Secured Promissory Note Form

What is the Secured Promissory Note

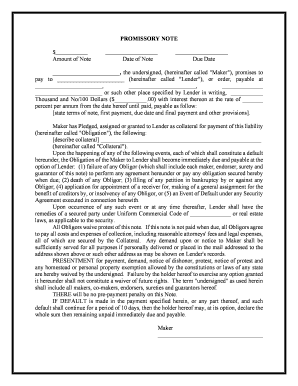

A secured promissory note is a financial instrument that outlines a borrower's promise to repay a loan, with the added assurance of collateral. This collateral can be any asset, such as real estate or personal property, which provides security to the lender in case of default. The secured note template serves as a formal agreement detailing the terms of the loan, including the interest rate, repayment schedule, and the specific collateral involved. By utilizing a secured note, both parties have a clear understanding of their rights and obligations, making it a crucial document in financial transactions.

Key Elements of the Secured Promissory Note

When creating a secured promissory note, several key elements must be included to ensure its legality and effectiveness. These elements typically consist of:

- Borrower and Lender Information: Names and contact details of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Details on how and when payments will be made.

- Collateral Description: A clear description of the asset securing the loan.

- Default Terms: Conditions under which the lender can claim the collateral.

Including these elements in a secured promissory note template helps protect both the lender's and borrower's interests, ensuring clarity and legal compliance.

Steps to Complete the Secured Promissory Note

Completing a secured promissory note involves several straightforward steps to ensure all necessary information is accurately captured. Here are the steps to follow:

- Gather Information: Collect all relevant details about the borrower, lender, loan amount, interest rate, and collateral.

- Choose a Template: Select a secured note template that meets your needs and complies with state laws.

- Fill in the Details: Carefully input the gathered information into the template, ensuring accuracy.

- Review the Document: Both parties should review the completed note for any errors or omissions.

- Sign the Note: Both the borrower and lender must sign the document, ideally in the presence of a witness or notary.

Following these steps can help ensure that the secured promissory note is completed correctly and is legally binding.

Legal Use of the Secured Promissory Note

The legal use of a secured promissory note is governed by state laws, which can vary significantly. Generally, for a secured note to be legally binding, it must meet specific criteria, including clear terms and conditions, proper signatures, and compliance with applicable laws. The collateral must also be legally owned by the borrower and appropriately described in the note. It is advisable to consult legal counsel to ensure that the secured promissory note adheres to all legal requirements, thereby protecting the interests of both parties involved.

How to Obtain the Secured Promissory Note

Obtaining a secured promissory note can be accomplished through various means. Many financial institutions provide standardized templates that can be customized to fit specific needs. Additionally, legal websites and document preparation services often offer downloadable secured note templates. It is essential to ensure that any template used complies with state laws and includes all necessary elements to be enforceable. For those seeking a tailored approach, consulting a legal professional for assistance in drafting a secured promissory note may be beneficial.

Examples of Using the Secured Promissory Note

Secured promissory notes are commonly used in various financial transactions. Examples include:

- Real Estate Transactions: A buyer may secure a loan with the property being purchased as collateral.

- Personal Loans: Individuals may use valuable assets, such as vehicles, to secure loans from friends or family.

- Business Loans: Companies often use inventory or equipment as collateral for loans to fund operations or expansion.

These examples illustrate the versatility of secured promissory notes in different lending scenarios, providing security for lenders while facilitating borrowing for individuals and businesses.

Quick guide on how to complete secured promissory note

Prepare Secured Promissory Note effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Secured Promissory Note on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and eSign Secured Promissory Note without exertion

- Find Secured Promissory Note and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Secured Promissory Note and ensure exceptional communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a secured note template?

A secured note template is a legal document used to outline the terms of a secured loan, detailing the borrower's obligation and the lender's rights. This template ensures that the agreement is clear and enforceable, protecting both parties involved in the transaction.

-

How can airSlate SignNow help with my secured note template?

AirSlate SignNow offers an easy-to-use platform where you can create, customize, and eSign your secured note template efficiently. With the user-friendly interface, you can streamline your document workflow and ensure that all legal requirements are met.

-

Is there a cost associated with using the secured note template in airSlate SignNow?

AirSlate SignNow provides flexible pricing plans, which include access to various document templates, including secured note templates. You can choose a plan that fits your business needs, ensuring you get the best value for your eSigning requirements.

-

What features does the secured note template offer?

The secured note template in airSlate SignNow includes features such as document tracking, customizable fields, and secure cloud storage. These features enhance the usability of your template, making it easier to manage signed agreements and maintain records.

-

Can I customize the secured note template to fit my specific needs?

Yes, airSlate SignNow allows for complete customization of the secured note template. You can modify key elements such as terms, rates, and repayment schedules to tailor the document to your specific business scenarios.

-

Does airSlate SignNow integrate with other applications for managing secured note templates?

Absolutely! AirSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Dropbox, allowing you to efficiently manage your secured note templates alongside other essential tools your business uses.

-

What are the benefits of using a secured note template with airSlate SignNow?

Using a secured note template with airSlate SignNow streamlines the signing process, enhances security, and eliminates paperwork. You'll experience faster transactions and increased professionalism, ultimately improving your business operations.

Get more for Secured Promissory Note

Find out other Secured Promissory Note

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online