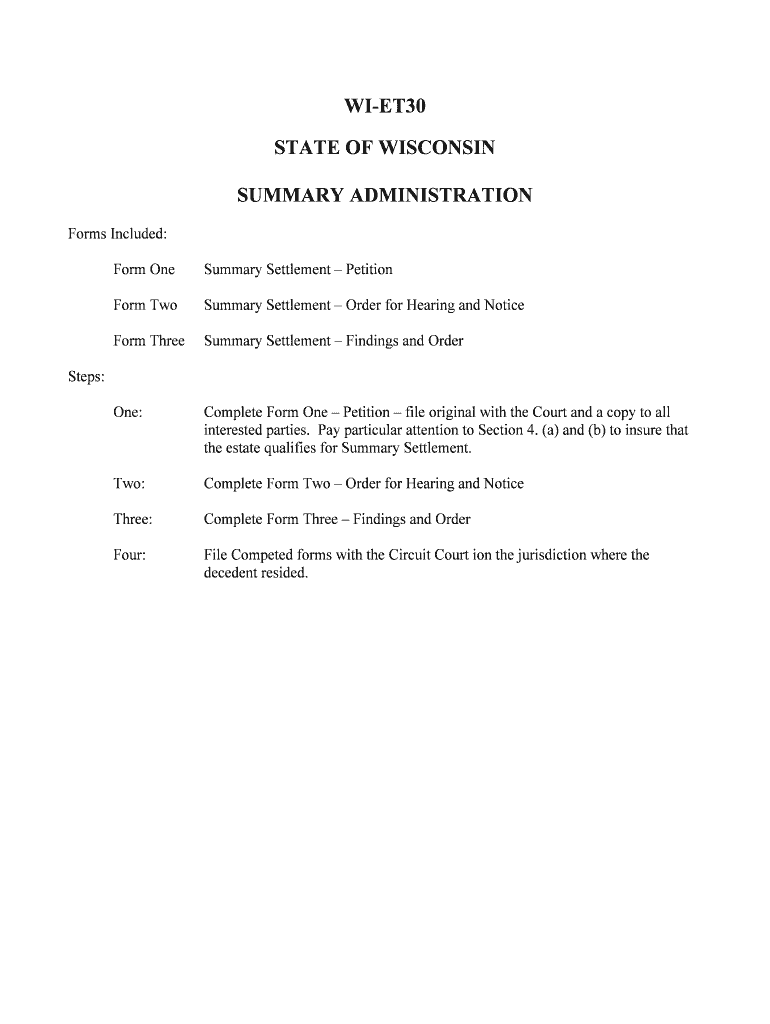

Steps to complete the WI ET30

Completing the WI ET30 involves several key steps:

- Review the eligibility requirements to ensure you qualify for exemption.

- Obtain the WI ET30 form from your employer or the Wisconsin Department of Revenue.

- Fill out the form accurately, providing all necessary personal information.

- Sign and date the form to validate your claim for exemption.

- Submit the completed form to your employer and retain a copy for your records.

Legal use of the WI ET30

The WI ET30 form is legally recognized as a valid means for employees to claim exemption from state tax withholding. To ensure its legal standing, the form must be completed accurately and submitted to the employer in a timely manner. Employers are required to honor the exemptions claimed on the form, provided that the employee meets the necessary criteria. It is advisable for employees to consult with a tax professional if there are any uncertainties regarding their eligibility or the implications of claiming an exemption.

IRS Guidelines

While the WI ET30 is specific to Wisconsin state tax withholding, it is important to understand how it aligns with federal tax regulations. The IRS provides guidelines on tax withholding, which can influence how exemptions are claimed at the state level. Employees should be aware of their federal tax obligations and ensure that claiming an exemption on the WI ET30 does not conflict with their federal tax responsibilities. Consulting IRS resources or a tax advisor can provide clarity on how state and federal guidelines interact.

Filing Deadlines / Important Dates

Filing deadlines for the WI ET30 form typically coincide with the start of employment or when an employee's tax situation changes. It is important to submit the form as soon as eligibility is determined to avoid unnecessary withholding. Additionally, employees should be mindful of any changes in their financial situation that may affect their exemption status throughout the year. Keeping track of important dates related to tax filings can help ensure compliance and optimal financial management.

Quick guide on how to complete wi et30

Effortlessly manage WI ET30 on any device

Digital document management has become increasingly popular among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without hassle. Handle WI ET30 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and electronically sign WI ET30 seamlessly

- Find WI ET30 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, arduous form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign WI ET30 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is WI ET30 and how does it relate to airSlate SignNow?

WI ET30 is a powerful electronic signature solution offered by airSlate SignNow that enables users to efficiently sign and send documents. This feature supports a variety of file formats and simplifies the signing process, ensuring your business can operate seamlessly and securely.

-

How much does the WI ET30 plan cost?

The WI ET30 plan is competitively priced, providing businesses with an affordable option for electronic signatures. Pricing varies based on the number of users and specific features needed, so it’s best to consult airSlate SignNow's pricing page for more detailed information.

-

What features are included in WI ET30?

WI ET30 includes a comprehensive set of features such as customizable templates, real-time tracking of documents, and multi-party signing. These tools help streamline the document management process, making it a valuable asset for any business looking to improve workflow efficiency.

-

Is WI ET30 compliant with industry regulations?

Yes, WI ET30 is fully compliant with industry standards such as eIDAS and ESIGN, ensuring that your electronic signatures are legally binding. This compliance keeps your business aligned with legal requirements and fosters trust with clients and partners.

-

Can WI ET30 integrate with other software?

Absolutely! WI ET30 seamlessly integrates with various applications such as CRM, document management systems, and cloud storage solutions. This flexibility allows businesses to enhance their current workflow by incorporating eSigning capabilities directly into their existing processes.

-

What are the benefits of using WI ET30 for businesses?

Using WI ET30 offers numerous benefits, including increased efficiency in document signing, reduced paper usage, and improved turnaround times. By adopting an electronic signature solution like WI ET30, businesses can heighten productivity and contribute to a more sustainable environment.

-

Is WI ET30 easy to use for beginners?

Yes, WI ET30 is designed with user-friendliness in mind, making it accessible for individuals with varying levels of technical expertise. The intuitive interface and guided setup ensure that even beginners can quickly learn how to send and eSign documents effectively.

Get more for WI ET30

- Consious sedationn records sheet form

- Dr joan g calkins md reviewshamburg nyvitalscom form

- Notice of privacy practicesfirsthealth form

- Anxiety self assessment scale form

- Rx pacific thoracic surgery form

- Do not e mail this form

- Caresource providergroup hierarchy change request form

- Billing policies potomac urology form

Find out other WI ET30

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure