Mn W 9 Form 2011

What is the Mn W-9 Form

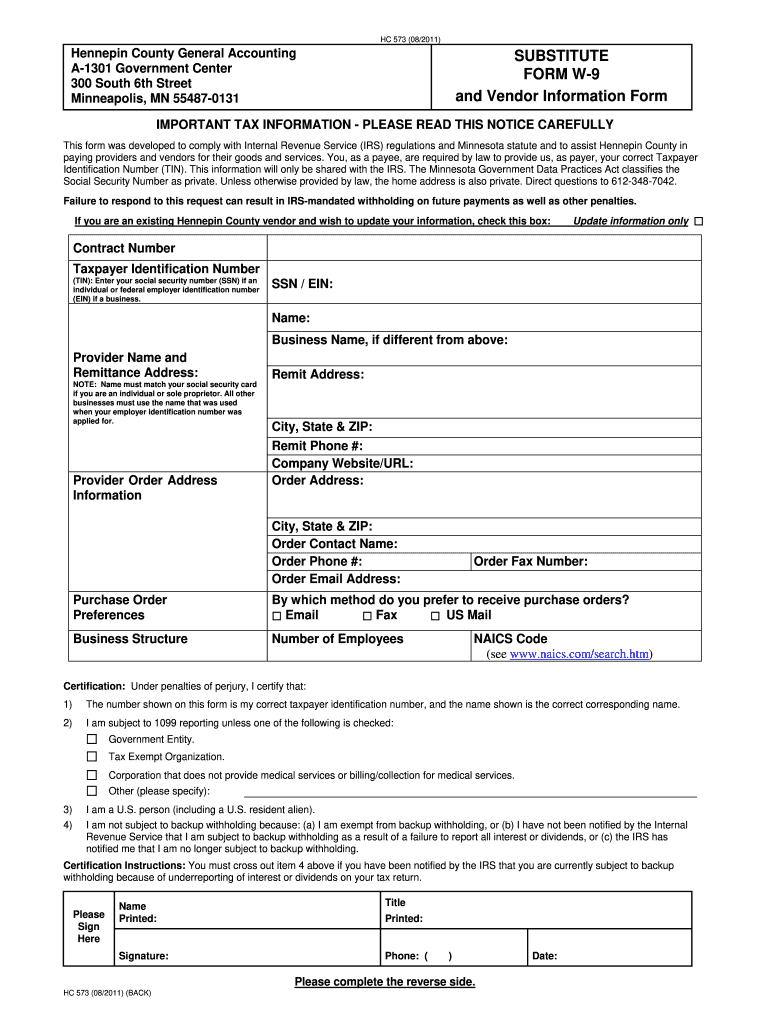

The Mn W-9 Form is a tax document used by individuals and businesses in the United States to provide their taxpayer identification information to entities that are required to report certain types of income to the Internal Revenue Service (IRS). This form is essential for freelancers, contractors, and other self-employed individuals who receive payments from clients. By completing the Mn W-9 Form, you certify your taxpayer identification number (TIN) and confirm your status as a U.S. person, which can include individuals, corporations, partnerships, and estates.

How to Obtain the Mn W-9 Form

You can easily obtain the Mn W-9 Form from the IRS website or through various tax preparation software platforms. The form is available as a downloadable PDF, allowing you to print it for completion. Additionally, many accounting professionals and tax advisors can provide you with a copy if needed. Ensure that you are using the most current version of the form to comply with federal regulations.

Steps to Complete the Mn W-9 Form

Completing the Mn W-9 Form involves several straightforward steps:

- Provide your name: Enter your full legal name as it appears on your tax return.

- Enter your business name: If applicable, include your business name or disregarded entity name.

- Fill in your tax classification: Indicate whether you are an individual, corporation, partnership, or other entity.

- Input your taxpayer identification number: This can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Certify your information: Sign and date the form to confirm that the information provided is accurate.

Legal Use of the Mn W-9 Form

The Mn W-9 Form is legally recognized by the IRS and is crucial for ensuring compliance with tax reporting requirements. By submitting this form, you authorize the entity requesting it to report payments made to you, which helps ensure proper tax withholding and reporting. It is important to keep a copy of the completed form for your records, as it may be requested by the IRS or other tax authorities in the future.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Mn W-9 Form. It is essential to follow these guidelines to avoid penalties or issues with tax reporting. The form must be filled out accurately, and any changes to your information, such as a name change or change in tax classification, should be updated promptly. The IRS also emphasizes the importance of safeguarding your taxpayer identification number to prevent identity theft.

Form Submission Methods

The Mn W-9 Form can be submitted in various ways, depending on the requirements of the requesting entity. Common submission methods include:

- Online submission: Some businesses may allow you to complete and submit the form electronically through their secure portals.

- Mail: You can print the completed form and mail it directly to the entity that requested it.

- In-person delivery: If preferred, you can hand deliver the form to the requesting party.

Quick guide on how to complete mn w 9 2011 form

Your instructional manual on how to prepare your Mn W 9 Form

If you're wondering how to complete and submit your Mn W 9 Form, here are some brief guidelines on how to simplify the tax filing process.

To begin, simply register for your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document management solution that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editor, you can navigate between text, checkboxes, and eSignatures while easily making changes as necessary. Streamline your tax processes with enhanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Mn W 9 Form in just minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our library to find any IRS tax form; browse through variants and schedules.

- Click Get form to open your Mn W 9 Form in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to submission errors and slower refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct mn w 9 2011 form

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out a W-9?

An employer will request a W-9 form of Independent Contractors so they can report the payments to the IRS at year-end. Generally, a 1099-MISC is completed by the employer and submitted to the IRS and State tax agencies only if the amount of payments made to that contractor exceeds $600 for services on an annual basis. It is common to request the W9 in advance, just in case you break that minimum threshold in the future. You will know if they reported $45 to the IRS because you will also receive a copy of the 1099 and can act accordingly. Hope this helps!

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

Why do you need to fill out a W-9 form to get back a broker fee from renting an apartment?

Is the person requesting that you fill out this form going to be cutting you a check for this fee? In other words, is this broker fee a payment to you for services you rendered? Money that you need to declare as income and thus pay income taxes to the IRS?If not, if this check is for some other reason, then I don’t believe that you should complete this form.I’m not a lawyer, so there could very well be something that I am unaware of, but it looks suspicious to me. I sure would like to know more about this issue.

Create this form in 5 minutes!

How to create an eSignature for the mn w 9 2011 form

How to generate an eSignature for your Mn W 9 2011 Form in the online mode

How to generate an eSignature for your Mn W 9 2011 Form in Google Chrome

How to create an electronic signature for signing the Mn W 9 2011 Form in Gmail

How to generate an electronic signature for the Mn W 9 2011 Form right from your smartphone

How to generate an electronic signature for the Mn W 9 2011 Form on iOS devices

How to generate an eSignature for the Mn W 9 2011 Form on Android devices

People also ask

-

What is the Mn W 9 Form and why do I need it?

The Mn W 9 Form is a document used by businesses in Minnesota to request the Taxpayer Identification Number (TIN) of individuals or entities. It is essential for accurate tax reporting and ensures compliance with IRS regulations. Using airSlate SignNow to complete and send the Mn W 9 Form simplifies the process, making it quick and efficient.

-

How does airSlate SignNow help with completing the Mn W 9 Form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the Mn W 9 Form. Our user-friendly interface ensures that all necessary fields are completed accurately, reducing the chances of errors. Plus, you can store and manage all your signed documents securely within the platform.

-

Is airSlate SignNow a cost-effective solution for managing the Mn W 9 Form?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective choice for businesses needing to manage the Mn W 9 Form. With various subscription options, you can select a plan that fits your budget while benefiting from unlimited document signing and storage. Our platform helps reduce printing and mailing costs as well.

-

Can I integrate airSlate SignNow with other applications for the Mn W 9 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and more. This means you can easily import or export your Mn W 9 Form data, streamlining your workflow and enhancing productivity.

-

What security features does airSlate SignNow offer for the Mn W 9 Form?

Security is a top priority at airSlate SignNow. We provide advanced encryption, secure cloud storage, and compliance with industry standards to protect your data when managing the Mn W 9 Form. You can trust that your sensitive information is safe and secure throughout the signing process.

-

How can airSlate SignNow enhance the efficiency of processing the Mn W 9 Form?

Using airSlate SignNow dramatically speeds up the process of completing and collecting the Mn W 9 Form. Our platform allows for instant eSignatures and automated reminders, which means you can reduce turnaround times and improve overall efficiency. This allows your business to focus on its core activities rather than paperwork.

-

What types of businesses can benefit from using the Mn W 9 Form with airSlate SignNow?

Any business that works with independent contractors or vendors in Minnesota can benefit from using the Mn W 9 Form with airSlate SignNow. From freelancers to large corporations, our platform accommodates diverse business needs, making it easier to manage tax documentation efficiently.

Get more for Mn W 9 Form

- 2012 campaign disclosure manual for county candidates form

- A new mexico corporation form

- Business services secretary of state of new mexico form

- Become a notary secretary of state of new mexico form

- Operating agreement llc operating agreement free search form

- Contact us secretary of state of new mexico form

- New mexico bond claim law in construction faqs forms

- Husband and wife as form

Find out other Mn W 9 Form

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement