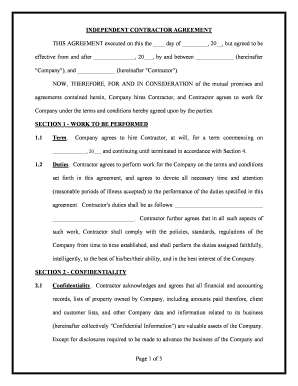

Independent Contractor Employment Form

What is the Independent Contractor Employment

The independent contractor employment relationship is defined as a contractual agreement between a business and a self-employed individual. This arrangement allows the contractor to provide services to the business without being classified as an employee. The contractor retains control over how the work is performed, and they are typically responsible for their own taxes and benefits. This type of employment is common in various industries, including construction, consulting, and creative fields.

Key elements of the Independent Contractor Employment

When drafting an independent contractor agreement, several key elements must be included to ensure clarity and legal compliance:

- Scope of Work: Clearly define the tasks and responsibilities expected from the contractor.

- Payment Terms: Specify the compensation structure, including rates, payment methods, and schedules.

- Duration of Agreement: Indicate the start and end dates of the contract.

- Confidentiality Clauses: Include provisions to protect sensitive business information.

- Termination Conditions: Outline the circumstances under which either party can terminate the agreement.

Steps to complete the Independent Contractor Employment

Completing an independent contractor agreement form involves several straightforward steps:

- Gather Information: Collect necessary details about the contractor and the business.

- Draft the Agreement: Use a contractor agreement form sample as a template to create a customized document.

- Review Terms: Ensure all terms are clear and mutually agreed upon by both parties.

- Sign the Agreement: Utilize a secure eSignature platform to sign the document electronically.

- Store the Document: Keep a copy of the signed agreement for future reference and compliance.

Legal use of the Independent Contractor Employment

To ensure the legal validity of an independent contractor agreement, it must comply with federal and state laws. The agreement should meet the requirements set forth by the IRS regarding the classification of workers. Misclassification can lead to penalties, so it is essential to understand the criteria that differentiate an independent contractor from an employee. Proper documentation and adherence to legal standards will help protect both parties in the event of disputes.

Examples of using the Independent Contractor Employment

Independent contractor agreements are widely used across various sectors. For instance:

- A construction company hires a contractor to complete a specific project, detailing the scope and timeline in the agreement.

- A marketing agency engages a freelance graphic designer to create promotional materials under a clearly defined contract.

- A software development firm contracts an independent programmer to develop a specific application, outlining deliverables and payment terms.

Required Documents

When entering into an independent contractor agreement, certain documents may be required to establish the relationship and ensure compliance:

- W-9 Form: This form is used to collect the contractor's taxpayer identification information.

- Proof of Insurance: Contractors may need to provide evidence of liability insurance, depending on the nature of the work.

- Business License: Some jurisdictions require independent contractors to hold a valid business license.

Quick guide on how to complete independent contractor employment

Complete Independent Contractor Employment effortlessly on any device

Managing documents online has gained increasing popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the needed form and securely store it online. airSlate SignNow offers you all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Independent Contractor Employment on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Independent Contractor Employment with ease

- Obtain Independent Contractor Employment and click on Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specially provides for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Independent Contractor Employment and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a contractor agreement form sample?

A contractor agreement form sample is a template that outlines the terms and conditions between a client and a contractor. It typically includes details like payment, project scope, and timelines. Using a contractor agreement form sample helps ensure that both parties are clear on their responsibilities, reducing the potential for disputes.

-

How can airSlate SignNow help with creating a contractor agreement form sample?

airSlate SignNow offers customizable templates, including a contractor agreement form sample, making it easy for you to create professional documents. You can edit pre-filled forms to suit your specific needs. This flexibility ensures that you get a tailor-made agreement that fits your project requirements.

-

Is airSlate SignNow cost-effective for small businesses needing a contractor agreement form sample?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to manage their documents efficiently. The platform offers competitive pricing plans, ensuring that even startups can access professional tools, including creating and managing a contractor agreement form sample without breaking the bank.

-

What are the key features of using airSlate SignNow for contractor agreements?

Key features of airSlate SignNow include e-signatures, customizable templates, and document tracking. These features make it easy to create a contractor agreement form sample and send it for signatures quickly. The platform also provides notifications when documents are signed, keeping you informed throughout the process.

-

Can I integrate airSlate SignNow with other tools for managing contractor agreements?

Yes, airSlate SignNow seamlessly integrates with popular tools like Google Drive, Dropbox, and various CRM systems. This allows you to streamline your workflow when dealing with a contractor agreement form sample. Integrations enhance your productivity by allowing you to manage all documents in one place.

-

What are the benefits of using a contractor agreement form sample?

Using a contractor agreement form sample ensures clarity and professionalism in your agreements, helping to prevent misunderstandings. It provides a legal framework that protects both the contractor and the client. Ultimately, using a well-structured contractor agreement can lead to smoother project executions.

-

How secure is the signing process with airSlate SignNow for contractor agreements?

The signing process with airSlate SignNow is highly secure, employing encryption and compliance with industry standards. This means that your contractor agreement form sample will remain confidential and protected throughout the signing process. You can confidently send documents knowing they are secure.

Get more for Independent Contractor Employment

- Reply to posting rainbow district school board form

- Ssc online 3258 form

- Metlife alico claim form download

- Transport order form

- Unveiling ceremony the emanuel synagogue emanuelsynagogue form

- Bike rental contract form

- Pine knob rental agreement form pdf pine knob ski resort

- Private account information sheet labcorp

Find out other Independent Contractor Employment

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple