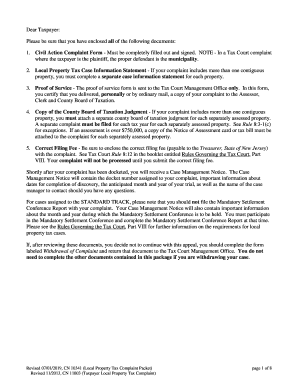

NOTE in a Tax Court Complaint Form

What is the note in a tax court complaint?

The note in a tax court complaint serves as a formal document that outlines the specifics of a taxpayer's dispute with the Internal Revenue Service (IRS). This document is crucial for initiating a case in tax court, as it details the taxpayer's claims and the reasons for contesting the IRS's determinations. The note must be precise and adhere to legal standards to ensure it is actionable within the court system.

Key elements of the note in a tax court complaint

When preparing the note in a tax court complaint, several key elements must be included to ensure its validity:

- Identification of the parties: Clearly state the names and addresses of both the taxpayer and the IRS.

- Statement of facts: Provide a detailed account of the facts surrounding the dispute, including relevant dates and events.

- Legal basis for the complaint: Outline the specific tax laws or regulations that support the taxpayer's position.

- Relief sought: Specify what the taxpayer is requesting from the court, such as a reversal of the IRS's decision or a refund.

- Signature: The note must be signed by the taxpayer or their authorized representative to validate the document.

Steps to complete the note in a tax court complaint

Completing the note in a tax court complaint involves several important steps:

- Gather all relevant documentation related to the tax dispute, including notices from the IRS.

- Draft the note, ensuring all key elements are included and clearly articulated.

- Review the document for accuracy and completeness, checking for any legal requirements specific to your case.

- Sign the note, either electronically or in ink, depending on the submission method chosen.

- Submit the note to the appropriate tax court, ensuring compliance with filing deadlines.

Legal use of the note in a tax court complaint

The legal use of the note in a tax court complaint is governed by specific regulations that ensure its enforceability. To be legally binding, the note must comply with the requirements set forth by the U.S. tax code and relevant court rules. This includes proper formatting, timely submission, and adherence to any local court procedures. Failure to meet these requirements may result in dismissal of the case or other legal repercussions.

Filing deadlines / Important dates

Filing deadlines for the note in a tax court complaint are critical to the success of the case. Generally, taxpayers must file their complaint within ninety days of receiving a notice of deficiency from the IRS. It is essential to keep track of important dates, such as the date of the IRS notice and the deadline for filing the complaint, to avoid missing the opportunity to contest the IRS's decision.

Form submission methods (Online / Mail / In-Person)

The note in a tax court complaint can be submitted through various methods, depending on the court's regulations. Common submission methods include:

- Online: Some tax courts may allow electronic filing through their official websites.

- Mail: The note can be mailed to the court, ensuring it is sent to the correct address and postmarked by the deadline.

- In-Person: Taxpayers may also have the option to file the note in person at the court clerk's office.

Quick guide on how to complete note in a tax court complaint

Effortlessly prepare NOTE In A Tax Court Complaint on any device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to quickly create, edit, and electronically sign your documents without any holdups. Manage NOTE In A Tax Court Complaint on any device with airSlate SignNow's Android or iOS applications and enhance your document-related procedures today.

The simplest way to edit and eSign NOTE In A Tax Court Complaint seamlessly

- Obtain NOTE In A Tax Court Complaint and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your amendments.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign NOTE In A Tax Court Complaint and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 'NOTE In A Tax Court Complaint' and how can airSlate SignNow help?

A 'NOTE In A Tax Court Complaint' is a critical document outlining specific claims. airSlate SignNow streamlines the process of drafting and sending such documents, ensuring you can easily eSign and manage important legal paperwork efficiently.

-

How does airSlate SignNow enhance the process of filing a 'NOTE In A Tax Court Complaint'?

With airSlate SignNow, you can quickly prepare, send, and eSign a 'NOTE In A Tax Court Complaint'. The platform's intuitive interface allows for easy document management, so you can focus more on your case rather than the paperwork.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as document templates, cloud storage, and robust security measures to protect sensitive information. These features are particularly beneficial for managing a 'NOTE In A Tax Court Complaint' and other related documents.

-

Is airSlate SignNow cost-effective for individuals handling a 'NOTE In A Tax Court Complaint'?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals managing legal documents like a 'NOTE In A Tax Court Complaint'. With various pricing plans available, users can select the one that fits their needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software I use for tax management?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can seamlessly manage a 'NOTE In A Tax Court Complaint' alongside your existing tax management tools.

-

How secure is airSlate SignNow when handling sensitive documents like a 'NOTE In A Tax Court Complaint'?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and security measures to protect your sensitive documents, including any 'NOTE In A Tax Court Complaint' you may need to file.

-

Is it easy to eSign a 'NOTE In A Tax Court Complaint' using airSlate SignNow?

Yes, eSigning a 'NOTE In A Tax Court Complaint' with airSlate SignNow is incredibly simple. You can sign documents electronically from anywhere, making it quick and convenient to finalize important tax court filings.

Get more for NOTE In A Tax Court Complaint

Find out other NOTE In A Tax Court Complaint

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors