Personal Property Held by or in the Possession of the Decedent as Fiduciary or Trustee, Exempt Property, Family Form

Understanding the Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

The personal property held by or in the possession of the decedent as fiduciary or trustee refers to assets that a deceased individual managed on behalf of others. This type of property may include real estate, financial accounts, and personal belongings. Understanding this concept is crucial for family members and beneficiaries, as it can affect the distribution of assets after the decedent's passing. Exempt property typically includes items that are necessary for the decedent's family, ensuring that they have access to essential resources during a difficult time.

Steps to Complete the Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

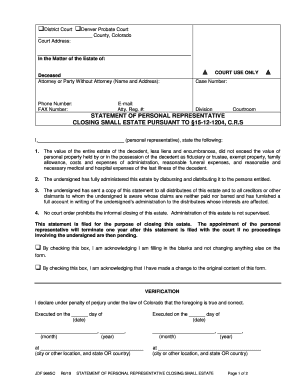

Completing the personal property held by or in the possession of the decedent as fiduciary or trustee form involves several key steps. First, gather all relevant documents, including the decedent's will, trust documents, and any records related to the property in question. Next, ensure that you understand the specific requirements for your state, as these can vary. Fill out the form accurately, providing detailed information about the property and its value. Once completed, review the form for any errors before submitting it to the appropriate court or authority.

Legal Use of the Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

The legal use of the personal property held by or in the possession of the decedent as fiduciary or trustee is essential for ensuring that the decedent's wishes are honored. This form is often used in probate proceedings, where the court oversees the distribution of the decedent's assets. It is important to comply with all legal requirements to avoid potential disputes among beneficiaries. Properly executing this form can help clarify the roles of fiduciaries and trustees, ensuring that they fulfill their obligations in managing the decedent's estate.

Key Elements of the Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

Several key elements are essential to the personal property held by or in the possession of the decedent as fiduciary or trustee form. These include the identification of the fiduciary or trustee, a detailed description of the property, and the value of the assets. It is also important to include any relevant dates, such as the date of the decedent's death and the date the property was acquired. Providing accurate and comprehensive information helps ensure that the form is processed smoothly and that the decedent's intentions are respected.

Obtaining the Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

To obtain the personal property held by or in the possession of the decedent as fiduciary or trustee, it is necessary to follow specific legal procedures. This often involves filing the appropriate forms with the probate court and providing documentation that supports your claim to the property. Depending on the state, you may need to prove your relationship to the decedent or provide evidence of your role as a fiduciary or trustee. It is advisable to consult with a legal professional to navigate this process effectively.

Examples of Using the Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

Examples of using the personal property held by or in the possession of the decedent as fiduciary or trustee include situations where a family member is managing a deceased parent's estate. In this case, the family member may need to fill out the form to claim the family home or other significant assets. Another example could involve a trust where a trustee must account for the decedent's investments and distribute them according to the terms of the trust. Each situation may present unique challenges, highlighting the importance of understanding the legal implications of managing personal property after a death.

Quick guide on how to complete personal property held by or in the possession of the decedent as fiduciary or trustee exempt property family

Accomplish Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without any holdups. Handle Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family with ease

- Find Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information with tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Leave behind lost or mislaid documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Alter and eSign Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is considered 'Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family'?

Personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family refers to assets that a deceased person had control over which might be excluded from the probate process. This includes items designated for family members or those that do not necessitate formal probate due to their value or nature. Understanding this concept is crucial for efficient estate management.

-

How can airSlate SignNow assist with documents related to personal property of a decedent?

airSlate SignNow makes it easy to eSign and send documents related to personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family. Our platform offers templates and workflow management, ensuring that all necessary forms are completed accurately and efficiently. This can signNowly reduce the hassle involved in estate settlement.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to cater to various business sizes and needs, including those managing personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family. Choose from monthly or annual subscriptions, with options for additional features as you scale. This ensures that users only pay for what they need.

-

What features does airSlate SignNow offer for managing estate documents?

AirSlate SignNow provides powerful features like document templates, eSignature capabilities, and real-time collaboration. These tools are especially useful when dealing with personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family. With easy customization, you can ensure all estate-related documents are handled seamlessly.

-

Is integration with other software available in airSlate SignNow?

Yes, airSlate SignNow integrates with a wide range of software applications, making it easier to handle documentation related to personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family. Whether you're using CRMs, cloud storage, or other business tools, our integrations help streamline your workflow and improve efficiency.

-

What benefits does eSigning provide for estate management?

eSigning offers numerous benefits for estate management, particularly for documents concerning personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family. It speeds up the entire signing process, allows for remote transactions, and provides a secure and legally binding method for obtaining signatures. This can eliminate delays often associated with traditional signing methods.

-

How secure is the document storage in airSlate SignNow?

Document security is a top priority at airSlate SignNow, especially for sensitive information tied to personal property held by or in the possession of the decedent as fiduciary or trustee, exempt property, family. We utilize state-of-the-art encryption and secure cloud storage, ensuring that all documents are well protected. Users can rest easy knowing their estate documents are safe and accessible only to authorized individuals.

Get more for Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

- Private process server arizona judicial branch form

- The superior court of arizona clerk of the superior court form

- Vehicle ampamp equipment purchase agreement free download form

- Agreementforsaleof automobile form

- 411021 iowa department of transportation power of attorney form

- I have received a rough draft of a warranty deed and a bill form

- Do these presents grant bargain sell and deliver unto purchaser the following described form

- The legal forms kit homestead schools inc

Find out other Personal Property Held By Or In The Possession Of The Decedent As Fiduciary Or Trustee, Exempt Property, Family

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word