Claim is Made Against This Estate, Itemized as Follows Form

What is the Claim Is Made Against This Estate, Itemized As Follows

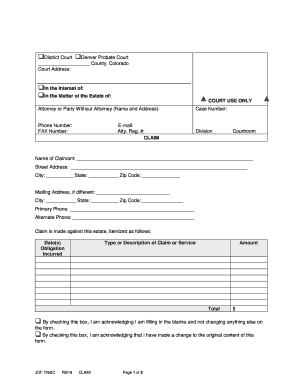

The Claim Is Made Against This Estate, Itemized As Follows form is a legal document used to detail claims against a deceased person's estate. This form is essential in probate proceedings, allowing creditors and claimants to formally present their claims for payment or settlement. It serves to provide a clear and organized list of all claims, ensuring that the estate's executor can address each one appropriately. Understanding this form is crucial for anyone involved in estate management or inheritance matters.

Steps to complete the Claim Is Made Against This Estate, Itemized As Follows

Completing the Claim Is Made Against This Estate, Itemized As Follows form involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the deceased's estate, including assets, liabilities, and any existing debts. Next, clearly itemize each claim, specifying the amount owed and the basis for the claim. It is important to provide supporting documentation for each claim, such as invoices or contracts. After filling out the form, review it for completeness and accuracy before submitting it to the appropriate probate court or executor.

Legal use of the Claim Is Made Against This Estate, Itemized As Follows

The legal use of the Claim Is Made Against This Estate, Itemized As Follows form is to formally notify the estate's executor and the probate court of outstanding debts or claims against the estate. This form must be filed within a specific timeframe, as dictated by state probate laws, to ensure that the claims are considered during the estate settlement process. Failure to file the form correctly or within the designated period may result in the loss of the right to collect on the claim.

State-specific rules for the Claim Is Made Against This Estate, Itemized As Follows

Each state has its own rules and regulations regarding the Claim Is Made Against This Estate, Itemized As Follows form. These rules may include specific deadlines for filing claims, required documentation, and procedures for notifying the estate's executor. It is essential for claimants to familiarize themselves with their state's probate laws to ensure compliance and protect their rights. Consulting with a legal professional can provide clarity on state-specific requirements.

Required Documents

When submitting the Claim Is Made Against This Estate, Itemized As Follows form, certain documents may be required to support the claims being made. Commonly required documents include invoices, contracts, or any other evidence that substantiates the claim. Additionally, proof of identity and relationship to the deceased may be necessary to validate the claim. Ensuring that all required documents are included can help facilitate a smoother review process by the probate court.

Examples of using the Claim Is Made Against This Estate, Itemized As Follows

There are various scenarios in which the Claim Is Made Against This Estate, Itemized As Follows form may be utilized. For instance, a creditor may use this form to claim unpaid debts for services rendered to the deceased. Similarly, a family member may file a claim for reimbursement of expenses incurred while caring for the deceased. Each example illustrates the importance of clearly itemizing claims to ensure that the estate's executor can address them appropriately during the probate process.

Quick guide on how to complete claim is made against this estate itemized as follows

Effortlessly Complete Claim Is Made Against This Estate, Itemized As Follows on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the functionality required to swiftly create, modify, and eSign your documents without delays. Manage Claim Is Made Against This Estate, Itemized As Follows on any device using airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest method to modify and eSign Claim Is Made Against This Estate, Itemized As Follows with ease

- Obtain Claim Is Made Against This Estate, Itemized As Follows and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for sending your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate issues of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Claim Is Made Against This Estate, Itemized As Follows to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean when a claim is made against this estate, itemized as follows?

When a claim is made against this estate, itemized as follows, it refers to a formal request for payment or obligation from the estate's assets. Understanding these claims is crucial for executors and beneficiaries to address potential liabilities and ensure proper asset distribution.

-

How can airSlate SignNow help in managing claims against an estate?

airSlate SignNow allows users to streamline the process of managing claims against an estate, itemized as follows. With our eSignature functionality, you can easily collect signatures on essential documents, ensuring that all claims are documented and processed efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring that you get the best value for managing claims against an estate, itemized as follows. Whether you’re a small business or a larger enterprise, our flexible pricing allows you to choose a plan that fits your budget.

-

Can airSlate SignNow integrate with other tools I use for estate management?

Yes, airSlate SignNow integrates seamlessly with a range of applications that can assist in managing claims against an estate, itemized as follows. Our platform ensures that you can connect with popular tools for accounting, document management, and more, enhancing your overall workflow.

-

What features does airSlate SignNow provide for tracking claims against an estate?

airSlate SignNow provides robust features for tracking claims against an estate, itemized as follows. You can monitor document status in real-time, set reminders for due dates, and generate audit trails to keep all parties informed and accountable.

-

Is airSlate SignNow compliant with legal requirements for estate management?

Absolutely, airSlate SignNow is designed with compliance in mind, so you can confidently manage claims against an estate, itemized as follows. Our eSignature solutions meet the legal standards required in many jurisdictions, validating your documents in the eyes of the law.

-

What benefits can I expect when using airSlate SignNow for estate claims?

By using airSlate SignNow to manage claims against an estate, itemized as follows, you benefit from increased efficiency, reduced paperwork, and improved collaboration among stakeholders. Our platform simplifies the entire process, helping you avoid unnecessary delays and complications.

Get more for Claim Is Made Against This Estate, Itemized As Follows

Find out other Claim Is Made Against This Estate, Itemized As Follows

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT